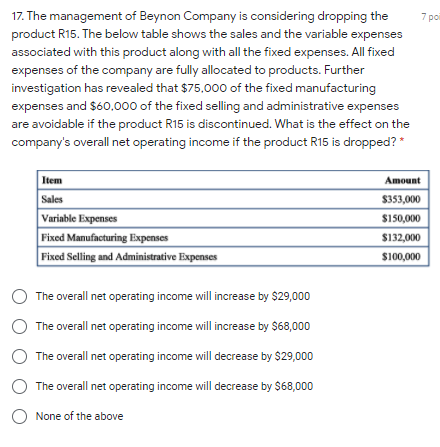

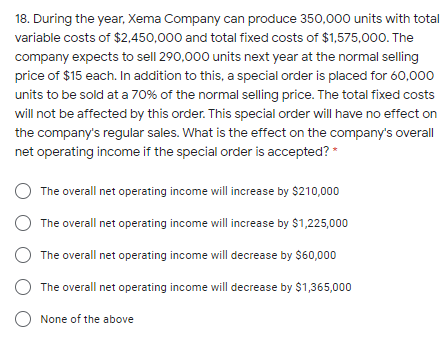

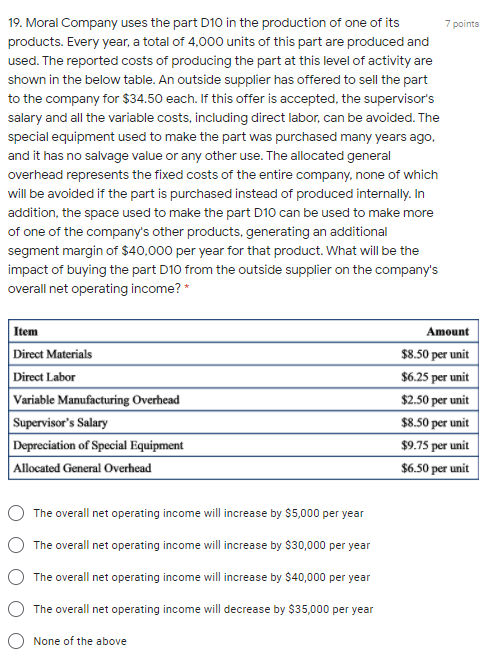

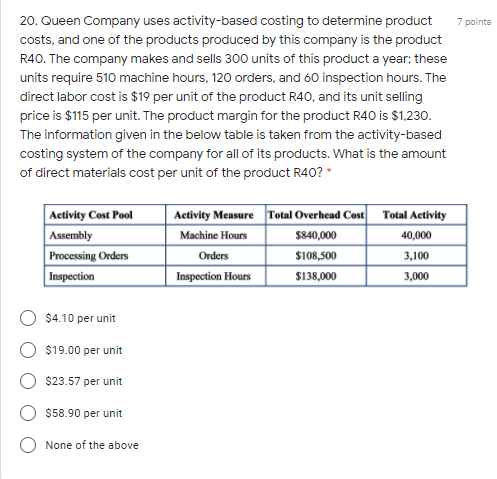

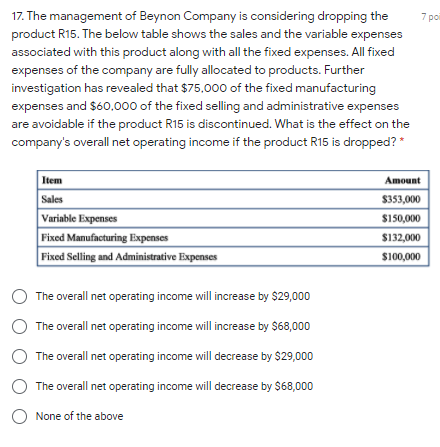

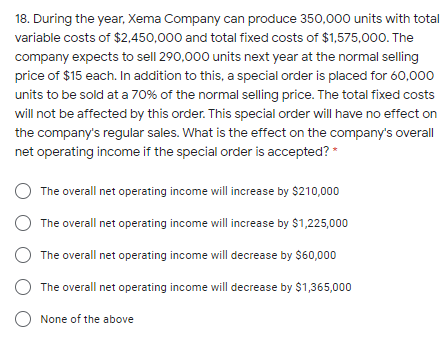

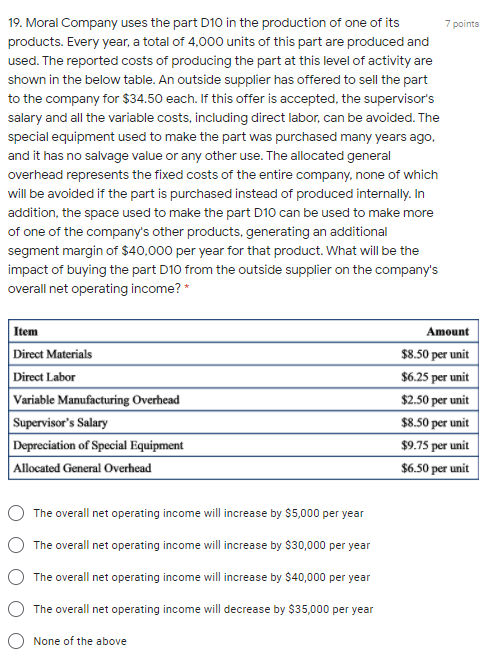

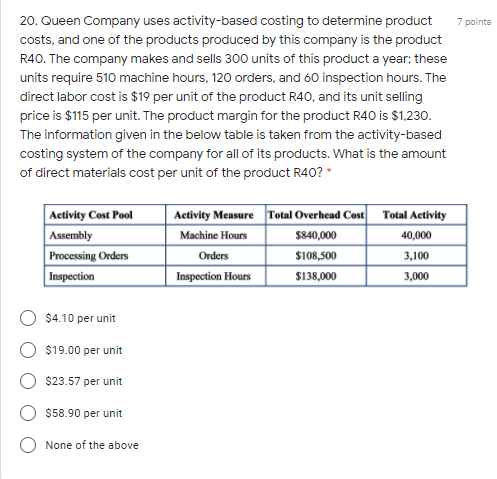

7 po 17. The management of Beynon Company is considering dropping the product R15. The below table shows the sales and the variable expenses associated with this product along with all the fixed expenses. All fixed expenses of the company are fully allocated to products. Further investigation has revealed that $75,000 of the fixed manufacturing expenses and $60,000 of the fixed selling and administrative expenses are avoidable if the product R15 is discontinued. What is the effect on the company's overall net operating income if the product R15 is dropped?* Item Amount $353,000 Sales Variable Expenses Fixed Manufacturing Expenses Fixed Selling and Administrative Expenses $150,000 $132,000 $100,000 The overall net operating income will increase by $29,000 The overall net operating income will increase by $68,000 The overall net operating income will decrease by $29,000 The overall net operating income will decrease by $68,000 None of the above 18. During the year, Xema Company can produce 350,000 units with total variable costs of $2,450,000 and total fixed costs of $1,575,000. The company expects to sell 290,000 units next year at the normal selling price of $15 each. In addition to this, a special order is placed for 60,000 units to be sold at a 70% of the normal selling price. The total fixed costs will not be affected by this order. This special order will have no effect on the company's regular sales. What is the effect on the company's overall net operating income if the special order is accepted? The overall net operating income will increase by $210,000 The overall net operating income will increase by $1,225,000 The overall net operating income will decrease by $60,000 The overall net operating income will decrease by $1,365,000 None of the above 7 points 19. Moral Company uses the part D10 in the production of one of its products. Every year, a total of 4.000 units of this part are produced and used. The reported costs of producing the part at this level of activity are shown in the below table. An outside supplier has offered to sell the part to the company for $34.50 each. If this offer is accepted, the supervisor's salary and all the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago. and it has no salvage value or any other use. The allocated general overhead represents the fixed costs of the entire company, none of which will be avoided if the part is purchased instead of produced internally. In addition, the space used to make the part D10 can be used to make more of one of the company's other products, generating an additional segment margin of $40,000 per year for that product. What will be the impact of buying the part D10 from the outside supplier on the company's overall net operating income?* Item Direct Materials Direct Labor Variable Manufacturing Overhead Supervisor's Salary Depreciation of Special Equipment Allocated General Overhead Amount $8.50 per unit $6.25 per unit $2.50 per unit $8.50 per unit $9.75 per unit $6.50 per unit The overall net operating income will increase by $5,000 per year The overall net operating income will increase by $30,000 per year The overall net operating income will increase by $40,000 per year The overall net operating income will decrease by $35,000 per year None of the above 7 points 20. Queen Company uses activity-based costing to determine product costs, and one of the products produced by this company is the product R40. The company makes and sells 300 units of this product a year, these units require 510 machine hours, 120 orders, and 60 inspection hours. The direct labor cost is $19 per unit of the product R40, and its unit selling price is $115 per unit. The product margin for the product R40 is $1,230. The information given in the below table is taken from the activity-based costing system of the company for all of its products. What is the amount of direct materials cost per unit of the product R40?* Activity Cost Pool Assembly Processing Orders Inspection Activity Measure Total Overhead Cost Total Activity Machine Hours $840,000 40,000 Orders $108,500 3,100 Inspection Hours $138,000 3,000 $4.10 per unit $19.00 per unit $23.57 per unit $58.90 per unit None of the above