Answered step by step

Verified Expert Solution

Question

1 Approved Answer

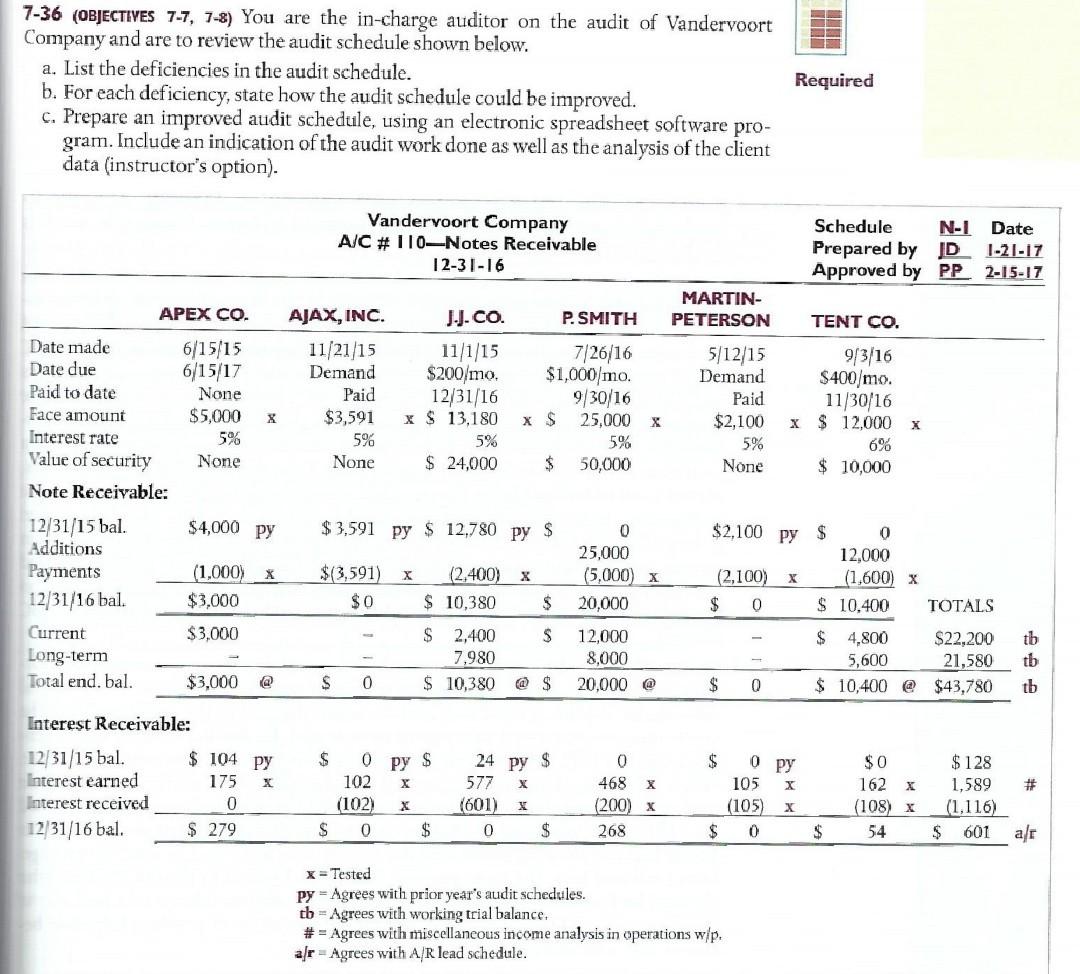

7-36 (OBJECTIVES 7-7, 7-8) You are the in-charge auditor on the audit of Vandervoort Company and are to review the audit schedule shown below. a.

7-36 (OBJECTIVES 7-7, 7-8) You are the in-charge auditor on the audit of Vandervoort Company and are to review the audit schedule shown below. a. List the deficiencies in the audit schedule. b. For each deficiency, state how the audit schedule could be improved. c. Prepare an improved audit schedule, using an electronic spreadsheet software pro- gram. Include an indication of the audit work done as well as the analysis of the client data (instructor's option). Required Vandervoort Company A/C# 110-Notes Receivable 12-31-16 Schedule N-1 Date Prepared by ID 1-21-17 Approved by PP. 2-15-17 APEX CO. P. SMITH MARTIN- PETERSON TENT CO. Date made Date due Paid to date Face amount Interest rate Value of security Note Receivable: 6/15/15 6/15/17 None $5,000 5% None AJAX, INC. 11/21/15 Demand Paid $3,591 5% None J.J.CO. 11/1/15 $200/mo. 12/31/16 XS 13,180 5% $ 24,000 7/26/16 $1,000/mo. 9/30/16 x $ 25,000 5% $ 50,000 5/12/15 Demand Paid $2,100 5% None 913/16 $400/mo. 11/30/16 $ 12,000 x 6% $ 10,000 $4,000 PY $3,591 py $ 12,780 py $ 12/31/15 bal. Additions Payments 12/31/16 bal. Current Long-term Total end. bal. (1,000) X $3,000 $(3,591) $0 (2,400) x $ 10,380 0 25,000 (5,000) x 20,000 12,000 8,000 20,000 @ $2,100 py $ 0 12,000 (2,100) X (1,600) X $ 0 $ 10,400 TOTALS $ $3,000 S 4,800 $ 2,400 7,980 $ 10,380 $ 5,600 $ 10,400 @ $22,200 21,580 $43,780 th tb $3,000 @ $ 0 @ $ $ 0 tb Interest Receivable: $ 104 PY $ X X X 12/31/15 bal. Interest earned Interest received 12/31/16 bal. 175 0 $ 279 $ O py $ 102 (102) X S 0 $ 24 py$ 577 (601) X 0 $ 0 468 (200) x 268 0 py 105 X (105) X $0 162 X (108) x 54 $ 128 1,589 # (1,116) $ 601 ar $ 0 $ x =Tested Py = Agrees with prior year's audit schedules. tb = Agrees with working trial balance. # = Agrees with miscellaneous income analysis in operations wip. ar = Agrees with A/R lead schedule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started