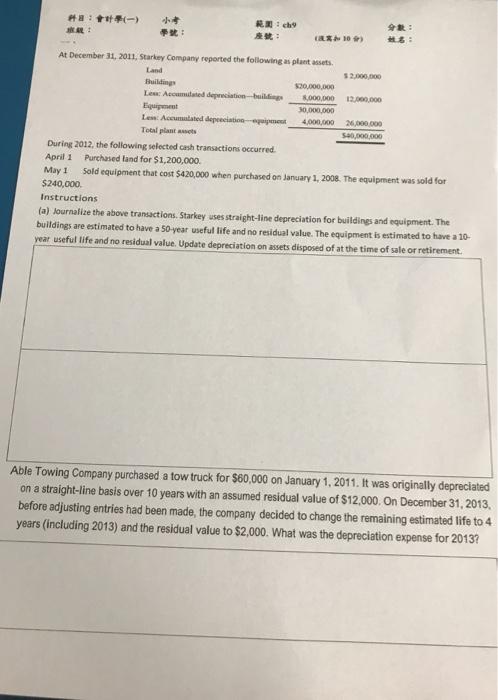

8 :-) ch 109) At December 31, 2011, Starkey Company reported the following as plantes Land Building 20.000.000 Low: Accommitted depreciation-balding 8.000.000 12.000.000 Equipment 30.000.000 Les Acomated depreciate 4,000,000 26,000,000 Total plante 540,000,000 During 2012, the following selected cash transactions occurred April 1 Purchased land for $1,200,000 May 1 Sold equipment that cost $420,000 when purchased on January 1, 2008. The equipment was sold for $240,000 Instructions (a) Journalize the above transactions. Starkey uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 50-year useful life and no residual value. The equipment is estimated to have a 10- year useful life and no residual value. Update depreciation an assets disposed of at the time of sale or retirement. Able Towing Company purchased a tow truck for $60,000 on January 1, 2011. It was originally depreciated on a straight-line basis over 10 years with an assumed residual value of $12,000. On December 31, 2013, before adjusting entries had been made, the company decided to change the remaining estimated life to 4 years (including 2013) and the residual value to $2,000. What was the depreciation expense for 2013? 8 :-) ch 109) At December 31, 2011, Starkey Company reported the following as plantes Land Building 20.000.000 Low: Accommitted depreciation-balding 8.000.000 12.000.000 Equipment 30.000.000 Les Acomated depreciate 4,000,000 26,000,000 Total plante 540,000,000 During 2012, the following selected cash transactions occurred April 1 Purchased land for $1,200,000 May 1 Sold equipment that cost $420,000 when purchased on January 1, 2008. The equipment was sold for $240,000 Instructions (a) Journalize the above transactions. Starkey uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 50-year useful life and no residual value. The equipment is estimated to have a 10- year useful life and no residual value. Update depreciation an assets disposed of at the time of sale or retirement. Able Towing Company purchased a tow truck for $60,000 on January 1, 2011. It was originally depreciated on a straight-line basis over 10 years with an assumed residual value of $12,000. On December 31, 2013, before adjusting entries had been made, the company decided to change the remaining estimated life to 4 years (including 2013) and the residual value to $2,000. What was the depreciation expense for 2013