Answered step by step

Verified Expert Solution

Question

1 Approved Answer

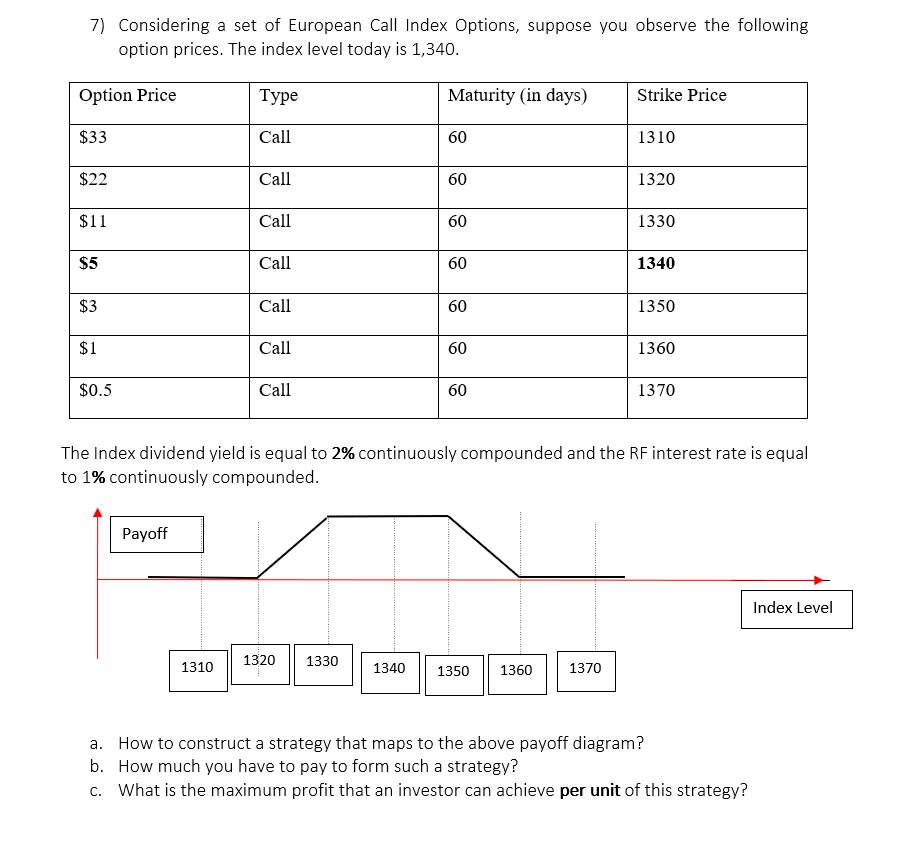

7) Considering a set of European Call Index Options, suppose you observe the following option prices. The index level today is 1,340. Option Price

7) Considering a set of European Call Index Options, suppose you observe the following option prices. The index level today is 1,340. Option Price Maturity (in days) Strike Price $33 Call 60 1310 $22 Call 60 60 1320 $11 Call 60 1330 $5 Call $3 Call $1 Call $0.5 Call 60 60 60 60 60 1340 60 1350 60 1360 60 1370 The Index dividend yield is equal to 2% continuously compounded and the RF interest rate is equal to 1% continuously compounded. Payoff 1320 1330 1310 1340 1350 1360 1370 a. How to construct a strategy that maps to the above payoff diagram? b. How much you have to pay to form such a strategy? c. What is the maximum profit that an investor can achieve per unit of this strategy? Index Level

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution a To construct a strategy that maps to the above payoff diagram we can use a combination of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started