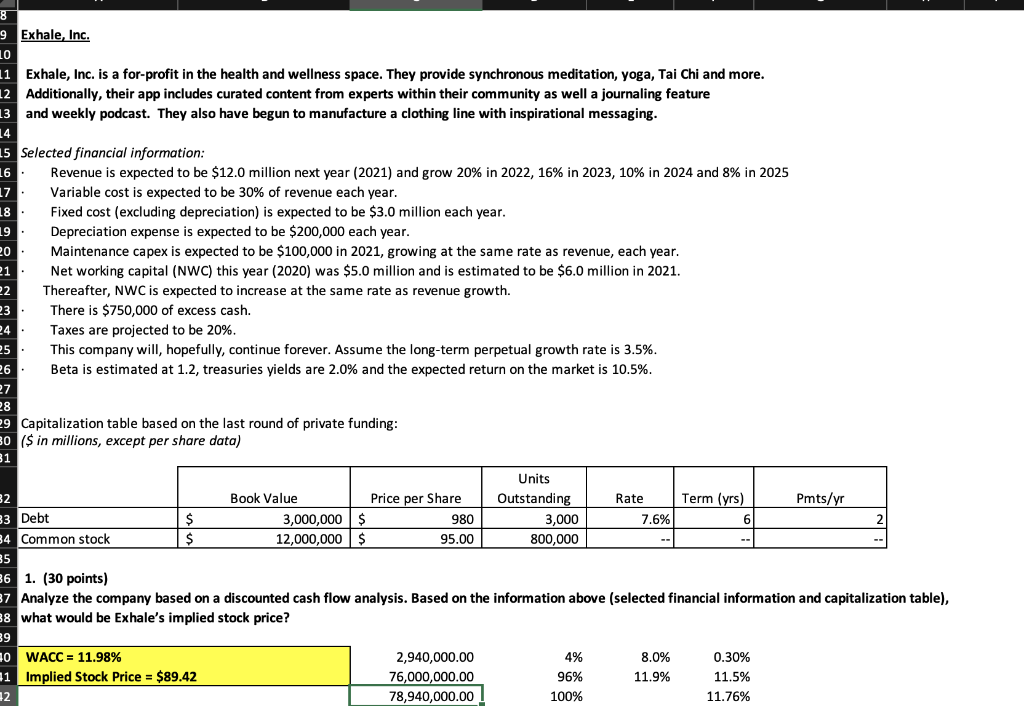

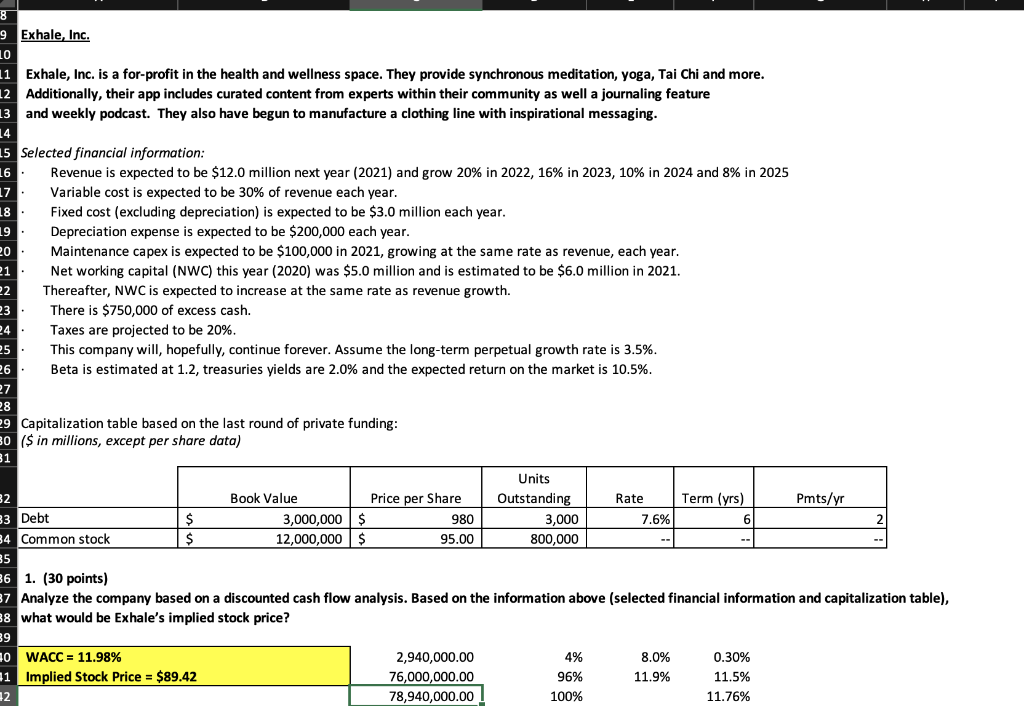

8 9 Exhale, Inc. 10 11 Exhale, Inc. is a for-profit in the health and wellness space. They provide synchronous meditation, yoga, Tai Chi and more. 12 Additionally, their app includes curated content from experts within their community as well a journaling feature 13 and weekly podcast. They also have begun to manufacture a clothing line with inspirational messaging. 14 15 Selected financial information: 16 Revenue is expected to be $12.0 million next year (2021) and grow 20% in 2022, 16% in 2023, 10% in 2024 and 8% in 2025 17 Variable cost is expected to be 30% of revenue each year. 18 Fixed cost (excluding depreciation) is expected to be $3.0 million each year. 19 Depreciation expense is expected to be $200,000 each year. 20 Maintenance capex is expected to be $100,000 in 2021, growing at the same rate as revenue, each year. 21 Net working capital (NWC) this year (2020) was $5.0 million and is estimated to be $6.0 million in 2021. 22 Thereafter, NWC is expected to increase at the same rate as revenue growth. 23 There is $750,000 of excess cash. 24 Taxes are projected to be 20%. 25 This company will, hopefully, continue forever. Assume the long-term perpetual growth rate is 3.5%. 26 Beta is estimated at 1.2, treasuries yields are 2.0% and the expected return on the market is 10.5%. 27 28 9 Capitalization table based on the last round of private funding: 30 ($ in millions, except per share data) 31 Units 32 Book Value Price per Share Outstanding Rate Term (yrs) Pmts/yr 33 Debt $ 3,000,000 $ 980 3,000 7.6% 6 4 Common stock $ 12,000,000 $ 95.00 800,000 35 36 1. (30 points) 7 Analyze the company based on a discounted cash flow analysis. Based on the information above (selected financial information and capitalization table), 38 what would be Exhale's implied stock price? 29 10 WACC = 11.98% 2,940,000.00 4% 8.0% 0.30% 11 Implied Stock Price = $89.42 76,000,000.00 96% 11.9% 11.5% 12 78,940,000.00 100% 11.76% 8 9 Exhale, Inc. 10 11 Exhale, Inc. is a for-profit in the health and wellness space. They provide synchronous meditation, yoga, Tai Chi and more. 12 Additionally, their app includes curated content from experts within their community as well a journaling feature 13 and weekly podcast. They also have begun to manufacture a clothing line with inspirational messaging. 14 15 Selected financial information: 16 Revenue is expected to be $12.0 million next year (2021) and grow 20% in 2022, 16% in 2023, 10% in 2024 and 8% in 2025 17 Variable cost is expected to be 30% of revenue each year. 18 Fixed cost (excluding depreciation) is expected to be $3.0 million each year. 19 Depreciation expense is expected to be $200,000 each year. 20 Maintenance capex is expected to be $100,000 in 2021, growing at the same rate as revenue, each year. 21 Net working capital (NWC) this year (2020) was $5.0 million and is estimated to be $6.0 million in 2021. 22 Thereafter, NWC is expected to increase at the same rate as revenue growth. 23 There is $750,000 of excess cash. 24 Taxes are projected to be 20%. 25 This company will, hopefully, continue forever. Assume the long-term perpetual growth rate is 3.5%. 26 Beta is estimated at 1.2, treasuries yields are 2.0% and the expected return on the market is 10.5%. 27 28 9 Capitalization table based on the last round of private funding: 30 ($ in millions, except per share data) 31 Units 32 Book Value Price per Share Outstanding Rate Term (yrs) Pmts/yr 33 Debt $ 3,000,000 $ 980 3,000 7.6% 6 4 Common stock $ 12,000,000 $ 95.00 800,000 35 36 1. (30 points) 7 Analyze the company based on a discounted cash flow analysis. Based on the information above (selected financial information and capitalization table), 38 what would be Exhale's implied stock price? 29 10 WACC = 11.98% 2,940,000.00 4% 8.0% 0.30% 11 Implied Stock Price = $89.42 76,000,000.00 96% 11.9% 11.5% 12 78,940,000.00 100% 11.76%