Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Amour Supply Co. closes its books monthly, recording adjusting journal entries and preparing financial statements for its senior management. On July 31, 2023, its

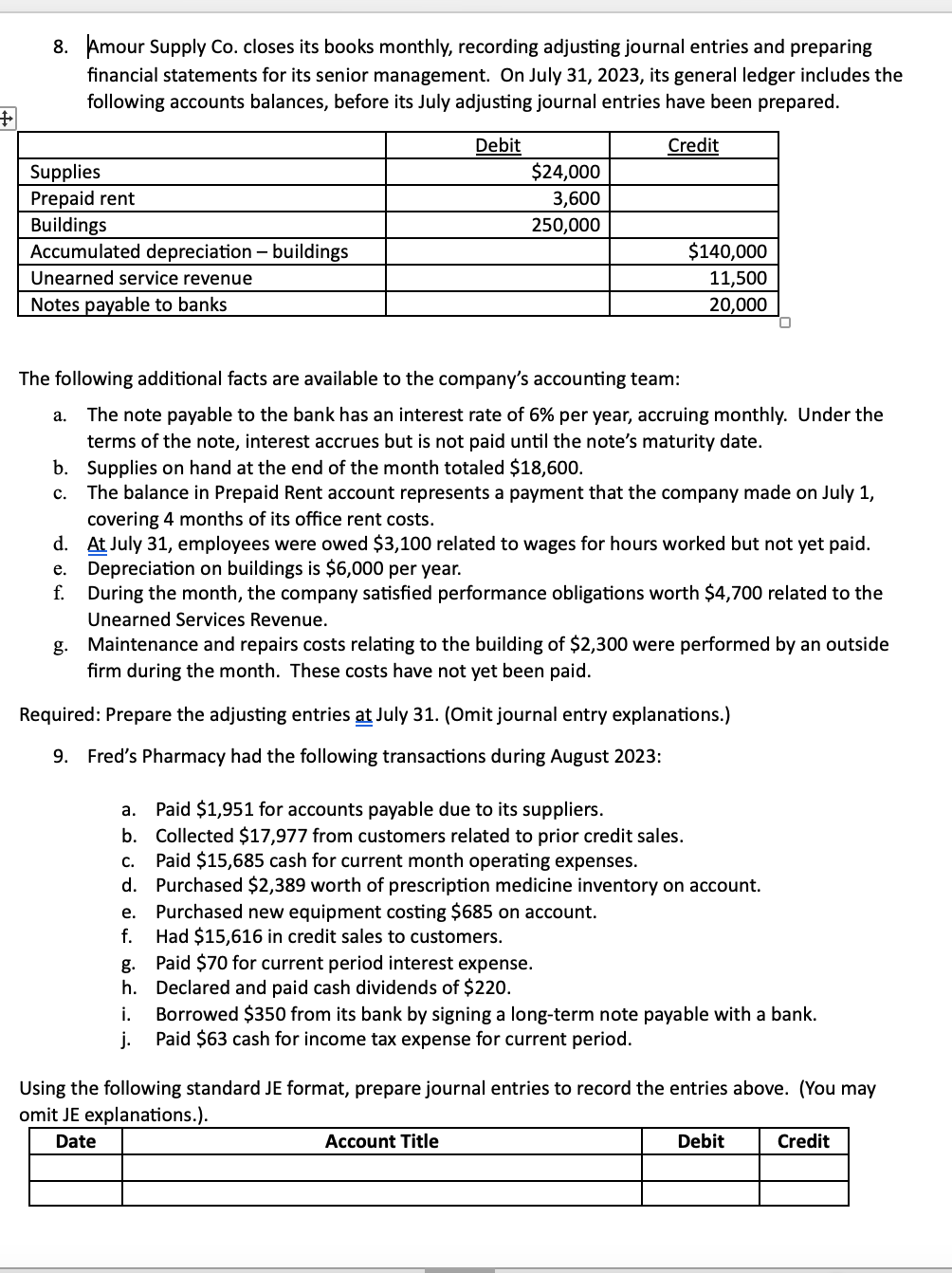

8. Amour Supply Co. closes its books monthly, recording adjusting journal entries and preparing financial statements for its senior management. On July 31, 2023, its general ledger includes the following accounts balances, before its July adjusting journal entries have been prepared. The following additional facts are available to the company's accounting team: a. The note payable to the bank has an interest rate of 6% per year, accruing monthly. Under the terms of the note, interest accrues but is not paid until the note's maturity date. b. Supplies on hand at the end of the month totaled $18,600. c. The balance in Prepaid Rent account represents a payment that the company made on July 1, covering 4 months of its office rent costs. d. At July 31, employees were owed $3,100 related to wages for hours worked but not yet paid. e. Depreciation on buildings is $6,000 per year. f. During the month, the company satisfied performance obligations worth $4,700 related to the Unearned Services Revenue. g. Maintenance and repairs costs relating to the building of $2,300 were performed by an outside firm during the month. These costs have not yet been paid. Required: Prepare the adjusting entries at July 31. (Omit journal entry explanations.) 9. Fred's Pharmacy had the following transactions during August 2023: a. Paid $1,951 for accounts payable due to its suppliers. b. Collected $17,977 from customers related to prior credit sales. c. Paid $15,685 cash for current month operating expenses. d. Purchased $2,389 worth of prescription medicine inventory on account. e. Purchased new equipment costing $685 on account. f. Had $15,616 in credit sales to customers. g. Paid $70 for current period interest expense. h. Declared and paid cash dividends of $220. i. Borrowed $350 from its bank by signing a long-term note payable with a bank. j. Paid $63 cash for income tax expense for current period. Using the following standard JE format, prepare journal entries to record the entries above. (You may

8. Amour Supply Co. closes its books monthly, recording adjusting journal entries and preparing financial statements for its senior management. On July 31, 2023, its general ledger includes the following accounts balances, before its July adjusting journal entries have been prepared. The following additional facts are available to the company's accounting team: a. The note payable to the bank has an interest rate of 6% per year, accruing monthly. Under the terms of the note, interest accrues but is not paid until the note's maturity date. b. Supplies on hand at the end of the month totaled $18,600. c. The balance in Prepaid Rent account represents a payment that the company made on July 1, covering 4 months of its office rent costs. d. At July 31, employees were owed $3,100 related to wages for hours worked but not yet paid. e. Depreciation on buildings is $6,000 per year. f. During the month, the company satisfied performance obligations worth $4,700 related to the Unearned Services Revenue. g. Maintenance and repairs costs relating to the building of $2,300 were performed by an outside firm during the month. These costs have not yet been paid. Required: Prepare the adjusting entries at July 31. (Omit journal entry explanations.) 9. Fred's Pharmacy had the following transactions during August 2023: a. Paid $1,951 for accounts payable due to its suppliers. b. Collected $17,977 from customers related to prior credit sales. c. Paid $15,685 cash for current month operating expenses. d. Purchased $2,389 worth of prescription medicine inventory on account. e. Purchased new equipment costing $685 on account. f. Had $15,616 in credit sales to customers. g. Paid $70 for current period interest expense. h. Declared and paid cash dividends of $220. i. Borrowed $350 from its bank by signing a long-term note payable with a bank. j. Paid $63 cash for income tax expense for current period. Using the following standard JE format, prepare journal entries to record the entries above. (You may Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started