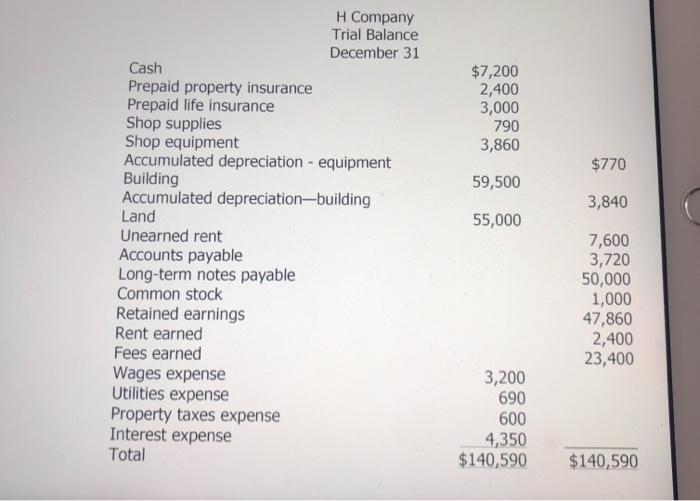

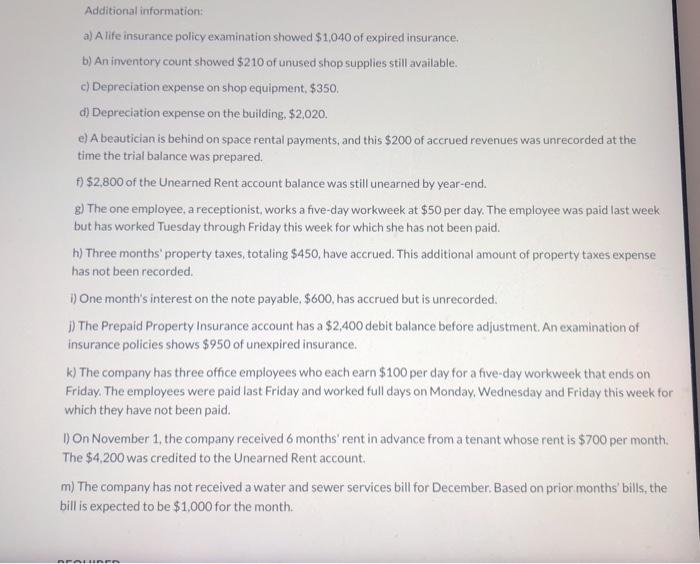

$7,200 2,400 3,000 790 3,860 $770 59,500 3,840 55,000 H Company Trial Balance December 31 Cash Prepaid property insurance Prepaid life insurance Shop supplies Shop equipment Accumulated depreciation - equipment Building Accumulated depreciation-building Land Unearned rent Accounts payable Long-term notes payable Common stock Retained earnings Rent earned Fees earned Wages expense Utilities expense Property taxes expense Interest expense Total 7,600 3,720 50,000 1,000 47,860 2,400 23,400 3,200 690 600 4,350 $140,590 $140,590 Additional information: a) A life insurance policy examination showed $1,040 of expired insurance, b) An inventory count showed $210 of unused shop supplies still available. c) Depreciation expense on shop equipment, $350. d) Depreciation expense on the building. $2,020. e) A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared ) $2,800 of the Unearned Rent account balance was still unearned by year-end. 8) The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked Tuesday through Friday this week for which she has not been paid. h) Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded 1) One month's interest on the note payable $600, has accrued but is unrecorded. 1) The Prepaid Property Insurance account has a $2,400 debit balance before adjustment. An examination of insurance policies shows $950 of unexpired insurance. k) The company has three office employees who each earn $100 per day for a five-day workweek that ends on Friday. The employees were paid last Friday and worked full days on Monday, Wednesday and Friday this week for which they have not been paid. On November 1, the company received 6 months' rent in advance from a tenant whose rent is $700 per month. The $4,200 was credited to the Unearned Rent account. m) The company has not received a water and sewer services bill for December. Based on prior months' bills, the bill is expected to be $1,000 for the month. un REQUIRED 1. JOURNALIZE THE NECESSARY ADJUSTING ENTRIES 2. PREPARED ADJUSTED TRIAL BALANCE 3. PREPARED FINANCIAL STATEMENTS (INCOME STATEMENT, STATEMENT OF OWNER'S EQUITY 4. MAKE POST CLOSING ENTRIES 5. PREPARED POST CLOSING TRIAL BALANCE