Answered step by step

Verified Expert Solution

Question

1 Approved Answer

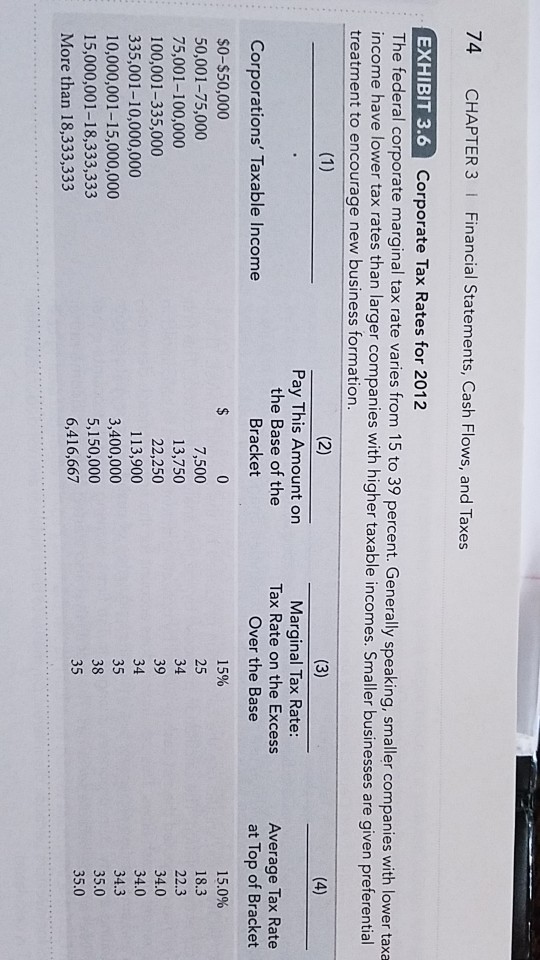

74 CHAPTER 3 I Financial Statements, Cash Flows, and Taxes EXHIBIT 3.6 Corporate Tax Rates for 2012 he federal corporate marginal tax rate varies from

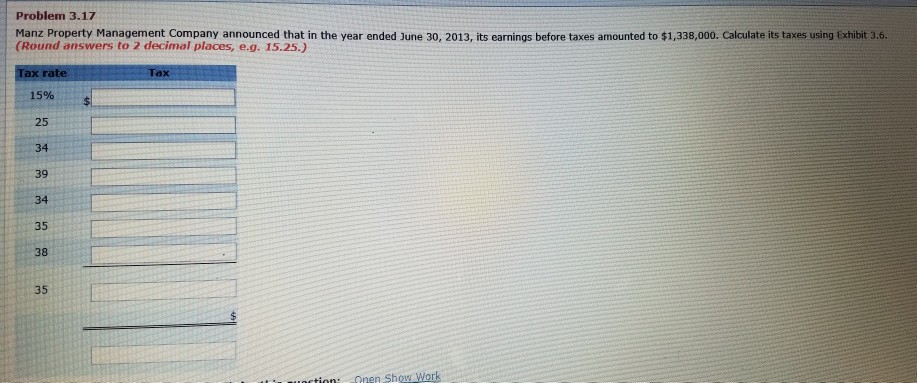

74 CHAPTER 3 I Financial Statements, Cash Flows, and Taxes EXHIBIT 3.6 Corporate Tax Rates for 2012 he federal corporate marginal tax rate varies from 15 to 39 percent. Generally speaking, smaller companies with lower taxa income have lower tax rates than larger companies with higher taxable incomes. Smaller businesses are given preferential treatment to encourage new business formation Pay This Amount on the Base of the Bracket Marginal Tax Rate: Tax Rate on the Excess Over the Base Average Tax Rate at Top of Bracket Corporations' Taxable Income $0-$50,000 50,001-75,000 75,001-100,000 100,001-335,000 335,001-10,000,000 10,000,001-15,000,000 15,000,001-18,333,333 More than 18,333,333 1590 25 34 39 34 35 38 35 15.0% 7,500 13,750 22,250 113,900 3,400,000 5,150,000 6,416,667 18.3 22.3 34.0 34.0 34.3 35.0 35.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started