Answered step by step

Verified Expert Solution

Question

1 Approved Answer

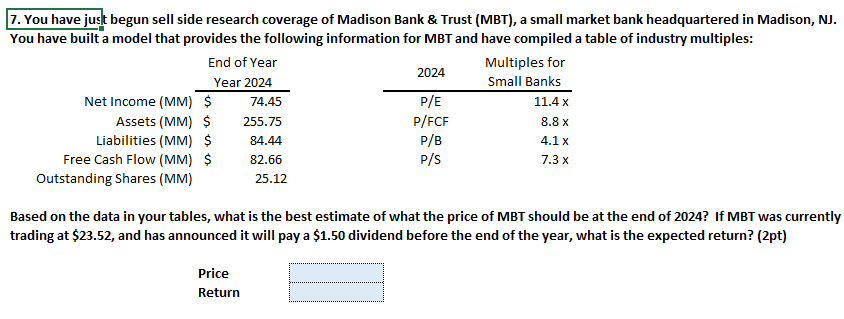

7. You have just begun sell side research coverage of Madison Bank & Trust (MBT), a small market bank headquartered in Madison, NJ. You

7. You have just begun sell side research coverage of Madison Bank & Trust (MBT), a small market bank headquartered in Madison, NJ. You have built a model that provides the following information for MBT and have compiled a table of industry multiples: Multiples for Small Banks End of Year Year 2024 Net Income (MM) $ 74.45 Assets (MM) $ 255.75 Liabilities (MM) $ 84.44 Free Cash Flow (MM) $ Outstanding Shares (MM) 82.66 25.12 2024 P/E 11.4 x P/FCF 8.8 x P/B P/S 4.1 x 7.3 x Based on the data in your tables, what is the best estimate of what the price of MBT should be at the end of 2024? If MBT was currently trading at $23.52, and has announced it will pay a $1.50 dividend before the end of the year, what is the expected return? (2pt) Price Return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Identified Problem Description 11You have just begun sellside research coverage of Madison Bank Trus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started