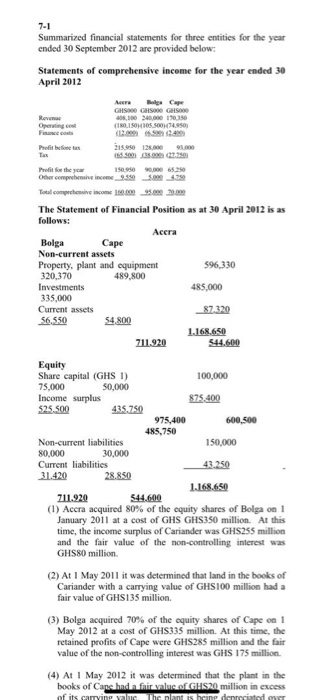

7-1 Summarized financial statements for three entities for the year ended 30 September 2012 are provided below: Statements of comprehensive income for the year ended 30 April 2012 Acero e Cape GHS GHS GHS 0,100 320.000 1700350 ISO 105.00 14.950 Opening cost 215.950 12.000 93.000 Profit for the ye Other comprehensive income_9.5 500 1.22 Total comprensive income The Statement of Financial Position as at 30 April 2012 is as follows: Accra Bolga Cape Non-current assets Property, plant and equipment 596,330 320,370 489,800 Investments 485,000 335,000 Current assets 87.320 56.550 54,800 1.168.650 711.920 544.600 Equity Share capital (GHS 1) 100,000 75,000 50,000 Income surplus 875.400 $25.500 435.750 975,400 600.500 485,750 Non-current liabilities 150,000 80,000 30,000 Current liabilities 43.250 31.420 28.850 1.168.650 211.920 544.600 (1) Acera acquired 80% of the equity shares of Bolga on 1 January 2011 at a cost of GHS GHS350 million. At this time, the income surplus of Cariander was GHS255 million and the fair value of the non-controlling interest was GHS80 million (2) At 1 May 2011 it was determined that land in the books of Cariander with a carrying value of GHS100 million had a fair value of GHS135 million (3) Bolga acquired 70% of the equity shares of Cape on 1 May 2012 at a cost of GHS335 million. At this time, the retained profits of Cape were GHS285 million and the fair value of the non-controlling interest was GHS 175 million (4) At 1 May 2012 it was determined that the plant in the books of Cape Indian firir value of GHS20 million in excess of its carrying value The plant is being derreciated 7-1 Summarized financial statements for three entities for the year ended 30 September 2012 are provided below: Statements of comprehensive income for the year ended 30 April 2012 Acero e Cape GHS GHS GHS 0,100 320.000 1700350 ISO 105.00 14.950 Opening cost 215.950 12.000 93.000 Profit for the ye Other comprehensive income_9.5 500 1.22 Total comprensive income The Statement of Financial Position as at 30 April 2012 is as follows: Accra Bolga Cape Non-current assets Property, plant and equipment 596,330 320,370 489,800 Investments 485,000 335,000 Current assets 87.320 56.550 54,800 1.168.650 711.920 544.600 Equity Share capital (GHS 1) 100,000 75,000 50,000 Income surplus 875.400 $25.500 435.750 975,400 600.500 485,750 Non-current liabilities 150,000 80,000 30,000 Current liabilities 43.250 31.420 28.850 1.168.650 211.920 544.600 (1) Acera acquired 80% of the equity shares of Bolga on 1 January 2011 at a cost of GHS GHS350 million. At this time, the income surplus of Cariander was GHS255 million and the fair value of the non-controlling interest was GHS80 million (2) At 1 May 2011 it was determined that land in the books of Cariander with a carrying value of GHS100 million had a fair value of GHS135 million (3) Bolga acquired 70% of the equity shares of Cape on 1 May 2012 at a cost of GHS335 million. At this time, the retained profits of Cape were GHS285 million and the fair value of the non-controlling interest was GHS 175 million (4) At 1 May 2012 it was determined that the plant in the books of Cape Indian firir value of GHS20 million in excess of its carrying value The plant is being derreciated