Answered step by step

Verified Expert Solution

Question

1 Approved Answer

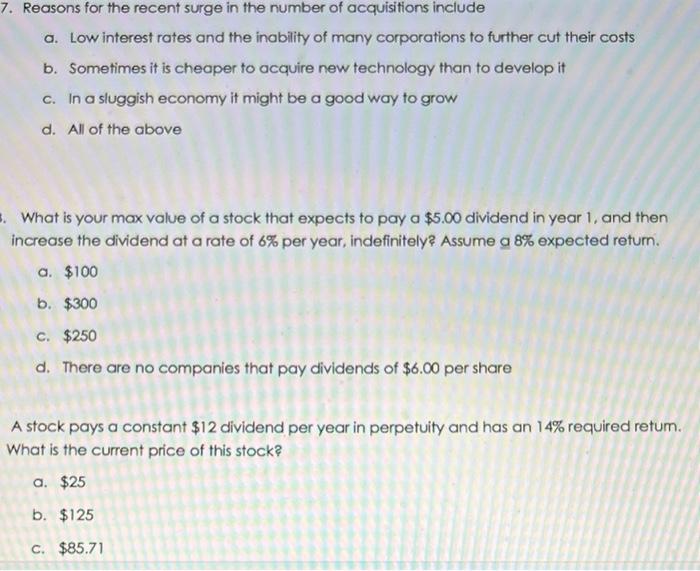

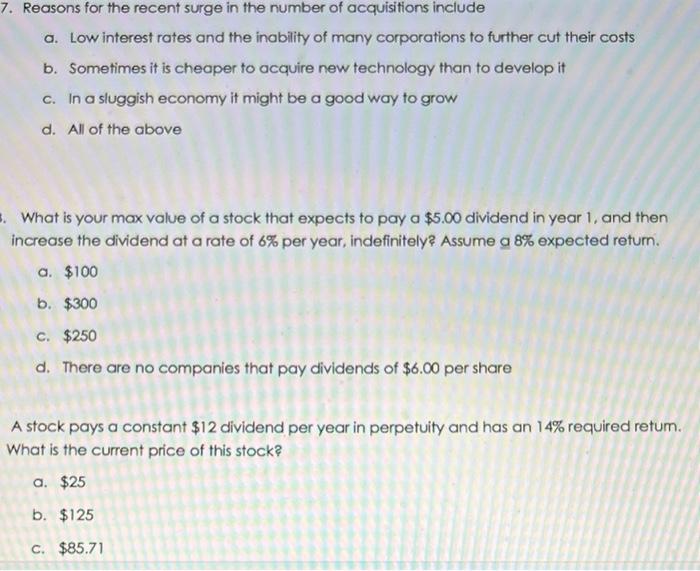

7,8,9 7. Reasons for the recent surge in the number of acquisitions include a. Low interest rates and the inability of many corporations to further

7,8,9

7. Reasons for the recent surge in the number of acquisitions include a. Low interest rates and the inability of many corporations to further cut their costs b. Sometimes it is cheaper to acquire new technology than to develop it C. In a sluggish economy it might be a good way to grow d. All of the above What is your max value of a stock that expects to pay a $5.00 dividend in year 1, and then increase the dividend at a rate of 6% per year, indefinitely? Assume a 8% expected return. a $100 b. $300 c. $250 d. There are no companies that pay dividends of $6.00 per share A stock pays a constant $12 dividend per year in perpetuity and has an 14% required retum. What is the current price of this stock a. $25 b. $125 C. $85.71

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started