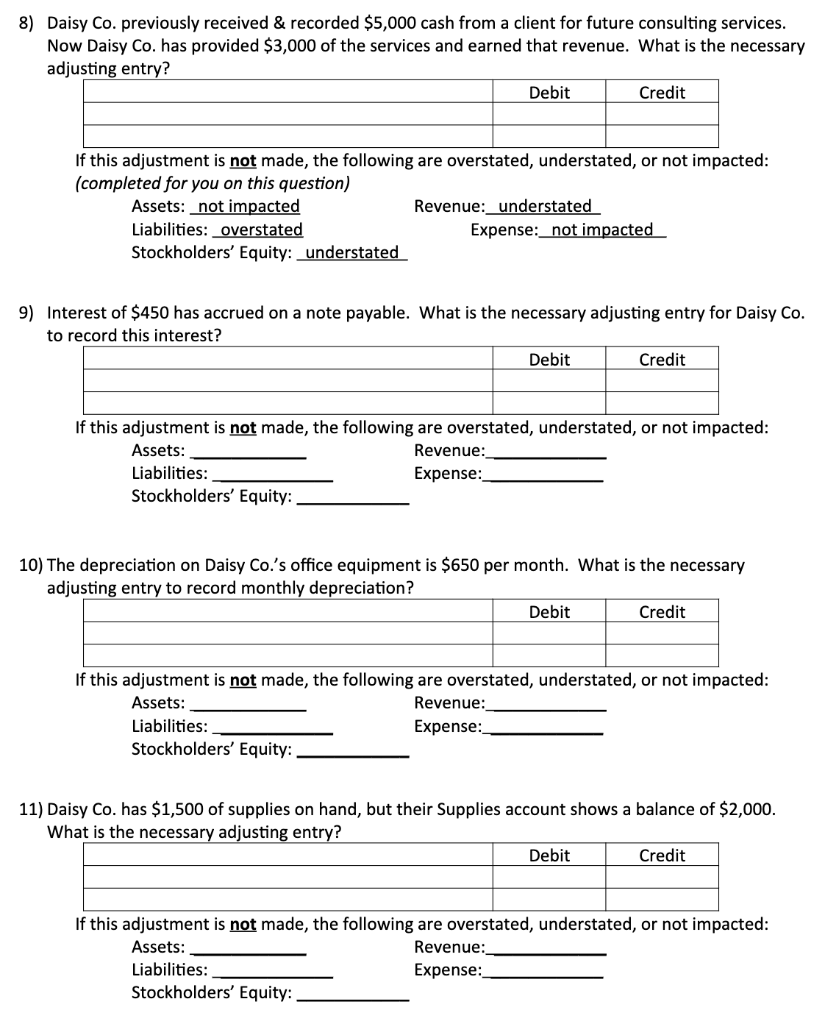

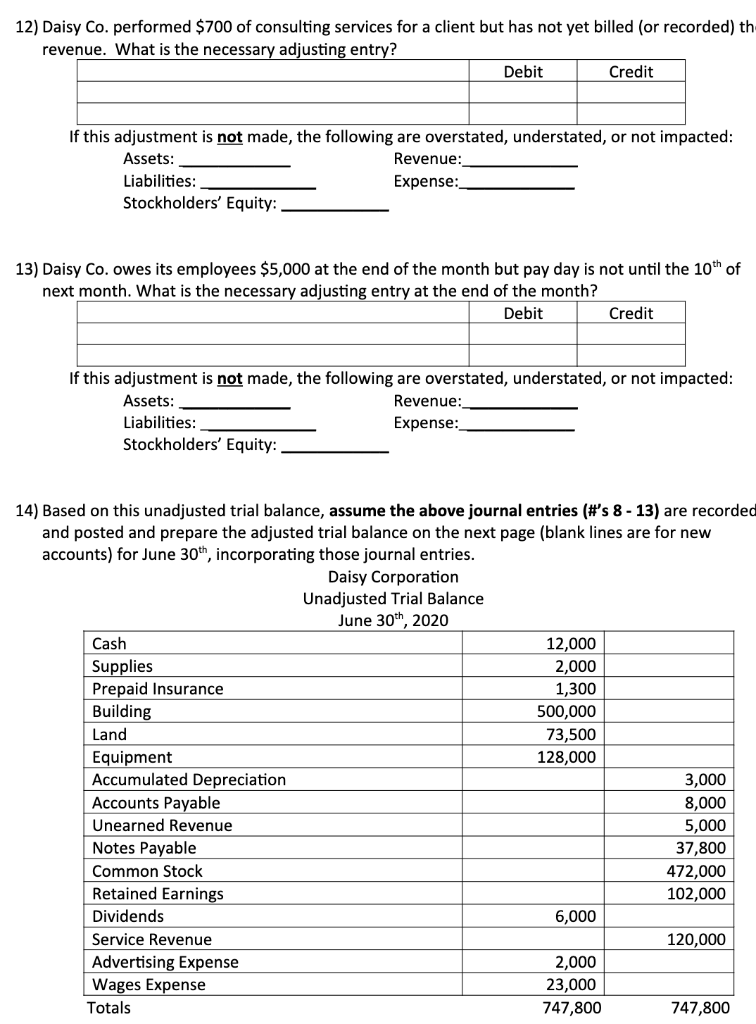

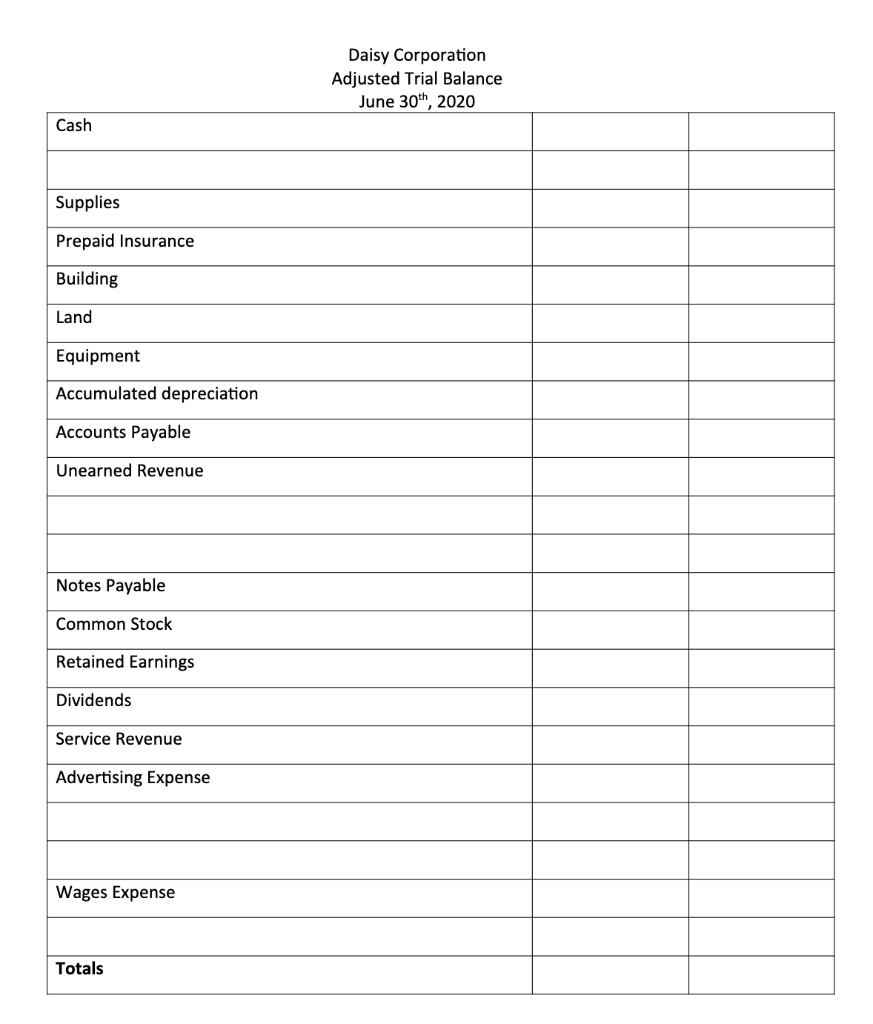

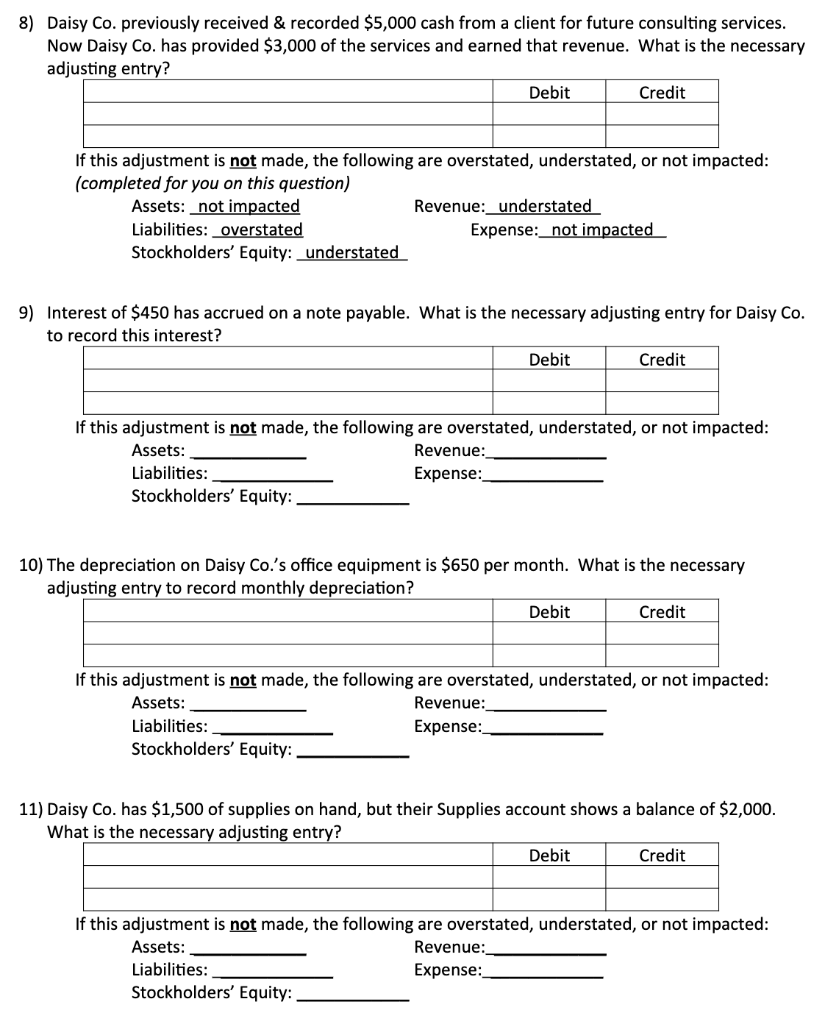

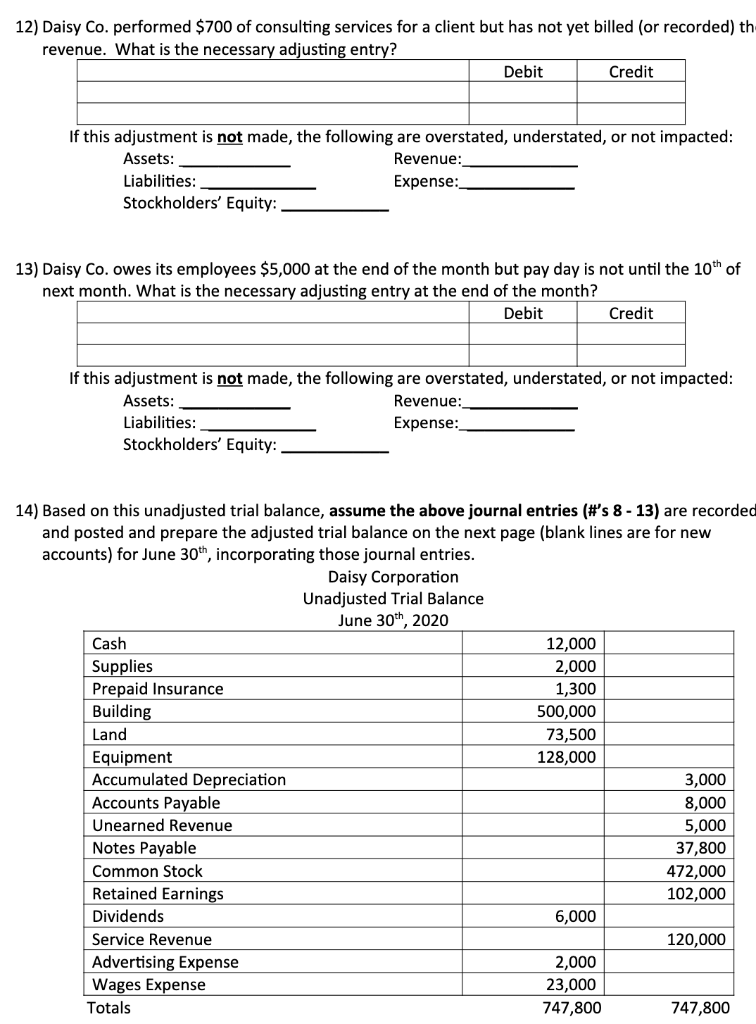

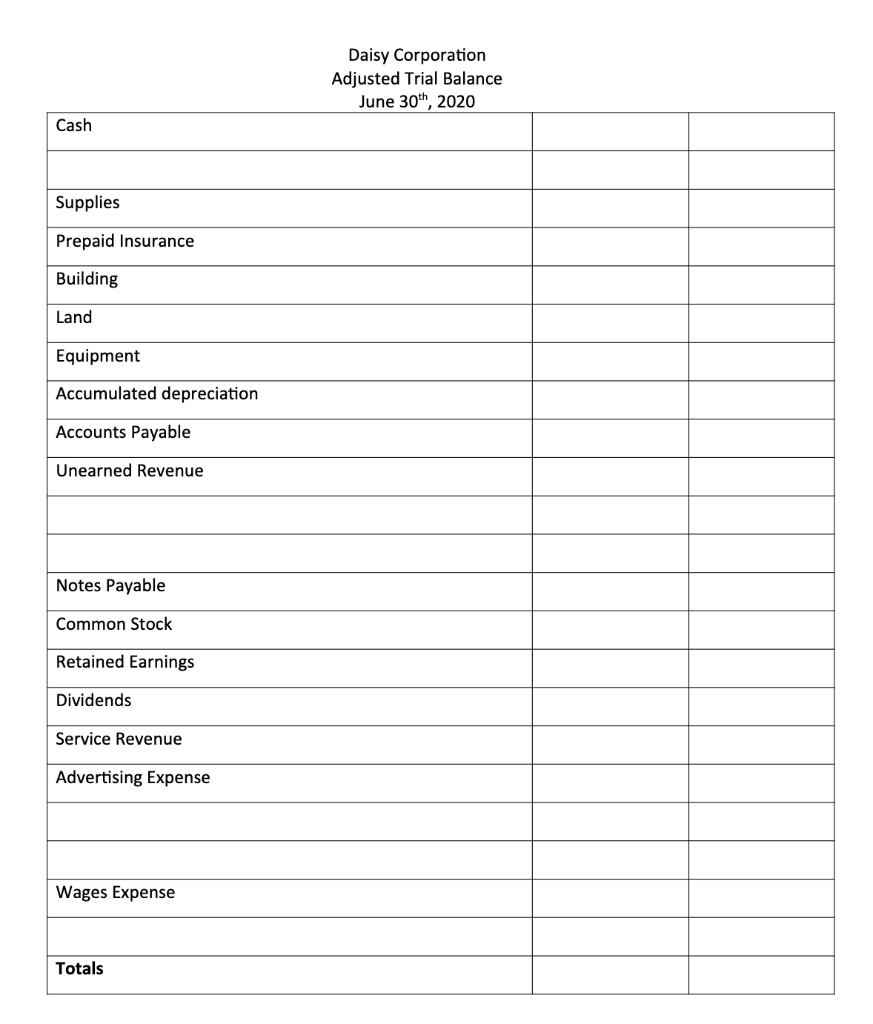

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services. Now Daisy Co. has provided $3,000 of the services and earned that revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: (completed for you on this question) Assets: not impacted Revenue: understated Liabilities: overstated Expense:_not impacted Stockholders' Equity: understated 9) Interest of $450 has accrued on a note payable. What is the necessary adjusting entry for Daisy Co. to record this interest? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: Assets: Revenue: Liabilities: Expense: Stockholders' Equity: 10) The depreciation on Daisy Co.'s office equipment is $650 per month. What is the necessary adjusting entry to record monthly depreciation? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: Assets: Revenue: Liabilities: Expense: Stockholders' Equity: 11) Daisy Co. has $1,500 of supplies on hand, but their Supplies account shows a balance of $2,000. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: Assets: Revenue: Liabilities: Expense:_ Stockholders' Equity: 12) Daisy Co. performed $700 of consulting services for a client but has not yet billed (or recorded) th revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: Assets: Revenue: Liabilities: Expense: Stockholders' Equity: 13) Daisy Co. owes its employees $5,000 at the end of the month but pay day is not until the 10th of next month. What is the necessary adjusting entry at the end of the month? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: Assets: Revenue: Liabilities: Expense: Stockholders' Equity: 14) Based on this unadjusted trial balance, assume the above journal entries (#'s 8 - 13) are recorded and posted and prepare the adjusted trial balance on the next page (blank lines are for new accounts) for June 30th, incorporating those journal entries. Daisy Corporation Unadjusted Trial Balance June 30th, 2020 Cash 12,000 Supplies 2,000 Prepaid Insurance 1,300 Building 500,000 Land 73,500 Equipment 128,000 Accumulated Depreciation 3,000 Accounts Payable 8,000 Unearned Revenue 5,000 Notes Payable 37,800 Common Stock 472,000 Retained Earnings 102,000 Dividends 6,000 Service Revenue 120,000 Advertising Expense 2,000 Wages Expense 23,000 747,800 747,800 Totals Daisy Corporation Adjusted Trial Balance June 30th, 2020 Cash Supplies Prepaid Insurance Building Land Equipment Accumulated depreciation Accounts Payable Unearned Revenue Notes Payable Common Stock Retained Earnings Dividends Service Revenue Advertising Expense Wages Expense Totals