Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. Business or non-programmable calculators are allowed DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO 1 SECTION C - 75 MARKS

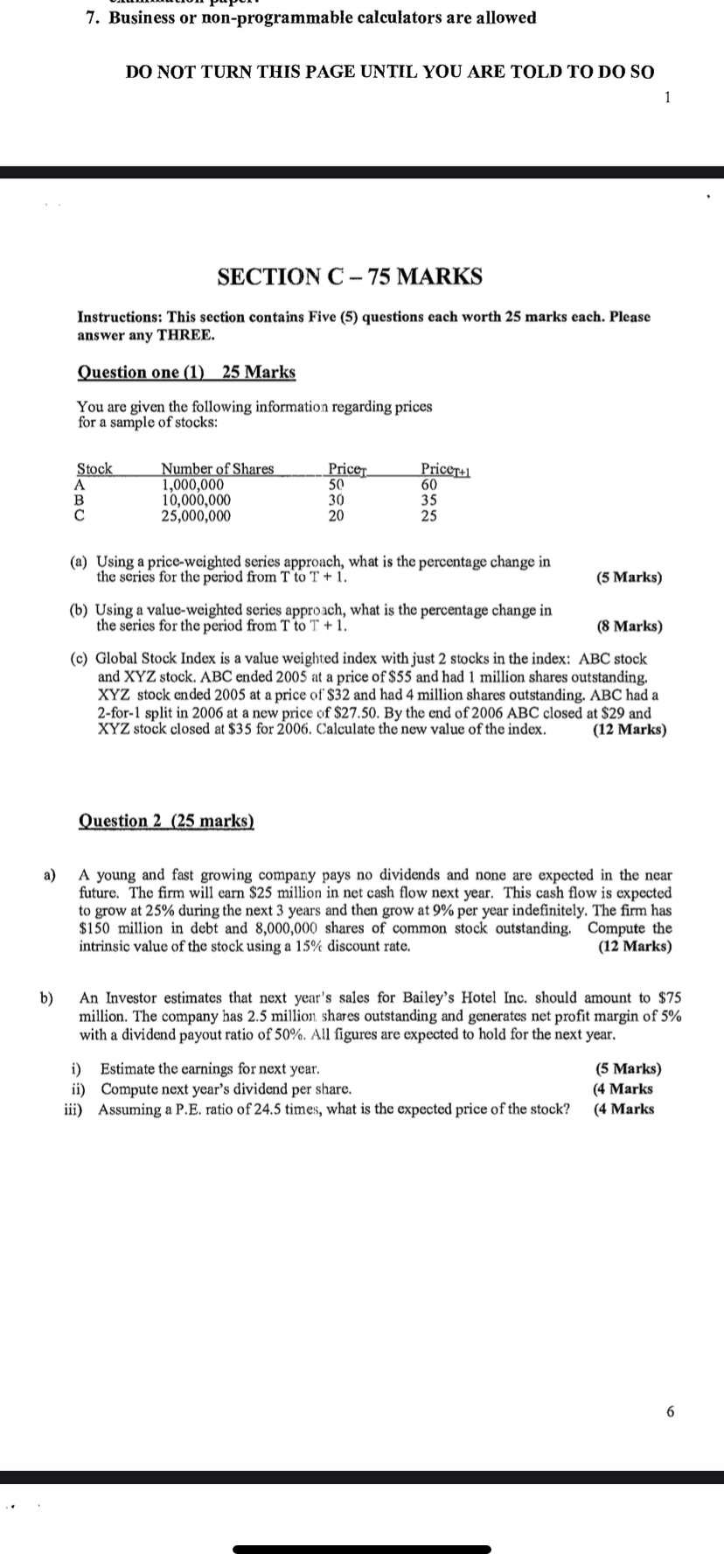

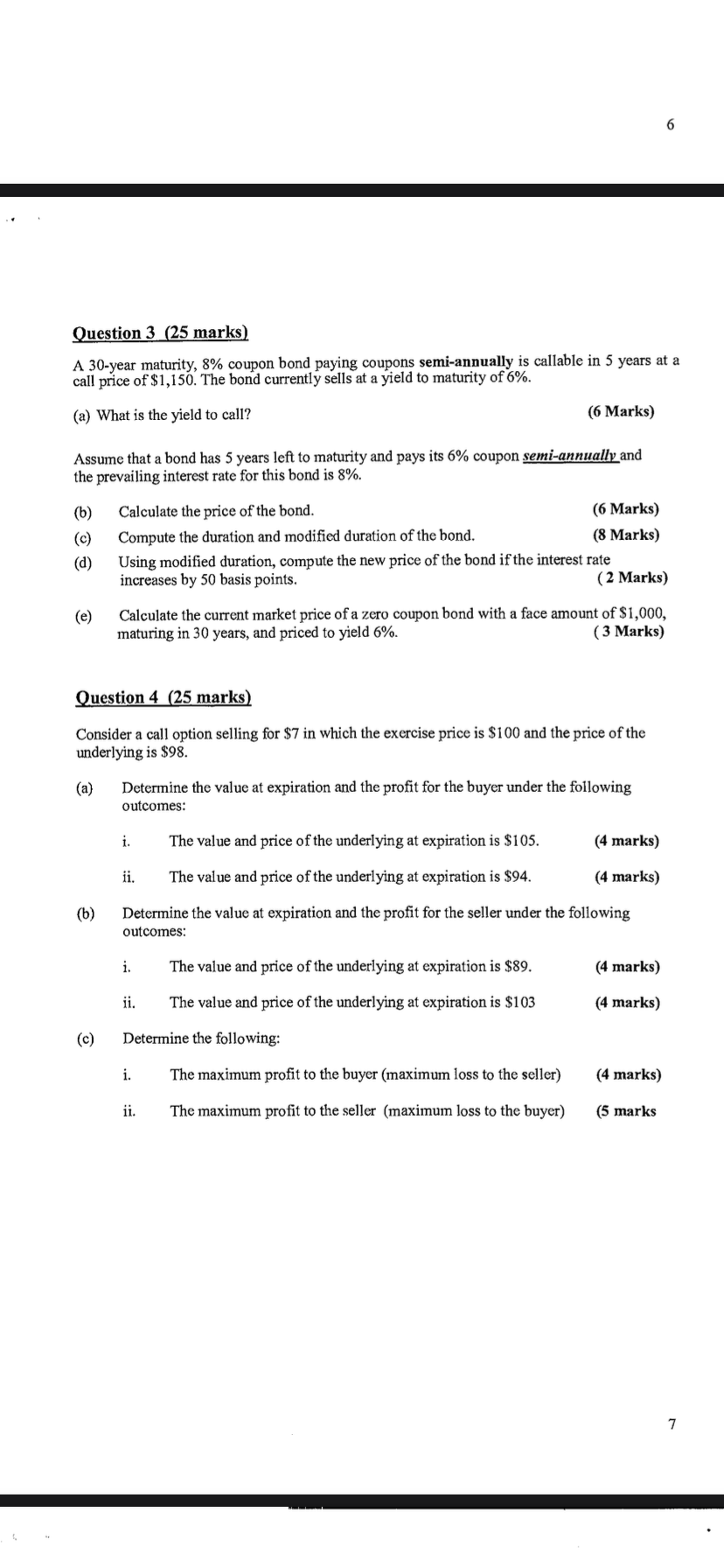

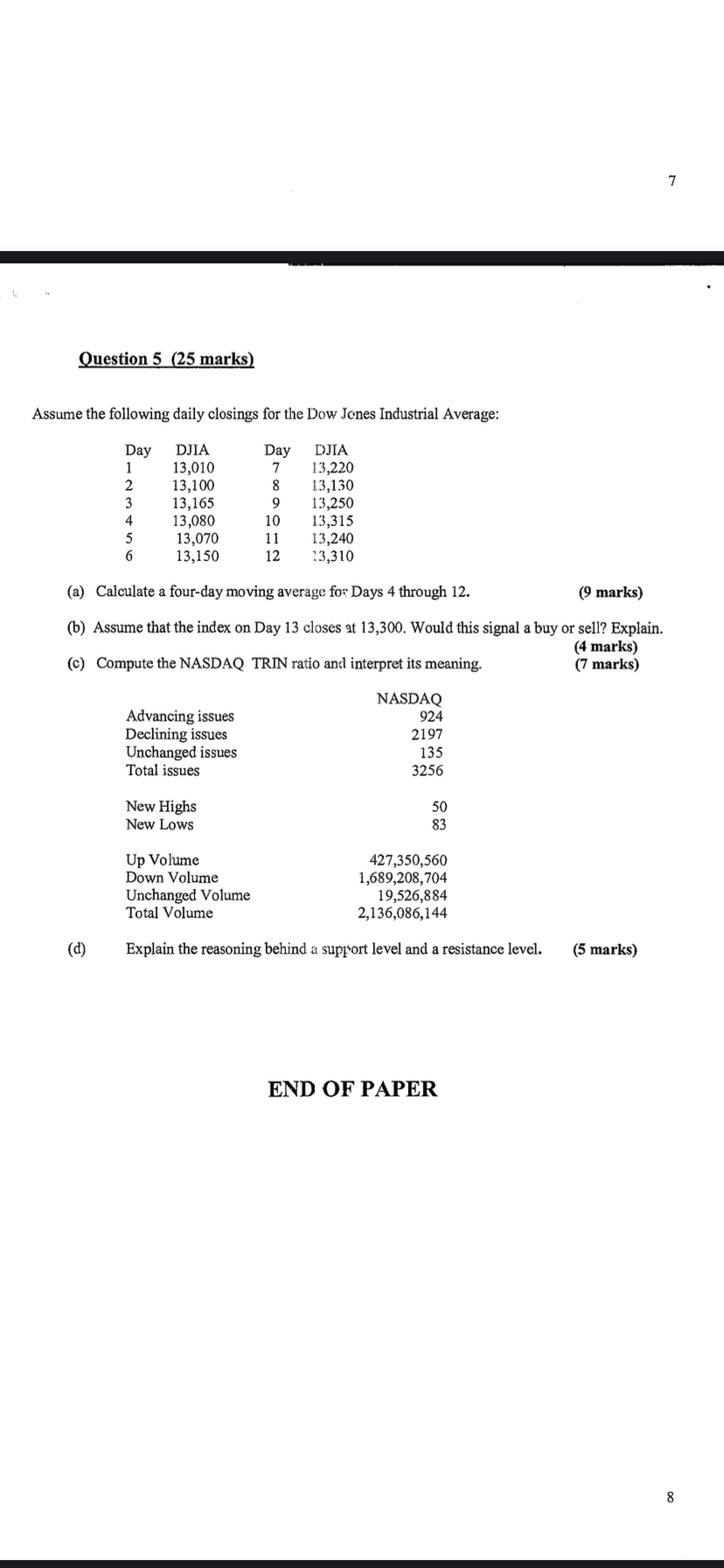

7. Business or non-programmable calculators are allowed DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO 1 SECTION C - 75 MARKS Instructions: This section contains Five (5) questions each worth 25 marks each. Please answer any THREE. Question one (1) 25 Marks You are given the following information regarding prices for a sample of stocks: (a) Using a price-weighted series approach, what is the percentage change in the series for the period from T to T+1. (5 Marks) (b) Using a value-weighted series approach, what is the percentage change in the series for the period from T to T+1. (8 Marks) (c) Global Stock Index is a value weighted index with just 2 stocks in the index: ABC stock and XYZ stock. ABC ended 2005 at a price of $55 and had 1 million shares outstanding. XYZ stock ended 2005 at a price of $32 and had 4 million shares outstanding. ABC had a 2 -for-1 split in 2006 at a new price of $27.50. By the end of 2006ABC closed at $29 and XYZ stock closed at $35 for 2006 . Calculate the new value of the index. (12 Marks) Question 2 (25 marks) a) A young and fast growing company pays no dividends and none are expected in the near future. The firm will earn $25 million in net cash flow next year. This cash flow is expected to grow at 25% during the next 3 years and then grow at 9% per year indefinitely. The firm has $150 million in debt and 8,000,000 shares of common stock outstanding. Compute the intrinsic value of the stock using a 15% discount rate. (12 Marks) b) An Investor estimates that next year's sales for Bailey's Hotel Inc. should amount to $75 million. The company has 2.5 million. shares outstanding and generates net profit margin of 5% with a dividend payout ratio of 50%. All figures are expected to hold for the next year. i) Estimate the earnings for next year. (5 Marks) ii) Compute next year's dividend per share. (4 Marks iii) Assuming a P.E. ratio of 24.5 times, what is the expected price of the stock? (4 Marks Question 3 (25 marks) A 30-year maturity, 8% coupon bond paying coupons semi-annually is callable in 5 years at a call price of $1,150. The bond currently sells at a yield to maturity of 6%. (a) What is the yield to call? (6 Marks) Assume that a bond has 5 years left to maturity and pays its 6% coupon semi-annually and the prevailing interest rate for this bond is 8%. (b) Calculate the price of the bond. (6 Marks) (c) Compute the duration and modified duration of the bond. (8 Marks) (d) Using modified duration, compute the new price of the bond if the interest rate increases by 50 basis points. ( 2 Marks) (e) Calculate the current market price of a zero coupon bond with a face amount of $1,000, maturing in 30 years, and priced to yield 6%. (3 Marks) Question 4 (25 marks) Consider a call option selling for $7 in which the exercise price is $100 and the price of the underlying is $98. (a) Determine the value at expiration and the profit for the buyer under the following outcomes: i. The value and price of the underlying at expiration is $105. (4 marks) ii. The value and price of the underlying at expiration is $94. (4 marks) (b) Determine the value at expiration and the profit for the seller under the following outcomes: i. The value and price of the underlying at expiration is $89. (4 marks) ii. The value and price of the underlying at expiration is $103 (4 marks) (c) Determine the following: i. The maximum profit to the buyer (maximum loss to the seller) (4 marks) ii. The maximum profit to the seller (maximum loss to the buyer) (5 marks Assume the following daily closings for the Dow Jones Industrial Average: (a) Calculate a four-day moving average for:Days 4 through 12 . (9 marks) (b) Assume that the index on Day 13 closes at 13,300. Would this signal a buy or sell? Explain. (c) Compute the NASDAQ TRIN ratio and interpret its meaning. (4 marks) (7 marks) (d) Explain the reasoning behind a support level and a resistance level. (5 marks) END OF PAPER

7. Business or non-programmable calculators are allowed DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO 1 SECTION C - 75 MARKS Instructions: This section contains Five (5) questions each worth 25 marks each. Please answer any THREE. Question one (1) 25 Marks You are given the following information regarding prices for a sample of stocks: (a) Using a price-weighted series approach, what is the percentage change in the series for the period from T to T+1. (5 Marks) (b) Using a value-weighted series approach, what is the percentage change in the series for the period from T to T+1. (8 Marks) (c) Global Stock Index is a value weighted index with just 2 stocks in the index: ABC stock and XYZ stock. ABC ended 2005 at a price of $55 and had 1 million shares outstanding. XYZ stock ended 2005 at a price of $32 and had 4 million shares outstanding. ABC had a 2 -for-1 split in 2006 at a new price of $27.50. By the end of 2006ABC closed at $29 and XYZ stock closed at $35 for 2006 . Calculate the new value of the index. (12 Marks) Question 2 (25 marks) a) A young and fast growing company pays no dividends and none are expected in the near future. The firm will earn $25 million in net cash flow next year. This cash flow is expected to grow at 25% during the next 3 years and then grow at 9% per year indefinitely. The firm has $150 million in debt and 8,000,000 shares of common stock outstanding. Compute the intrinsic value of the stock using a 15% discount rate. (12 Marks) b) An Investor estimates that next year's sales for Bailey's Hotel Inc. should amount to $75 million. The company has 2.5 million. shares outstanding and generates net profit margin of 5% with a dividend payout ratio of 50%. All figures are expected to hold for the next year. i) Estimate the earnings for next year. (5 Marks) ii) Compute next year's dividend per share. (4 Marks iii) Assuming a P.E. ratio of 24.5 times, what is the expected price of the stock? (4 Marks Question 3 (25 marks) A 30-year maturity, 8% coupon bond paying coupons semi-annually is callable in 5 years at a call price of $1,150. The bond currently sells at a yield to maturity of 6%. (a) What is the yield to call? (6 Marks) Assume that a bond has 5 years left to maturity and pays its 6% coupon semi-annually and the prevailing interest rate for this bond is 8%. (b) Calculate the price of the bond. (6 Marks) (c) Compute the duration and modified duration of the bond. (8 Marks) (d) Using modified duration, compute the new price of the bond if the interest rate increases by 50 basis points. ( 2 Marks) (e) Calculate the current market price of a zero coupon bond with a face amount of $1,000, maturing in 30 years, and priced to yield 6%. (3 Marks) Question 4 (25 marks) Consider a call option selling for $7 in which the exercise price is $100 and the price of the underlying is $98. (a) Determine the value at expiration and the profit for the buyer under the following outcomes: i. The value and price of the underlying at expiration is $105. (4 marks) ii. The value and price of the underlying at expiration is $94. (4 marks) (b) Determine the value at expiration and the profit for the seller under the following outcomes: i. The value and price of the underlying at expiration is $89. (4 marks) ii. The value and price of the underlying at expiration is $103 (4 marks) (c) Determine the following: i. The maximum profit to the buyer (maximum loss to the seller) (4 marks) ii. The maximum profit to the seller (maximum loss to the buyer) (5 marks Assume the following daily closings for the Dow Jones Industrial Average: (a) Calculate a four-day moving average for:Days 4 through 12 . (9 marks) (b) Assume that the index on Day 13 closes at 13,300. Would this signal a buy or sell? Explain. (c) Compute the NASDAQ TRIN ratio and interpret its meaning. (4 marks) (7 marks) (d) Explain the reasoning behind a support level and a resistance level. (5 marks) END OF PAPER Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started