Answered step by step

Verified Expert Solution

Question

1 Approved Answer

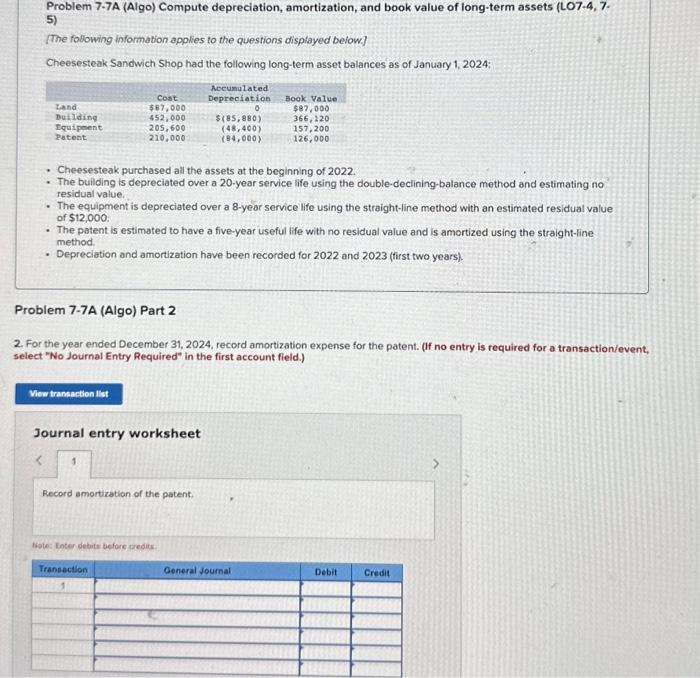

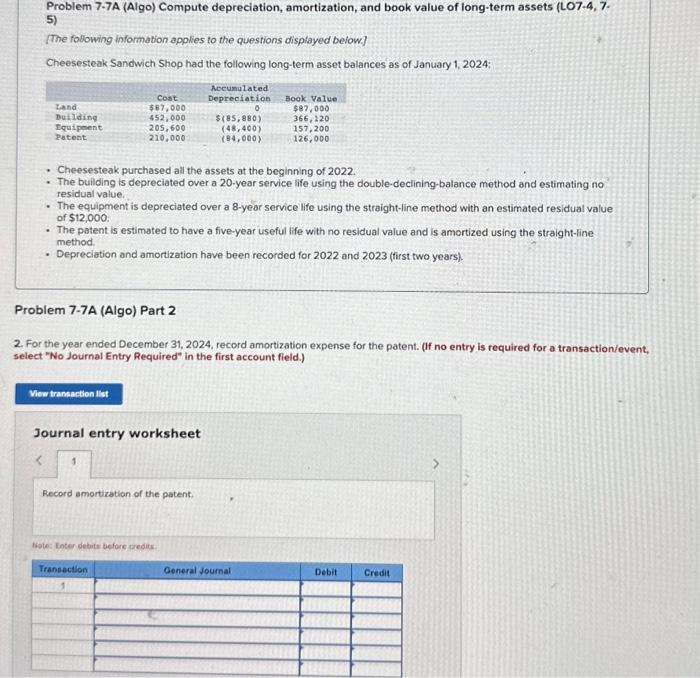

7-21 Problem 7.7A (Algo) Compute depreciation, amortization, and book value of long-term assets (LO7.4, 7. 5) The following information applies to the questions displayed below]

7-21

Problem 7.7A (Algo) Compute depreciation, amortization, and book value of long-term assets (LO7.4, 7. 5) The following information applies to the questions displayed below] Cheesesteak Sandwich Shop had the following long-term asset balances as of January 1, 2024: - Cheesesteak purchased all the assets at the beginning of 2022. - The building is depreciated over a 20-year service life using the double-declining-balance method and estimating no residual value. - The equipment is depreciated over a 8-year service life using the straight-line method with an estimated residual value of $12,000 : - The patent is estimated to have a five-year useful life with no residual value and is amortized using the straight-line method. - Depreciation and amortization have been recorded for 2022 and 2023 (first two years). roblem 7-7A (Algo) Part 2 For the year ended December 31, 2024, record amortization expense for the patent. (If no entry is required for a transaction/event, elect "No Journal Entry Required" in the first account field.) Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started