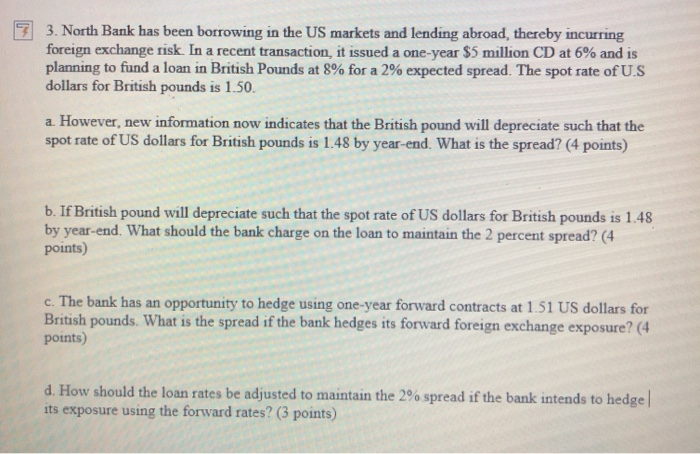

7 3. North Bank has been borrowing in the US markets and lending abroad, thereby incurring foreign exchange risk. In a recent transaction, it issued a one-year $5 million CD at 6% and is planning to fund a loan in British Pounds at 8% for a 2% expected spread. The spot rate of U.S dollars for British pounds is 1.50. a. However, new information now indicates that the British pound will depreciate such that the spot rate of US dollars for British pounds is 1.48 by year-end. What is the spread? (4 points) b. If British pound will depreciate such that the spot rate of US dollars for British pounds is 1.48 by year-end. What should the bank charge on the loan to maintain the 2 percent spread? (4 points) c. The bank has an opportunity to hedge using one-year forward contracts at 1.51 US dollars for British pounds. What is the spread if the bank hedges its forward foreign exchange exposure? (4 points) d. How should the loan rates be adjusted to maintain the 2% spread if the bank intends to hedge its exposure using the forward rates? (3 points) 7 3. North Bank has been borrowing in the US markets and lending abroad, thereby incurring foreign exchange risk. In a recent transaction, it issued a one-year $5 million CD at 6% and is planning to fund a loan in British Pounds at 8% for a 2% expected spread. The spot rate of U.S dollars for British pounds is 1.50. a. However, new information now indicates that the British pound will depreciate such that the spot rate of US dollars for British pounds is 1.48 by year-end. What is the spread? (4 points) b. If British pound will depreciate such that the spot rate of US dollars for British pounds is 1.48 by year-end. What should the bank charge on the loan to maintain the 2 percent spread? (4 points) c. The bank has an opportunity to hedge using one-year forward contracts at 1.51 US dollars for British pounds. What is the spread if the bank hedges its forward foreign exchange exposure? (4 points) d. How should the loan rates be adjusted to maintain the 2% spread if the bank intends to hedge its exposure using the forward rates? (3 points)