Answered step by step

Verified Expert Solution

Question

1 Approved Answer

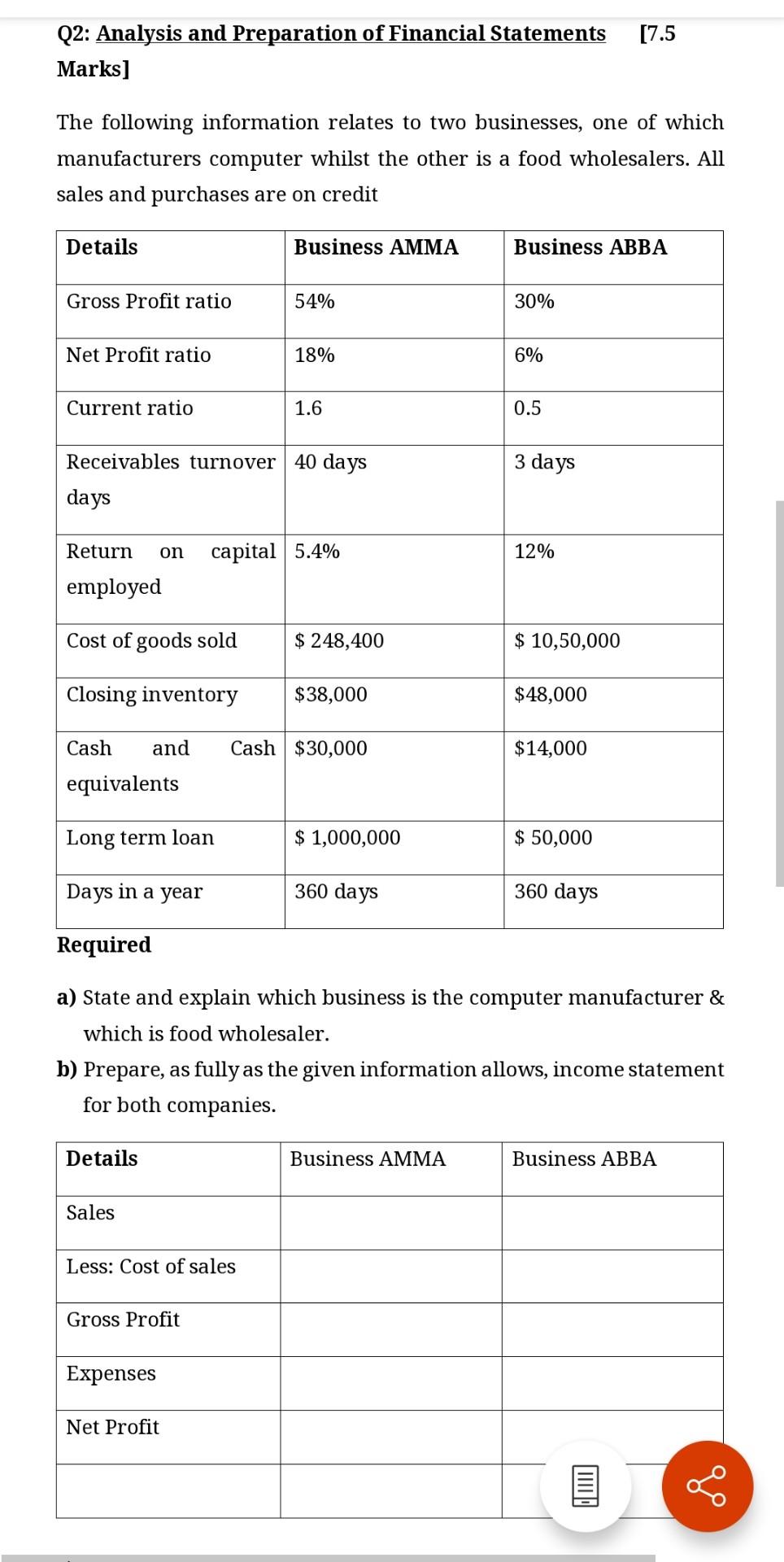

[7.5 Q2: Analysis and Preparation of Financial Statements Marks] The following information relates to two businesses, one of which manufacturers computer whilst the other is

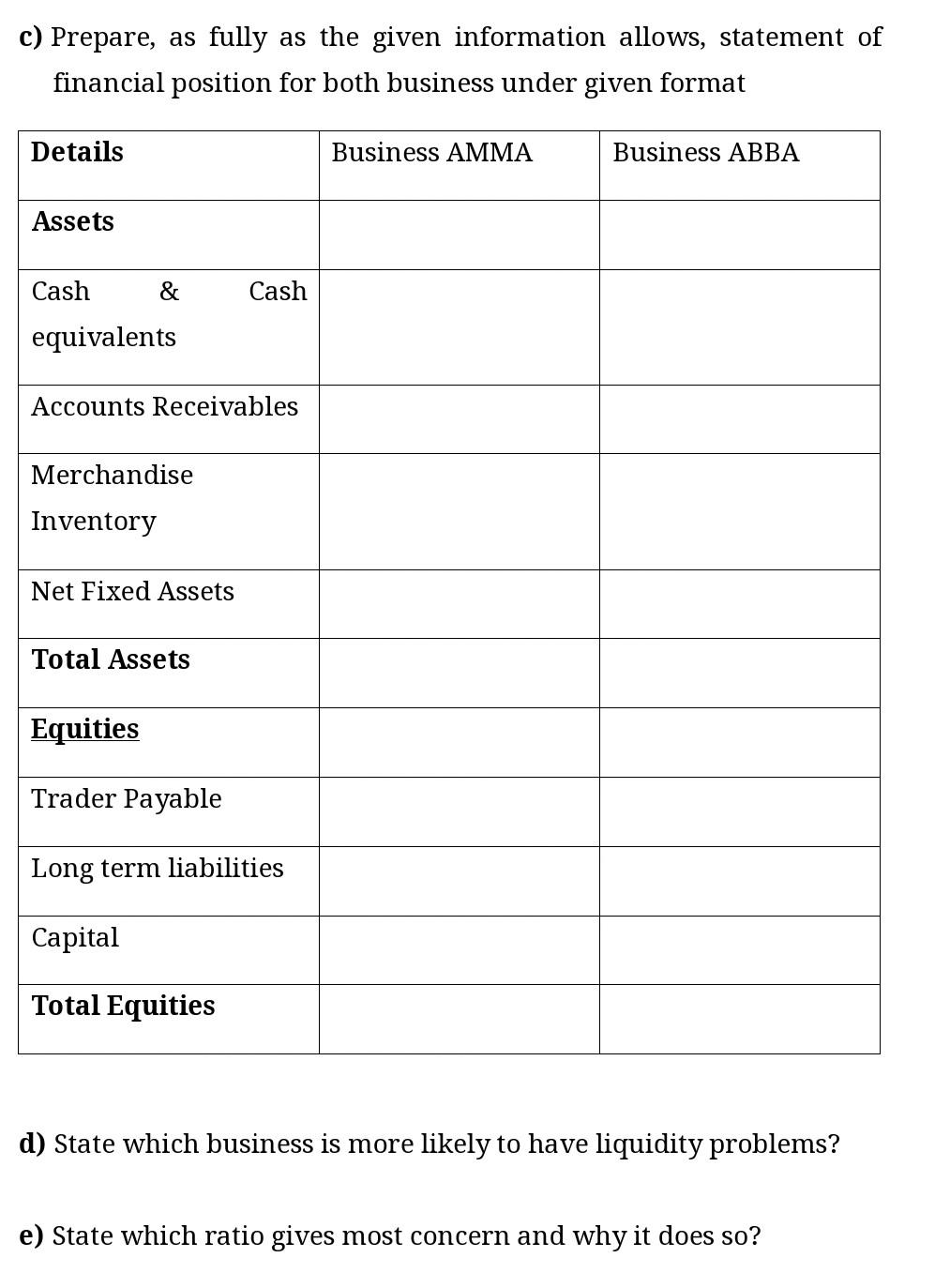

[7.5 Q2: Analysis and Preparation of Financial Statements Marks] The following information relates to two businesses, one of which manufacturers computer whilst the other is a food wholesalers. All sales and purchases are on credit Details Business AMMA Business ABBA Gross Profit ratio 54% 30% Net Profit ratio 18% 6% Current ratio 1.6 0.5 3 days Receivables turnover 40 days days Return on capital 5.4% 12% employed Cost of goods sold $ 248,400 $ 10,50,000 Closing inventory $38,000 $48,000 Cash and Cash $30,000 $14,000 equivalents Long term loan $ 1,000,000 $ 50,000 Days in a year 360 days 360 days Required a) State and explain which business is the computer manufacturer & which is food wholesaler. b) Prepare, as fully as the given information allows, income statement for both companies. Details Business AMMA Business ABBA Sales Less: Cost of sales Gross Profit Expenses Net Profit go c) Prepare, as fully as the given information allows, statement of financial position for both business under given format Details Business AMMA Business ABBA Assets Cash & Cash equivalents Accounts Receivables Merchandise Inventory Net Fixed Assets Total Assets Equities Trader Payable Long term liabilities Capital Total Equities d) State which business is more likely to have liquidity problems? e) State which ratio gives most concern and why it does so

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started