Question

7.23 Hedging Interest Rate Risk (Based on material in the online appendix for Chapter 7) Part A. Floral Delivery, Inc. (FD) acquired a fleet of

7.23 Hedging Interest Rate Risk (Based on material in the online appendix for Chapter 7)

Part A. Floral Delivery, Inc. (FD) acquired a fleet of vans on January 1, 2017, by issuing a $500,000, four-year, 4% fixed rate note, with interest payable annually on December 3. FD has the option to repay the note prior to maturity at the notes fair value. FD engages in a contract with the bank to swap its fixed-interest-rate obligation for a variable-interest-rate obligation; the variable rate in the swap is intended to track the variable rate used by the supplier to revalue the note while it is outstanding. The swap causes FDs inter- est payments to vary as the variable interest rate changes, but it locks the value of the note payable at $100,000, and thus qualifies the swap as a hedge of value changes in an existing liability. Under the terms of the swap, the counterparty (the bank) resets the interest rate each December 31. Assume that the interest rate is reset to 3% at December 31, 2017, and to 5% at December 31, 2018. Interest rates remain steady from that date forward.

REQUIRED Use the financial template used throughout the chapter to record the financial statement effects and journal entries of these transactions and events through December 31, 2019.

Part B.

REQUIRED

Repeat Part A assuming that the 4% interest rate is variable and that the supplier resets the interest rate each December 31 to establish the interest charge for the next calendar year. In this case, FD wants to protect its future cash flows against increases in the variable interest rate to more than the initial 4% rate, so it contracts with the bank to swap its variable-interest-rate obligation for a fixed- interest-rate obligation. The swap fixes the firms annual interest expense and cash expenditure to 4% of the $500,000 note. FD designates the swap contract as a cash flow hedge.

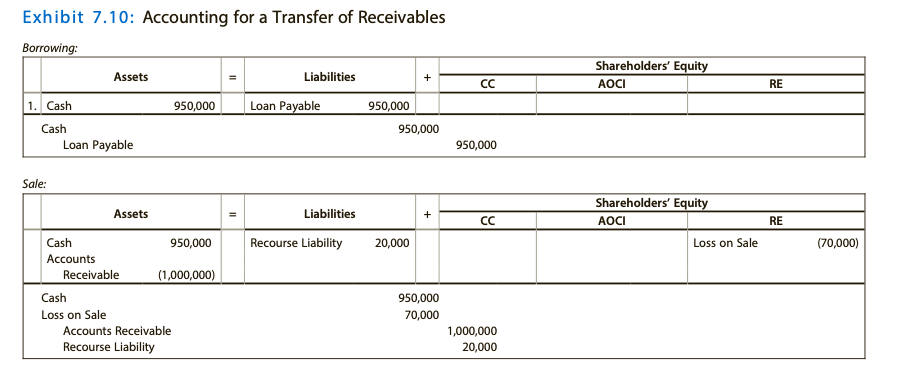

Template from Tb:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started