Question

7. A pension fund manager is considering three mutual funds. The first is a stock fund (S), the second is a long- term bond

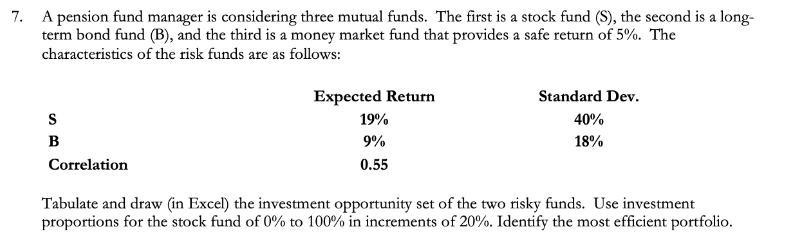

7. A pension fund manager is considering three mutual funds. The first is a stock fund (S), the second is a long- term bond fund (B), and the third is a money market fund that provides a safe return of 5%. The characteristics of the risk funds are as follows: S3 S B Correlation Expected Return 19% 9% 0.55 Standard Dev. 40% 18% Tabulate and draw (in Excel) the investment opportunity set of the two risky funds. Use investment proportions for the stock fund of 0% to 100% in increments of 20%. Identify the most efficient portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Statistics Communicating With Numbers

Authors: Sanjiv Jaggia, Alison Kelly

2nd Edition

0078020557, 978-0078020551

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App