Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. A whole life insurance with reduced early sum insured is issued to a life age 50. The sum insured payable at the end

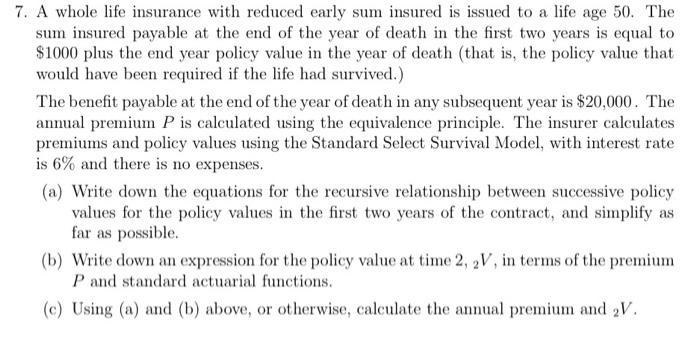

7. A whole life insurance with reduced early sum insured is issued to a life age 50. The sum insured payable at the end of the year of death in the first two years is equal to $1000 plus the end year policy value in the year of death (that is, the policy value that would have been required if the life had survived.) The benefit payable at the end of the year of death in any subsequent year is $20,000. The annual premium P is calculated using the equivalence principle. The insurer calculates premiums and policy values using the Standard Select Survival Model, with interest rate is 6% and there is no expenses. (a) Write down the equations for the recursive relationship between successive policy values for the policy values in the first two years of the contract, and simplify as far as possible. (b) Write down an expression for the policy value at time 2, 2V, in terms of the premium P and standard actuarial functions. (c) Using (a) and (b) above, or otherwise, calculate the annual premium and 2V.

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Let Vn denote the policy value at the end of year n Then we have V1 1000 V0 V2 1000 V1 Us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started