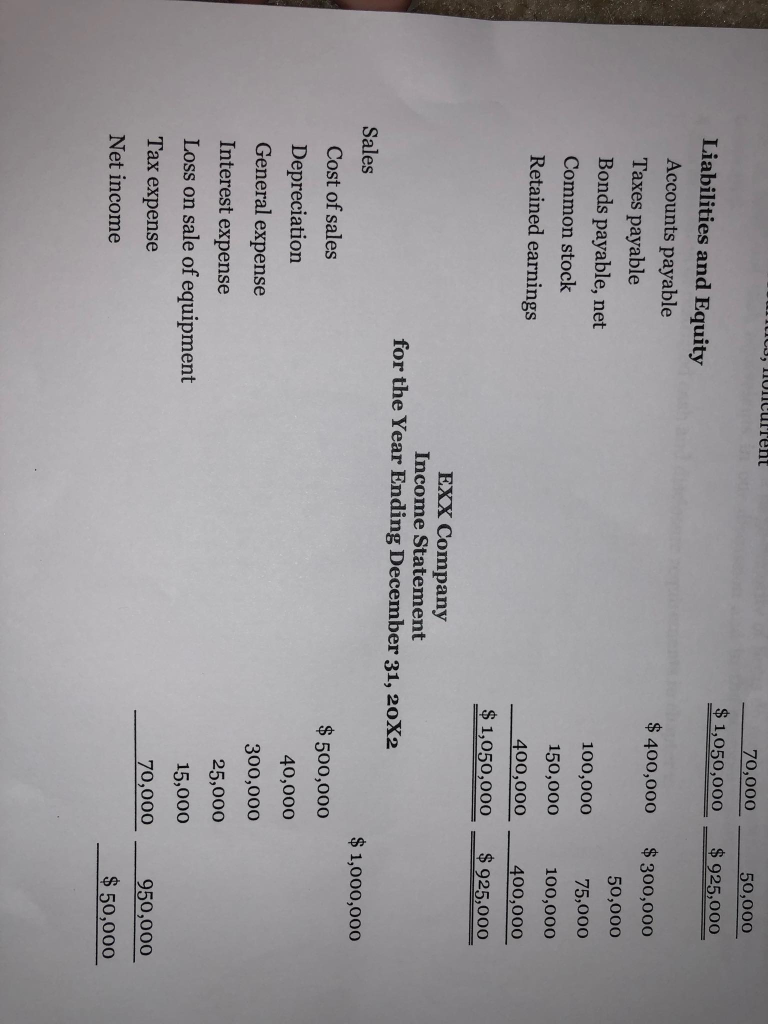

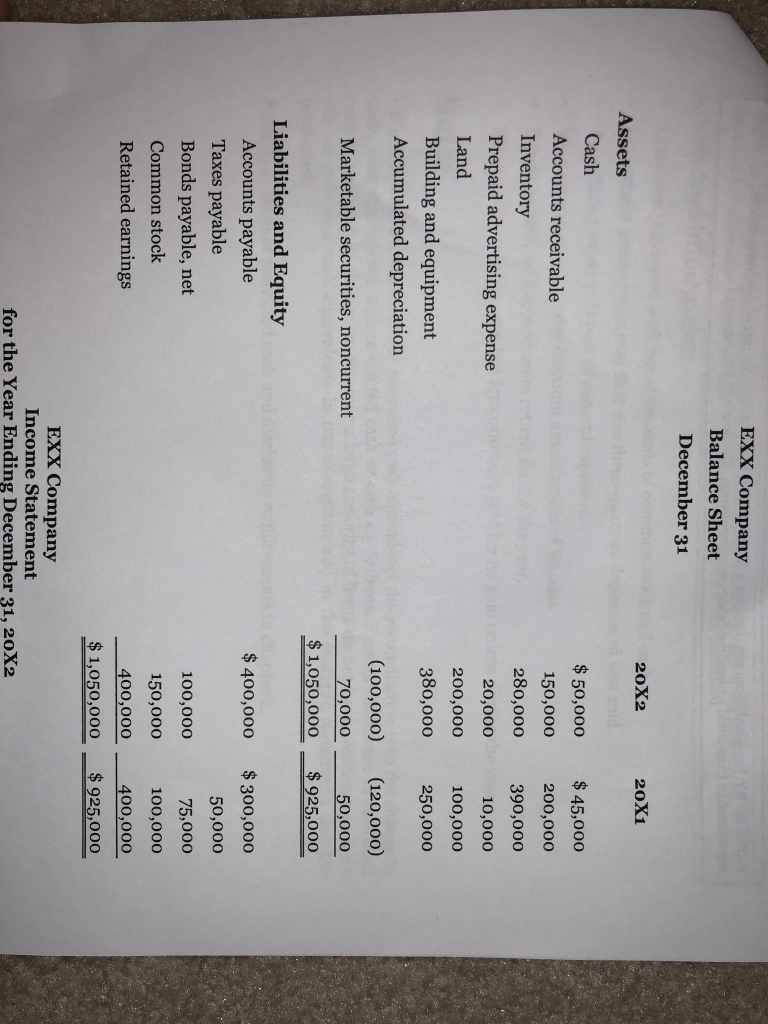

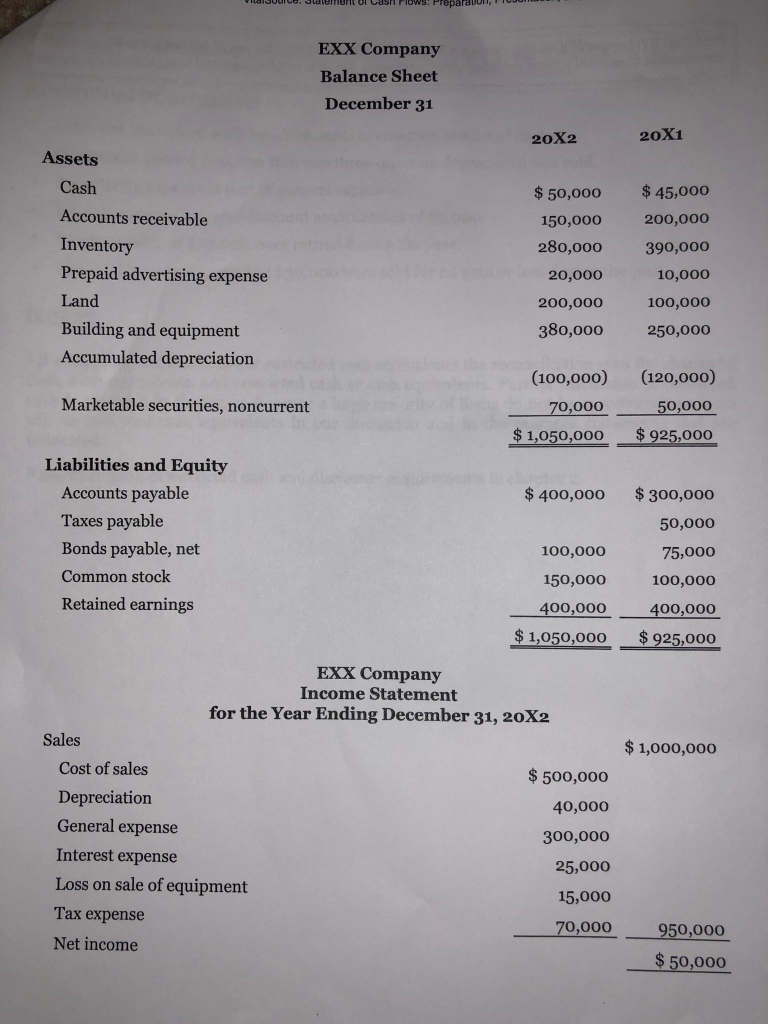

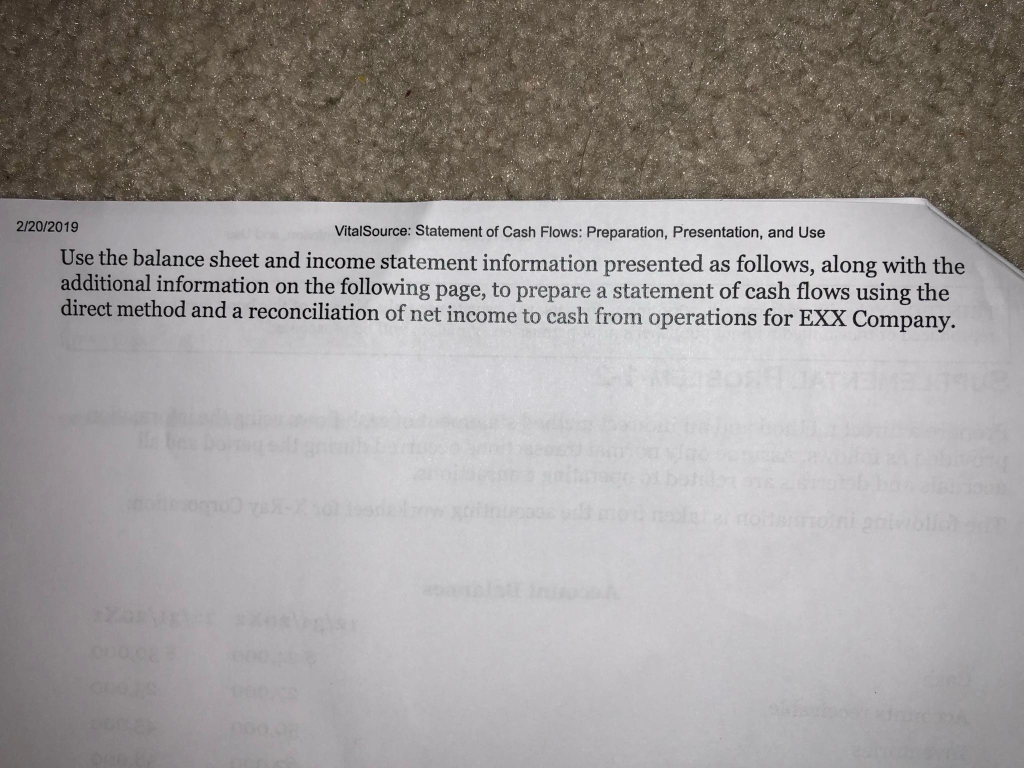

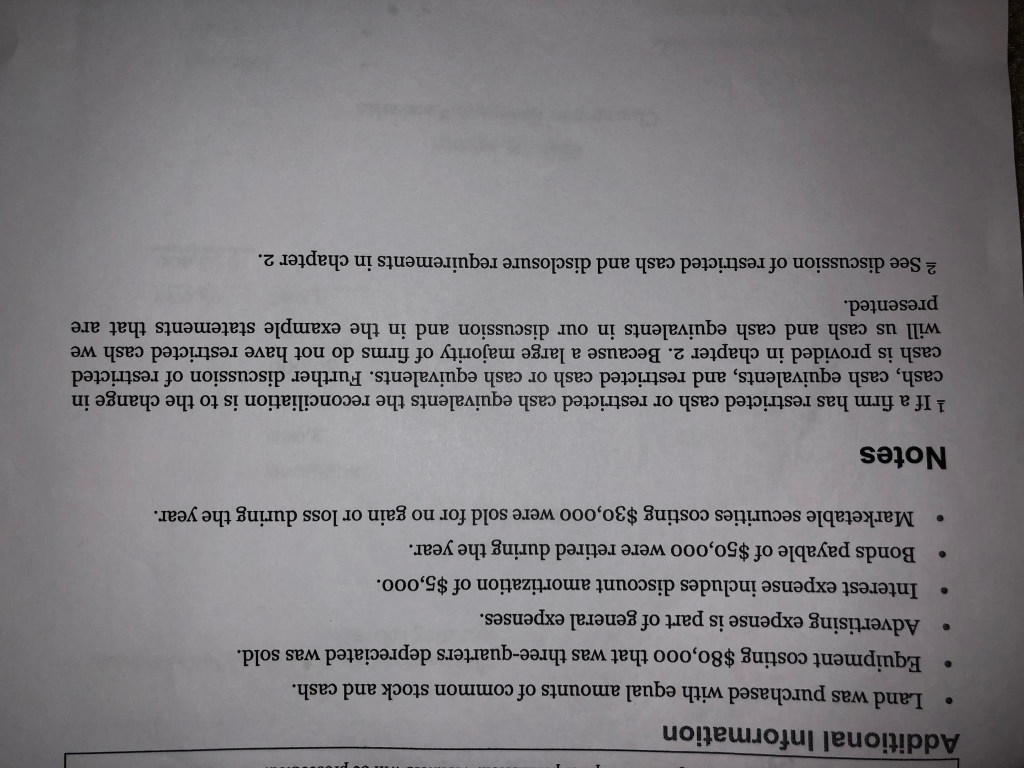

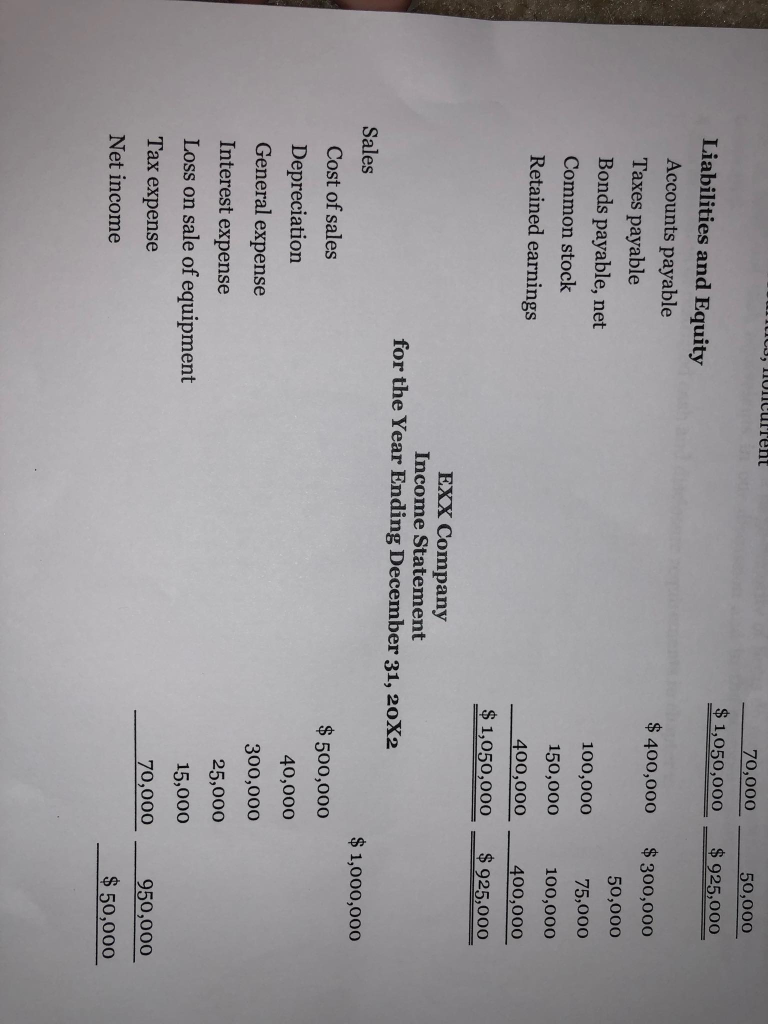

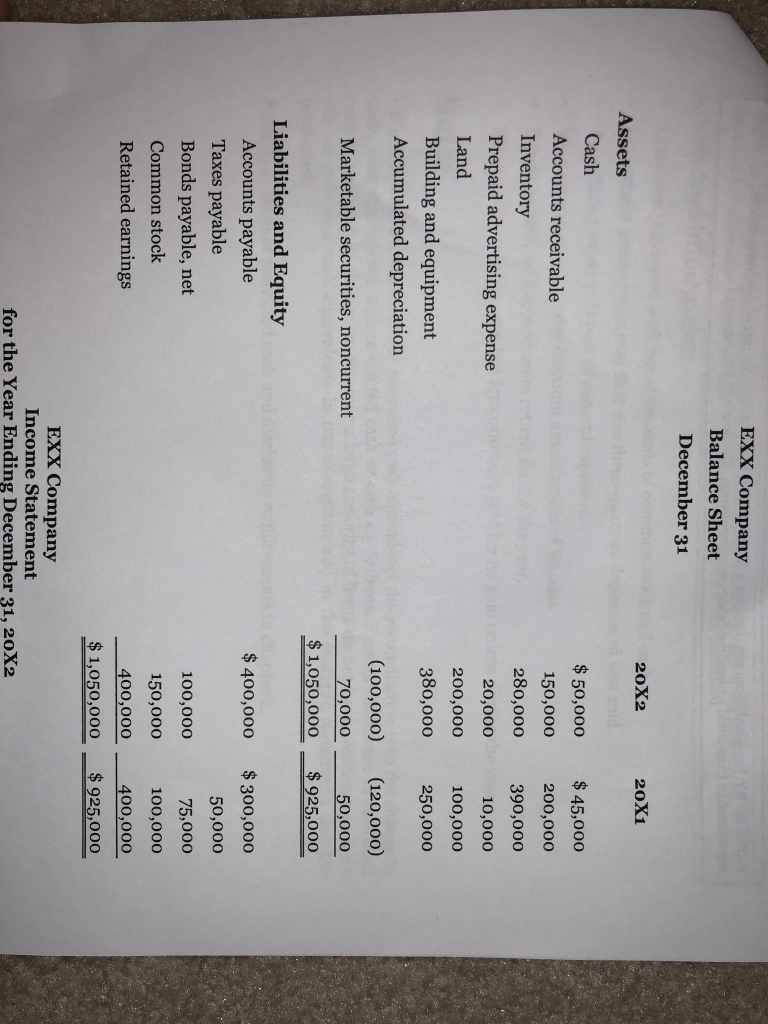

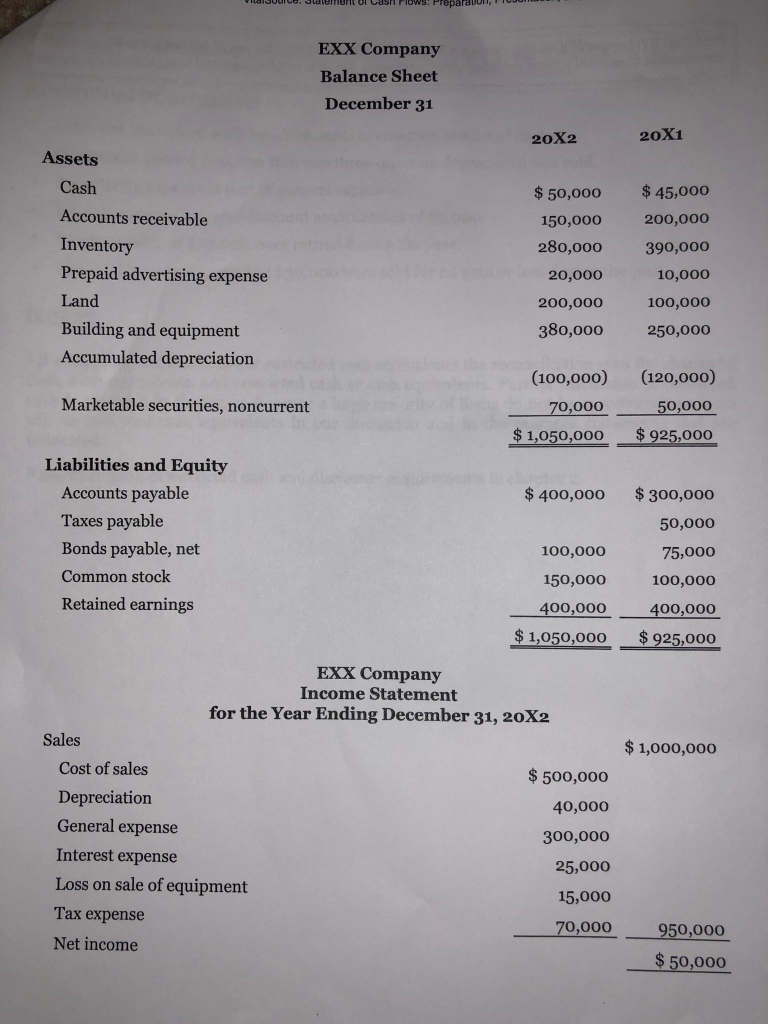

70,000 50,000 1,050,00o $925,000 Liabilities and Equity Accounts payable Taxes payable Bonds payable, net Common stock Retained earnings $400,000 $300,o00 50,000 75,000 100,00o 400,000 400,000 $ 1,050,000 $925,000 100,000 150,000 EXX Company Income Statement for the Year Ending December 31, 20X2 Sales $ 1,000,000 Cost of sales Depreciation General expense Interest expense Loss on sale of equipment Tax expense Net income $500,000 40,000 300,000 25,000 15,000 70,000 950,o00 $50,000 EXX Company Balance Sheet December 31 20X2 20X1 Assets Cash Accounts receivable Inventory Prepaid advertising expense Land Building and equipment Accumulated depreciation $50,000 $45,000 150,000 200,000 280,000 390,000o 10,000 100,000 380,000 250,000 20,000 200,000 (100,000) (120,000) 50,000 $1,050,000 $925,000 Marketable securities, noncurrent 70,000 Liabilities and Equity Accounts payable Taxes payable Bonds payable, net Common stock Retained earnings $ 400,000 $ 300,000 50,000 75,000 150,000 100,000 400,000400,000 $1,050,000 $925,000 100,000 EXX Company Income Statement for the Year Ending December 31, 20X2 EXX Company Balance Sheet December 31 20X2 20X1 Assets Cash Accounts receivable Inventory Prepaid advertising expense Land Building and equipment Acc $ 50,000 $ 45,000 150,000 200,00o 280,000 390,000 10,000 200,000 100,000 380,000 250,00o 20,000 umulated depreciation (100,000) (120,0oo) 50,000 $1,050,000 $ 925,000 Marketable securities, noncurrent 70,000 Liabilities and Equity Accounts payable Taxes payable Bonds payable, net Common stock Retained earnings $ 400,000 300,oo0 50,000 100,000 75,000 150,000 100,000 400,000400,000 $1,050,000 $925,000 EXX Company Income Statement for the Year Ending December 31, 20X2 Sales $1,000,00o Cost of sales Depreciation General expense Interest expense Loss on sale of equipment Tax expense Net income $500,000 40,000 300,000 25,000 15,000 70,000 950,000 $50,000 2/20/2019 VitalSource: Statement of Cash Flows: Preparation, Presentation, and Use Use the balance sheet and income statement information presented as follows, along with the additional information on the following page, to prepare a statement of cash flows using the direct method and a reconciliation of net income to cash from operations for EXX Company. Additional Information . Land was purchased with equal amounts of common stock and cash. Equipment costing $8o,o00 that was three-quarters depreciated was sold. Advertising expense is part of general expenses. Interest expense includes discount amortization of $5,ooo. Bonds payable of $50,ooo were retired during the year. Marketable securities costing $30,000 were sold for no gain or loss during the year. Notes 1 If a firm has restricted cash or restricted cash equivalents the reconciliation is to the change in cash, cash equivalents, and restricted cash or cash equivalents. Further discussion of restricted cash is provided in chapter 2. Because a large majority of firms do not have restricted cash we will us cash and cash equivalents in our discussion and in the example statements that are presented. 2 See discussion of restricted cash and disclosure requirements in chapter 2