Question

8. A payback period that is less than the required period signals an accept decision. True False 9. The payback calculation takes the time value

8.

A payback period that is less than the required period signals an accept decision.

True

False

9.

The payback calculation takes the time value of money into account.

True

False

10.

A company is considering a new four-year project with an initial investment requirement of $72,001. The equipment belongs in a 30% CCA class and will be worthless at the end of the project. Sales are estimated at $136,800 with costs of $87,901. The tax rate is 34%. What is the project OCF in the second year?

A. $41,406

B. 30,900

C. 20,394

D. 38,516

E. 28,506

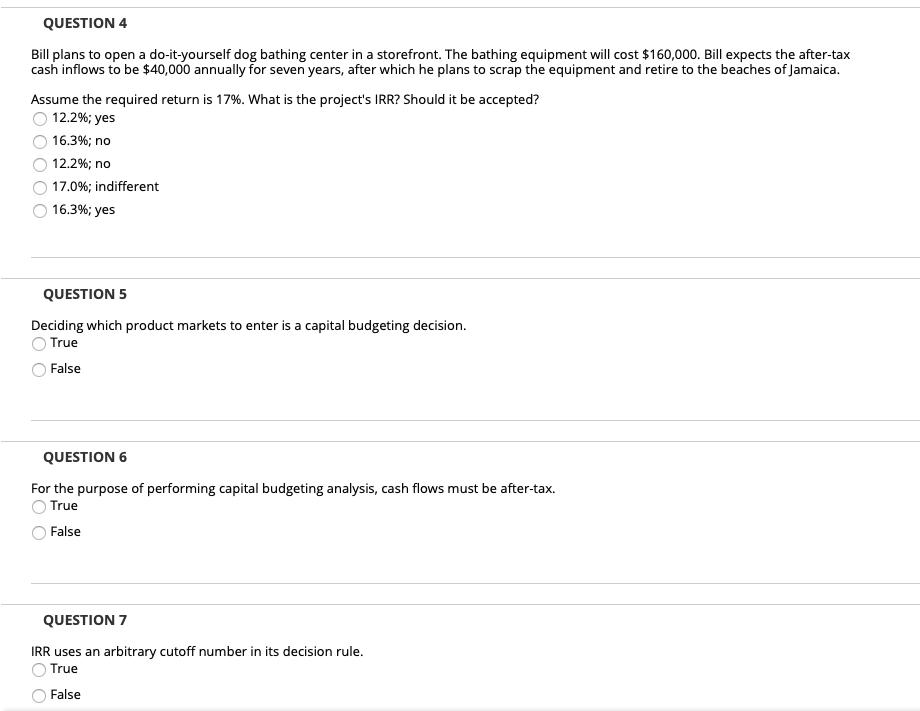

QUESTION 4 Bill plans to open a do-it-yourself dog bathing center in a storefront. The bathing equipment will cost $160,000. Bill expects the after-tax cash inflows to be $40,000 annually for seven years, after which he plans to scrap the equipment and retire to the beaches of Jamaica. Assume the required return is 17%. What is the project's IRR? Should it be accepted? 12.2%; yes 16.3%; no 12.2%; no 17.0%; indifferent 16.3%; yes QUESTION 5 Deciding which product markets to enter is a capital budgeting decision. True False QUESTION 6 For the purpose of performing capital budgeting analysis, cash flows must be after-tax. True False QUESTION 7 IRR uses an arbitrary cutoff number in its decision rule. True False

Step by Step Solution

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

4 163 no 5 True 6 True 7 False 8 False 9 False 10 D EXPLANATIONS 4 The projects IRR is 163 Since thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started