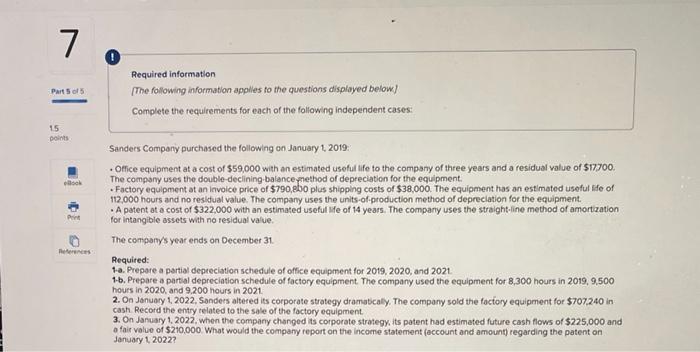

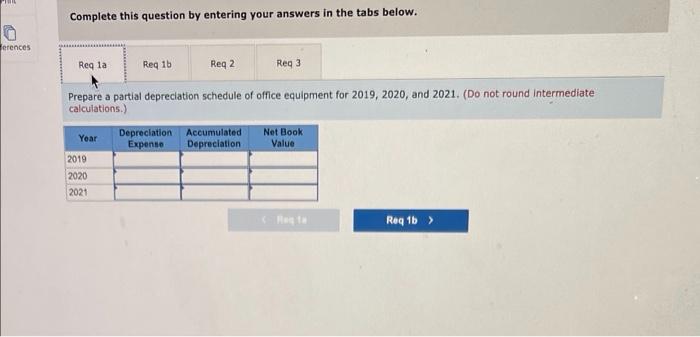

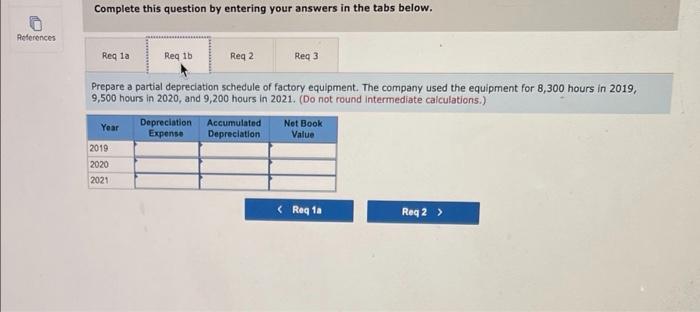

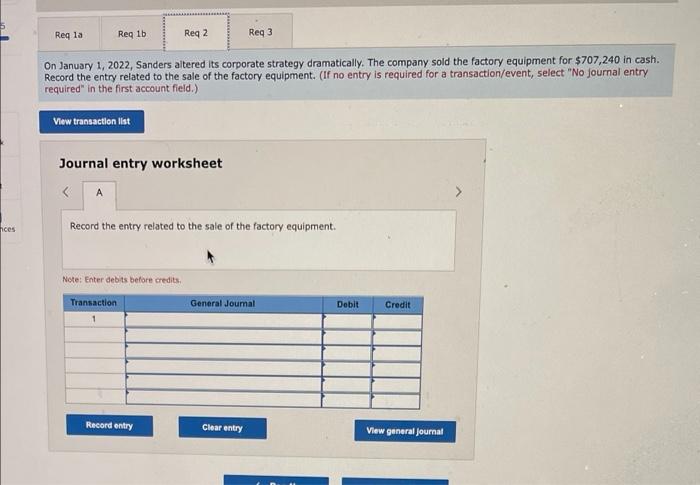

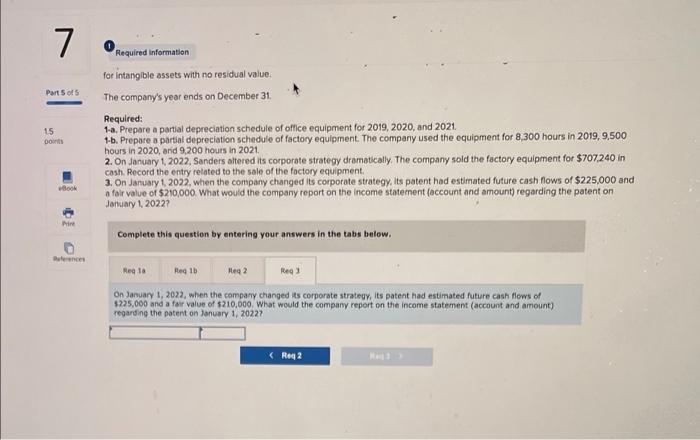

70 Part 05 Required information The following information applies to the questions displayed below! Complete the requirements for each of the following independent cases: 15 paints Point Sanders Company purchased the following on January 1 2019: Office equipment at a cost of $59,000 with an estimated useful life to the company of three years and a residual value of $17700. The company uses the double-declining balance method of depreciation for the equipment Factory equipment at an invoice price of $790,00 plus shipping costs of $38,000. The equipment has an estimated useful life of 112,000 hours and no residual value. The company uses the units-of-production method of depreciation for the equipment A patent at a cost of $322,000 with an estimated useful life of 14 years. The company uses the straight-line method of amortization for intangible assets with no residual value. The company's year ends on December 31 Required: 1a. Prepare a partial depreciation schedule of office equipment for 2019,2020, and 2021 1-5. Prepare a partial depreciation schedule of factory equipment. The company used the equipment for 8,300 hours in 2019, 9,500 hours in 2020, and 9.200 hours in 2021 2. On January 1, 2022. Sonders altered its corporate strategy dramatically. The company sold the factory equipment for $707.240 in cash Record the entry related to the sale of the factory equipment 3. On January 1 2022 when the company changed its corporate strategy. Its patent had estimated future cash flows of $225,000 and fair value of $210,000 What would the company report on the income statement account and amount) regarding the patent on January 1 2022? References Complete this question by entering your answers in the tabs below. a Ferences Req la Reg 16 Reg 2 Reg 3 Prepare a partial depreciation schedule of office equipment for 2019, 2020, and 2021. (Do not round Intermediate calculations.) Year Depreciation Accumulated Expense Depreciation Net Book Value 2019 2020 2021 Req 16 ) Complete this question by entering your answers in the tabs below. References Regla Req 1b Reg 2 Reg 3 Prepare a partial depreciation schedule of factory equipment. The company used the equipment for 8,300 hours in 2019, 9,500 hours in 2020, and 9,200 hours in 2021. (Do not round Intermediate calculations.) Year Depreciation Expense Accumulated Depreciation Net Book Value 2019 2020 2021 Req la Reg 1b Reg 2 Req3 On January 1, 2022, Sanders altered its corporate strategy dramatically. The company sold the factory equipment for $707,240 in cash. Record the entry related to the sale of the factory equipment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet