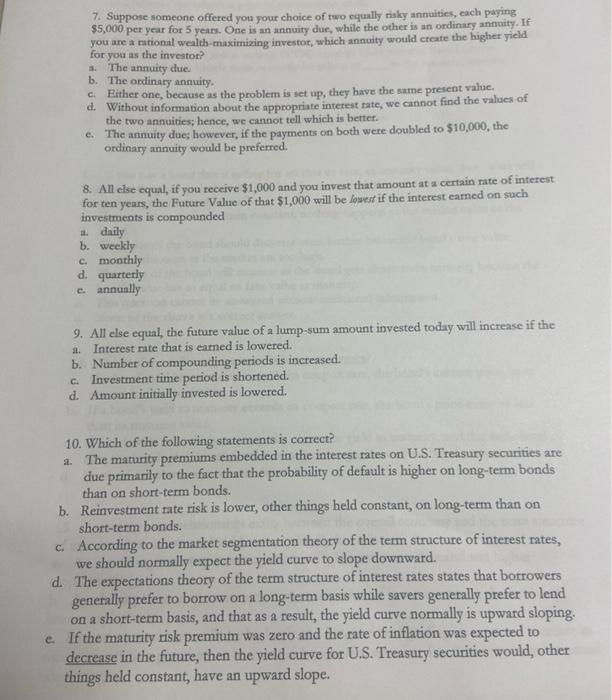

7. Suppose someone offered you your choice of two equally risky annuities, each paying $5,000 per year for 5 years. One is an annuity due, while the other is an ordinary annuity. If you are a rational wealth-maximizing investor, which annuity would create the higher yield for you as the investor? 1. The annuity due b. The ordinary annuity. Either one, because as the problem is set up, they have the same present value d. Without information about the appropriate interest rate, we cannot find the values of the two annuities; hence, we cannot tell which is better. e. The annuity due; however, if the payments on both were doubled to $10,000, the ordinary annuity would be preferred. 8. All else equal, if you receive $1,000 and you invest that amount at a certain rate of interest for ten years, the Future Value of that $1,000 will be lowest if the interest earned on such investments is compounded 1.daily b. weekly c. monthly d. quarterly c. annually a. 9. All else equal, the future value of a lump-sum amount invested today will increase if the Interest rate that is earned is lowered. b. Number of compounding periods is increased. Investment time period is shortened. d. Amount initially invested is lowered. C. 10. Which of the following statements is correct? 4. The maturity premiums embedded in the interest rates on U.S. Treasury securities are due primarily to the fact that the probability of default is higher on long-term bonds than on short-term bonds. b. Reinvestment rate risk is lower, other things held constant, on long-term than on short-term bonds. c. According to the market segmentation theory of the term structure of interest rates, we should normally expect the yield curve to slope downward. d. The expectations theory of the term structure of interest rates states that borrowers generally prefer to borrow on a long-term basis while savers generally prefer to lend on a short-term basis, and that as a result, the yield curve normally is upward sloping. e. If the maturity risk premium was zero and the rate of inflation was expected to decrease in the future, then the yield curve for U.S. Treasury securities would, other things held constant, have an upward slope