Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ts. Ranjit works as a senior executive with a local IT company (the company) in Cheras, Selangor. His wife, Mrs. Virmala is a retired bank

Ts. Ranjit works as a senior executive with a local IT company (the company) in Cheras, Selangor. His wife, Mrs. Virmala is a retired bank manager, and currently operates small business with her old friend, Ms. Bela. The couple has three children and all of them are Malaysian residents for the purpose of the Income Tax Act 1967 (as amended). Ts. Ranjit Ts. Ranjit provides the following information in respect of his income and benefits from employment for the year ended 31 December 2022: Gross salary of RM12,500 per month. He contributes 9% of his salary and bonus to the Employ

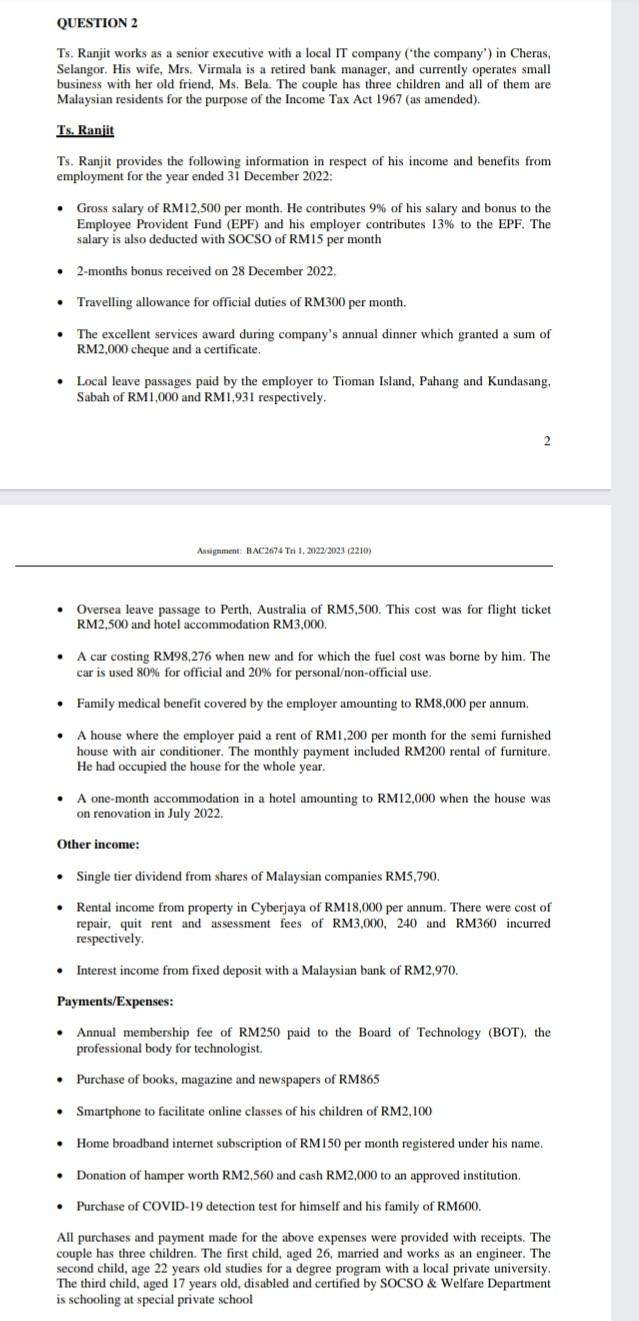

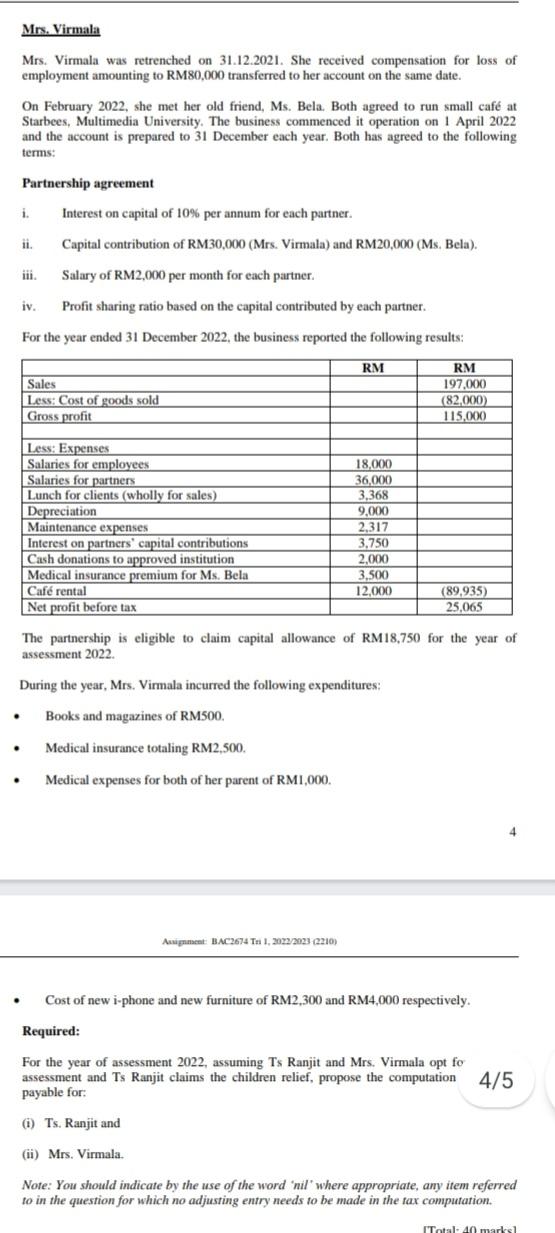

QUESTION 2 Ts. Ranjit works as a senior executive with a local IT company ('the company') in Cheras, Selangor. His wife, Mrs. Virmala is a retired bank manager, and currently operates small business with her old friend, Ms. Bela. The couple has three children and all of them are Malaysian residents for the purpose of the Income Tax Act 1967 (as amended). Ts. Raniit Ts. Ranjit provides the following information in respect of his income and benefits from employment for the year ended 31 December 2022: - Gross salary of RM12,500 per month. He contributes 9% of his salary and bonus to the Employee Provident Fund (EPF) and his employer contributes 13\% to the EPF. The salary is also deducted with SOCSO of RM15 per month - 2-months bonus received on 28 December 2022. - Travelling allowance for official duties of RM300 per month. - The excellent services award during company's annual dinner which granted a sum of RM2,000 cheque and a certificate. - Local leave passages paid by the employer to Tioman Island, Pahang and Kundasang, Sabah of RM1,000 and RM1,931 respectively. 2 - Oversea leave passage to Perth, Australia of RM5,500. This cost was for flight ticket RM2,500 and hotel accommodation RM3,000. - A car costing RM98,276 when new and for which the fuel cost was borne by him. The car is used 80% for official and 20% for personalon-official use. - Family medical benefit covered by the employer amounting to RM8,000 per annum. - A house where the employer paid a rent of RM1,200 per month for the semi furnished house with air conditioner. The monthly payment included RM200 rental of furniture. He had occupied the house for the whole year. - A one-month accommodation in a hotel amounting to RM12,000 when the house was on renovation in July 2022. Other income: - Single tier dividend from shares of Malaysian companies RM5,790. - Rental income from property in Cyberjaya of RM18,000 per annum. There were cost of repair, quit rent and assessment fees of RM3,000, 240 and RM360 incurred respectively. - Interest income from fixed deposit with a Malaysian bank of RM2,970. Payments/Expenses: - Annual membership fee of RM250 paid to the Board of Technology (BOT), the professional body for technologist. - Purchase of books, magazine and newspapers of RM865 - Smartphone to facilitate online classes of his children of RM2,100 - Home broadband internet subscription of RM150 per month registered under his name. - Donation of hamper worth RM2,560 and cash RM2,000 to an approved institution. - Purchase of COVID-19 detection test for himself and his family of RM600. All purchases and payment made for the above expenses were provided with receipts. The couple has three children. The first child, aged 26 , married and works as an engineer. The second child, age 22 years old studies for a degree program with a local private university. The third child, aged 17 years old, disabled and certified by SOCSO \& Welfare Department is schooling at special private school Mrs. Virmala Mrs. Virmala was retrenched on 31.12.2021. She received compensation for loss of employment amounting to RM80,000 transferred to her account on the same date. On February 2022, she met her old friend, Ms. Bela. Both agreed to run small caf at Starbees, Multimedia University. The business commenced it operation on 1 April 2022 and the account is prepared to 31 December each year. Both has agreed to the following terms: Partnership agreement i. Interest on capital of 10% per annum for each partner. ii. Capital contribution of RM30,000 (Mrs. Virmala) and RM20,000 (Ms. Bela). iii. Salary of RM2,000 per month for each partner. iv. Profit sharing ratio based on the capital contributed by each partner. For the year ended 31 December 2022, the business reported the following results: The partnership is eligible to claim capital allowance of RM18,750 for the year of assessment 2022. During the year, Mrs. Virmala incurred the following expenditures: - Books and magazines of RM500. - Medical insurance totaling RM2,500. - Medical expenses for both of her parent of RMI,000. 4 - Cost of new i-phone and new furniture of RM2,300 and RM4,000 respectively. Required: For the year of assessment 2022, assuming Ts Ranjit and Mrs. Virmala opt fo assessment and Ts Ranjit claims the children relief, propose the computation 4/5 payable for: (i) Ts. Ranjit and (ii) Mrs. Virmala. Note: You should indicate by the use of the word 'nil' where appropriate, any item referred to in the question for which no adjusting entry needs to be made in the tax computation. QUESTION 2 Ts. Ranjit works as a senior executive with a local IT company ('the company') in Cheras, Selangor. His wife, Mrs. Virmala is a retired bank manager, and currently operates small business with her old friend, Ms. Bela. The couple has three children and all of them are Malaysian residents for the purpose of the Income Tax Act 1967 (as amended). Ts. Raniit Ts. Ranjit provides the following information in respect of his income and benefits from employment for the year ended 31 December 2022: - Gross salary of RM12,500 per month. He contributes 9% of his salary and bonus to the Employee Provident Fund (EPF) and his employer contributes 13\% to the EPF. The salary is also deducted with SOCSO of RM15 per month - 2-months bonus received on 28 December 2022. - Travelling allowance for official duties of RM300 per month. - The excellent services award during company's annual dinner which granted a sum of RM2,000 cheque and a certificate. - Local leave passages paid by the employer to Tioman Island, Pahang and Kundasang, Sabah of RM1,000 and RM1,931 respectively. 2 - Oversea leave passage to Perth, Australia of RM5,500. This cost was for flight ticket RM2,500 and hotel accommodation RM3,000. - A car costing RM98,276 when new and for which the fuel cost was borne by him. The car is used 80% for official and 20% for personalon-official use. - Family medical benefit covered by the employer amounting to RM8,000 per annum. - A house where the employer paid a rent of RM1,200 per month for the semi furnished house with air conditioner. The monthly payment included RM200 rental of furniture. He had occupied the house for the whole year. - A one-month accommodation in a hotel amounting to RM12,000 when the house was on renovation in July 2022. Other income: - Single tier dividend from shares of Malaysian companies RM5,790. - Rental income from property in Cyberjaya of RM18,000 per annum. There were cost of repair, quit rent and assessment fees of RM3,000, 240 and RM360 incurred respectively. - Interest income from fixed deposit with a Malaysian bank of RM2,970. Payments/Expenses: - Annual membership fee of RM250 paid to the Board of Technology (BOT), the professional body for technologist. - Purchase of books, magazine and newspapers of RM865 - Smartphone to facilitate online classes of his children of RM2,100 - Home broadband internet subscription of RM150 per month registered under his name. - Donation of hamper worth RM2,560 and cash RM2,000 to an approved institution. - Purchase of COVID-19 detection test for himself and his family of RM600. All purchases and payment made for the above expenses were provided with receipts. The couple has three children. The first child, aged 26 , married and works as an engineer. The second child, age 22 years old studies for a degree program with a local private university. The third child, aged 17 years old, disabled and certified by SOCSO \& Welfare Department is schooling at special private school Mrs. Virmala Mrs. Virmala was retrenched on 31.12.2021. She received compensation for loss of employment amounting to RM80,000 transferred to her account on the same date. On February 2022, she met her old friend, Ms. Bela. Both agreed to run small caf at Starbees, Multimedia University. The business commenced it operation on 1 April 2022 and the account is prepared to 31 December each year. Both has agreed to the following terms: Partnership agreement i. Interest on capital of 10% per annum for each partner. ii. Capital contribution of RM30,000 (Mrs. Virmala) and RM20,000 (Ms. Bela). iii. Salary of RM2,000 per month for each partner. iv. Profit sharing ratio based on the capital contributed by each partner. For the year ended 31 December 2022, the business reported the following results: The partnership is eligible to claim capital allowance of RM18,750 for the year of assessment 2022. During the year, Mrs. Virmala incurred the following expenditures: - Books and magazines of RM500. - Medical insurance totaling RM2,500. - Medical expenses for both of her parent of RMI,000. 4 - Cost of new i-phone and new furniture of RM2,300 and RM4,000 respectively. Required: For the year of assessment 2022, assuming Ts Ranjit and Mrs. Virmala opt fo assessment and Ts Ranjit claims the children relief, propose the computation 4/5 payable for: (i) Ts. Ranjit and (ii) Mrs. Virmala. Note: You should indicate by the use of the word 'nil' where appropriate, any item referred to in the question for which no adjusting entry needs to be made in the tax computation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started