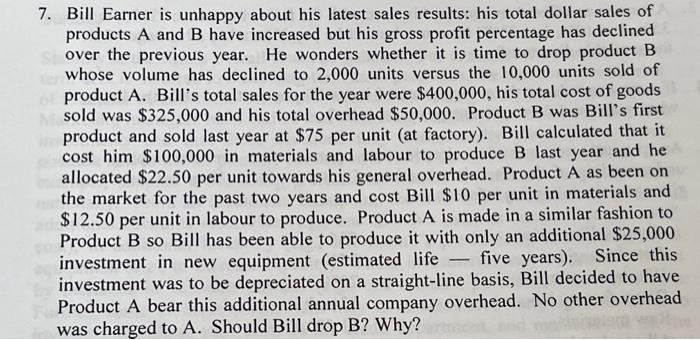

7. Bill Earner is unhappy about his latest sales results: his total dollar sales of products A and B have increased but his gross profit percentage has declined over the previous year. He wonders whether it is time to drop product B whose volume has declined to 2,000 units versus the 10,000 units sold of product A. Bill's total sales for the year were $400,000, his total cost of goods sold was $325,000 and his total overhead $50,000. Product B was Bill's first product and sold last year at $75 per unit (at factory). Bill calculated that it cost him $100,000 in materials and labour to produce B last year and he allocated $22.50 per unit towards his general overhead. Product A as been on the market for the past two years and cost Bill $10 per unit in materials and $12.50 per unit in labour to produce. Product A is made in a similar fashion to Product B so Bill has been able to produce it with only an additional $25,000 investment in new equipment (estimated life five years). Since this investment was to be depreciated on a straight-line basis, Bill decided to have Product A bear this additional annual company overhead. No other overhead was charged to A. Should Bill drop B? Why? 7. Bill Earner is unhappy about his latest sales results: his total dollar sales of products A and B have increased but his gross profit percentage has declined over the previous year. He wonders whether it is time to drop product B whose volume has declined to 2,000 units versus the 10,000 units sold of product A. Bill's total sales for the year were $400,000, his total cost of goods sold was $325,000 and his total overhead $50,000. Product B was Bill's first product and sold last year at $75 per unit (at factory). Bill calculated that it cost him $100,000 in materials and labour to produce B last year and he allocated $22.50 per unit towards his general overhead. Product A as been on the market for the past two years and cost Bill $10 per unit in materials and $12.50 per unit in labour to produce. Product A is made in a similar fashion to Product B so Bill has been able to produce it with only an additional $25,000 investment in new equipment (estimated life five years). Since this investment was to be depreciated on a straight-line basis, Bill decided to have Product A bear this additional annual company overhead. No other overhead was charged to A. Should Bill drop B? Why