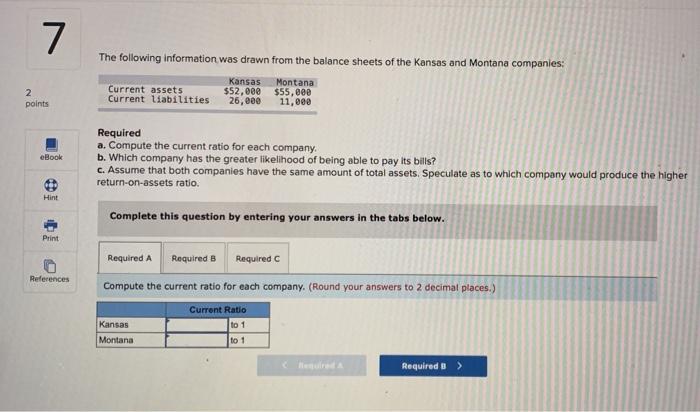

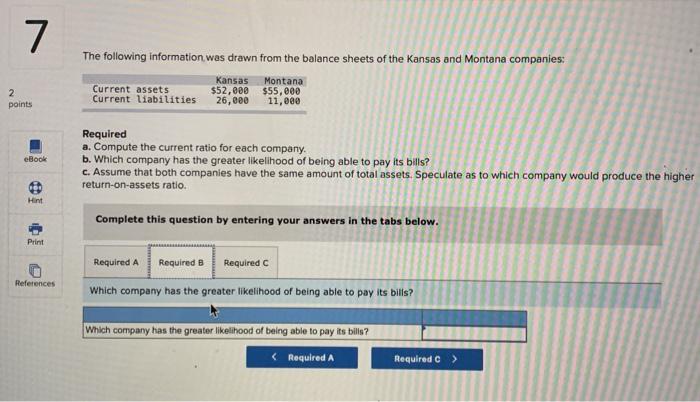

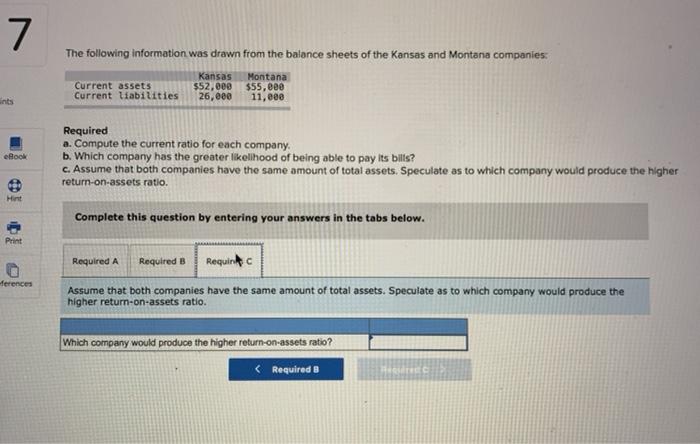

7 The following information was drawn from the balance sheets of the Kansas and Montana companies: 2 points Current assets Current liabilities Kansas Montana $52,000 $55,000 26,000 11,000 eBook Required a. Compute the current ratio for each company b. Which company has the greater likelihood of being able to pay its bills? c. Assume that both companies have the same amount of total assets. Speculate as to which company would produce the higher return-on-assets ratio. Hint Complete this question by entering your answers in the tabs below. Print References Required A Required B Required Compute the current ratio for each company. (Round your answers to 2 decimal places.) Current Ratio Kansas to 1 to 1 Montana Required 3 > 7 The following information was drawn from the balance sheets of the Kansas and Montana companies: Kansas Montana Current assets $52,000 $55,000 Current liabilities 26,00 11,080 2 points eBook Required a. Compute the current ratio for each company. b. Which company has the greater likelihood of being able to pay its bills? c. Assume that both companies have the same amount of total assets. Speculate as to which company would produce the higher return-on-assets ratio Hint Complete this question by entering your answers in the tabs below. Print Required A Required B Required Which company has the greater likelihood of being able to pay its bills? References Which company has the greater likelihood of being able to pay is bills? 7 The following information was drawn from the balance sheets of the Kansas and Montana companies Current assets Current liabilities Kansas $52,000 26,000 Montana $55,00 11,000 ints eBook Required a. Compute the current ratio for each company b. Which company has the greater likelihood of being able to pay its bills? c. Assume that both companies have the same amount of total assets. Speculate as to which company would produce the higher return-on-assets ratio. Hint Complete this question by entering your answers in the tabs below. Print Required A Required B Requinc erences Assume that both companies have the same amount of total assets. Speculate as to which company would produce the higher return-on-assets ratio. Which company would produce the higher return-on-assets ratio?