Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. At an interest rate of 9%, determine the future worth at the end of 5 years if five successive end-of-the year deposits are made

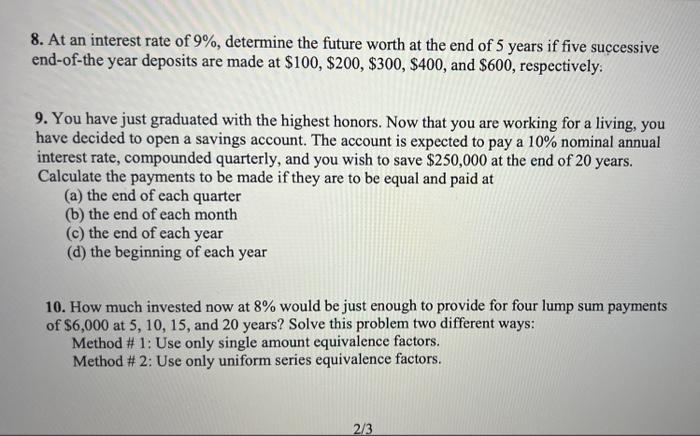

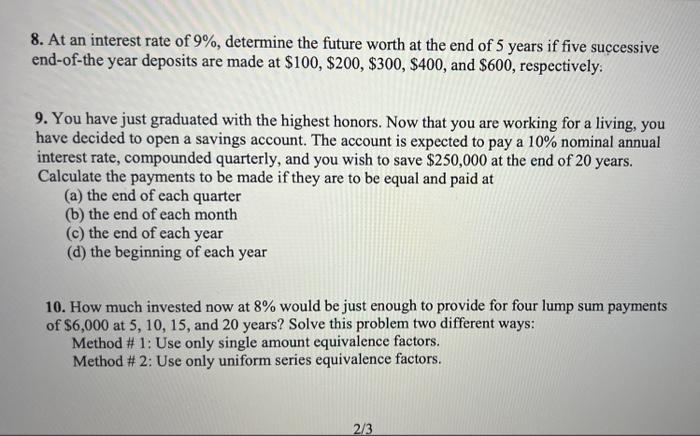

8. At an interest rate of 9%, determine the future worth at the end of 5 years if five successive end-of-the year deposits are made at $100, $200, $300, $400, and $600, respectively. 9. You have just graduated with the highest honors. Now that you are working for a living, you have decided to open a savings account. The account is expected to pay a 10% nominal annual interest rate, compounded quarterly, and you wish to save $250,000 at the end of 20 years. Calculate the payments to be made if they are to be equal and paid at (a) the end of each quarter (b) the end of each month (c) the end of each year (d) the beginning of each year 10. How much invested now at 8% would be just enough to provide for four lump sum payments of $6,000 at 5, 10, 15, and 20 years? Solve this problem two different ways: Method # 1: Use only single amount equivalence factors. Method # 2: Use only uniform series equivalence factors. 2/3

8. At an interest rate of 9%, determine the future worth at the end of 5 years if five successive end-of-the year deposits are made at $100, $200, $300, $400, and $600, respectively. 9. You have just graduated with the highest honors. Now that you are working for a living, you have decided to open a savings account. The account is expected to pay a 10% nominal annual interest rate, compounded quarterly, and you wish to save $250,000 at the end of 20 years. Calculate the payments to be made if they are to be equal and paid at (a) the end of each quarter (b) the end of each month (c) the end of each year (d) the beginning of each year 10. How much invested now at 8% would be just enough to provide for four lump sum payments of $6,000 at 5, 10, 15, and 20 years? Solve this problem two different ways: Method # 1: Use only single amount equivalence factors. Method # 2: Use only uniform series equivalence factors. 2/3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started