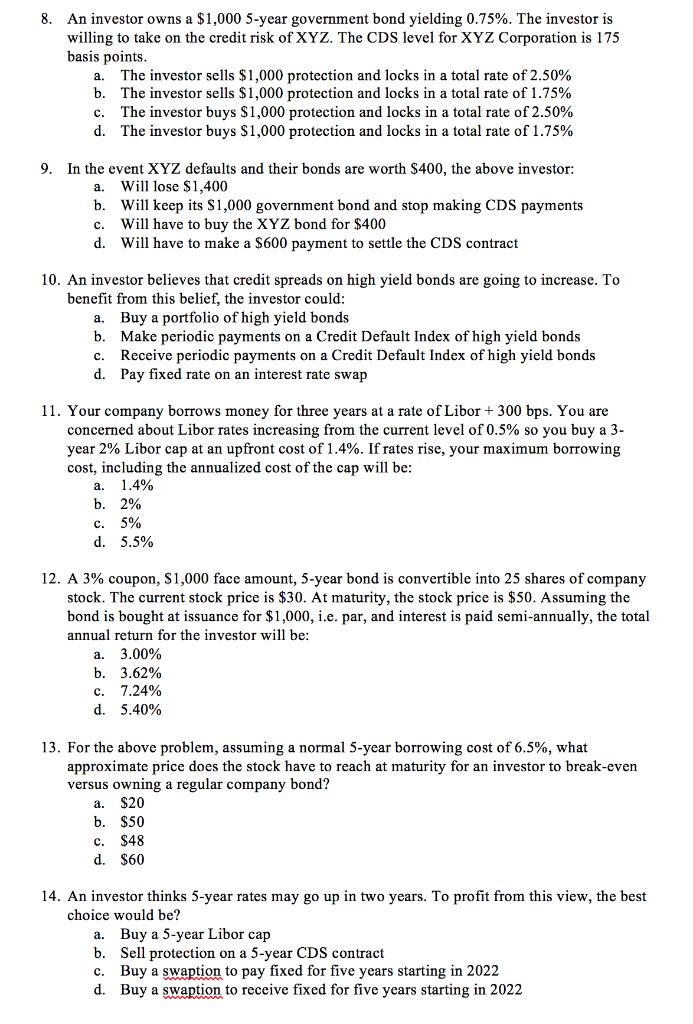

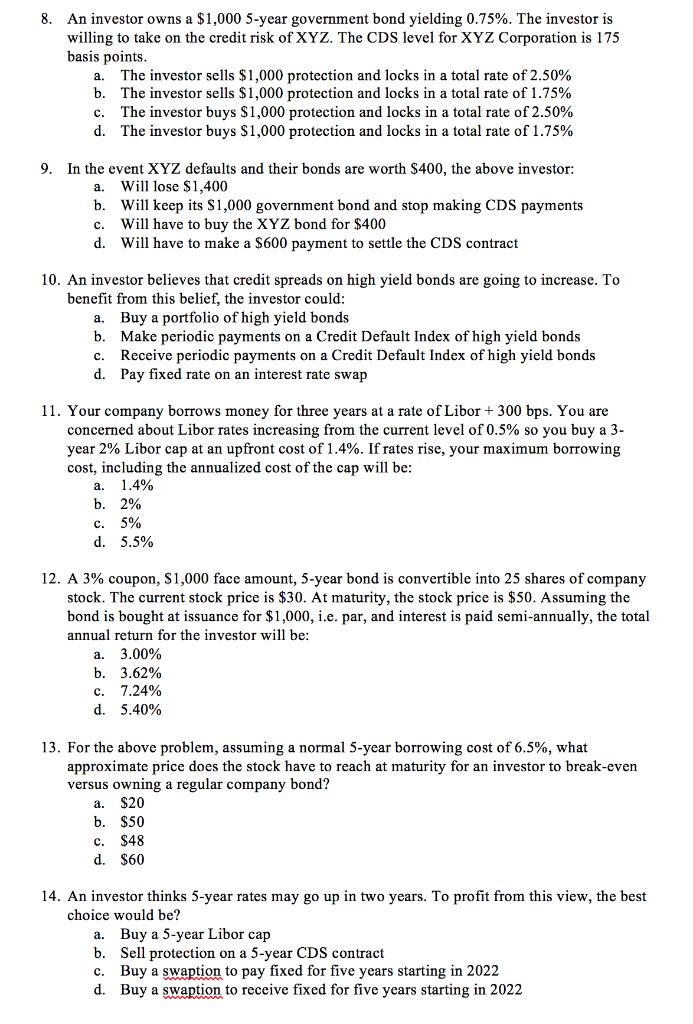

8. An investor owns a $1,000 5-year government bond yielding 0.75%. The investor is willing to take on the credit risk of XYZ. The CDS level for XYZ Corporation is 175 basis points. The investor sells $1,000 protection and locks in a total rate of 2.50% b. The investor sells $1,000 protection and locks in a total rate of 1.75% The investor buys $1,000 protection and locks in a total rate of 2.50% d. The investor buys $1,000 protection and locks in a total rate of 1.75% a. c. 9. In the event XYZ defaults and their bonds are worth $400, the above investor: a. Will lose $1,400 b. Will keep its $1,000 government bond and stop making CDS payments c. Will have to buy the XYZ bond for $400 d. Will have to make a $600 payment to settle the CDS contract 10. An investor believes that credit spreads on high yield bonds are going to increase. To benefit from this belief, the investor could: a. Buy a portfolio of high yield bonds b. Make periodic payments on a Credit Default Index of high yield bonds Receive periodic payments on a Credit Default Index of high yield bonds d. Pay fixed rate on an interest rate swap c. 11. Your company borrows money for three years at a rate of Libor+ 300 bps. You are concerned about Libor rates increasing from the current level of 0.5% so you buy a 3- year 2% Libor cap at an upfront cost of 1.4%. If rates rise, your maximum borrowing cost, including the annualized cost of the cap will be: 1.4% b. 2% 5% d. 5.5% a. c. 12. A 3% coupon, $1,000 face amount, 5-year bond is convertible into 25 shares of company stock. The current stock price is $30. At maturity, the stock price is $50. Assuming the bond is bought at issuance for $1,000, i.e. par, and interest is paid semi-annually, the total annual return for the investor will be: 3.00% b. 3.62% c. 7.24% d. 5.40% a. 13. For the above problem, assuming a normal 5-year borrowing cost of 6.5%, what approximate price does the stock have to reach at maturity for an investor to break-even versus owning a regular company bond? $20 b. $50 $48 d $60 a. c. 14. An investor thinks 5-year rates may go up in two years. To profit from this view, the best choice would be? a. Buy a 5-year Libor cap b. Sell protection on a 5-year CDS contract c. Buy a swaption to pay fixed for five years starting in 2022 d. Buy a swaption to receive fixed for five years starting in 2022