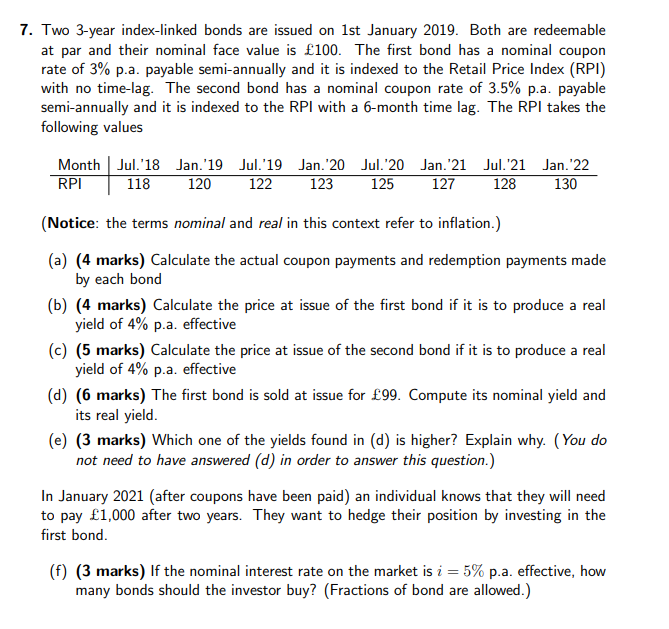

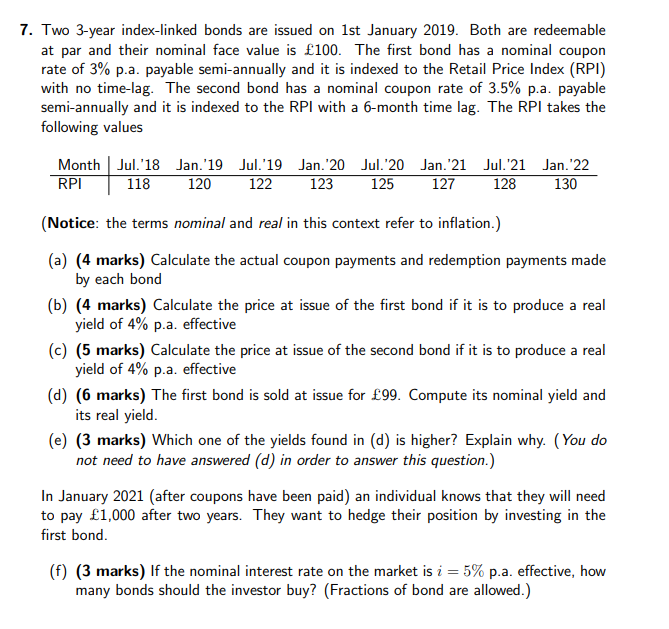

7. Two 3-year index-linked bonds are issued on 1st January 2019. Both are redeemable at par and their nominal face value is 100. The first bond has a nominal coupon rate of 3% p.a. payable semi-annually and it is indexed to the Retail Price Index (RPI) with no time-lag. The second bond has a nominal coupon rate of 3.5% p.a. payable semi-annually and it is indexed to the RPI with a 6-month time lag. The RPI takes the following values Month Jul. '18 Jan.'19 Jul. '19 Jan.'20 Jul.'20 Jan. 21 Jul. 21 Jan 22 RPI 118 120 122 123 125 127 128 130 (Notice: the terms nominal and real in this context refer to inflation.) (a) (4 marks) Calculate the actual coupon payments and redemption payments made by each bond (b) (4 marks) Calculate the price at issue of the first bond if it is to produce a real yield of 4% p.a. effective (c) (5 marks) Calculate the price at issue of the second bond if it is to produce a real yield of 4% p.a. effective (d) (6 marks) The first bond is sold at issue for 99. Compute its nominal yield and its real yield. (e) (3 marks) Which one of the yields found in (d) is higher? Explain why. (You do not need to have answered (d) in order to answer this question.) In January 2021 (after coupons have been paid) an individual knows that they will need to pay 1,000 after two years. They want to hedge their position by investing in the first bond. (f) (3 marks) If the nominal interest rate on the market is i = 5% p.a. effective, how many bonds should the investor buy? (Fractions of bond are allowed.) 7. Two 3-year index-linked bonds are issued on 1st January 2019. Both are redeemable at par and their nominal face value is 100. The first bond has a nominal coupon rate of 3% p.a. payable semi-annually and it is indexed to the Retail Price Index (RPI) with no time-lag. The second bond has a nominal coupon rate of 3.5% p.a. payable semi-annually and it is indexed to the RPI with a 6-month time lag. The RPI takes the following values Month Jul. '18 Jan.'19 Jul. '19 Jan.'20 Jul.'20 Jan. 21 Jul. 21 Jan 22 RPI 118 120 122 123 125 127 128 130 (Notice: the terms nominal and real in this context refer to inflation.) (a) (4 marks) Calculate the actual coupon payments and redemption payments made by each bond (b) (4 marks) Calculate the price at issue of the first bond if it is to produce a real yield of 4% p.a. effective (c) (5 marks) Calculate the price at issue of the second bond if it is to produce a real yield of 4% p.a. effective (d) (6 marks) The first bond is sold at issue for 99. Compute its nominal yield and its real yield. (e) (3 marks) Which one of the yields found in (d) is higher? Explain why. (You do not need to have answered (d) in order to answer this question.) In January 2021 (after coupons have been paid) an individual knows that they will need to pay 1,000 after two years. They want to hedge their position by investing in the first bond. (f) (3 marks) If the nominal interest rate on the market is i = 5% p.a. effective, how many bonds should the investor buy? (Fractions of bond are allowed.)