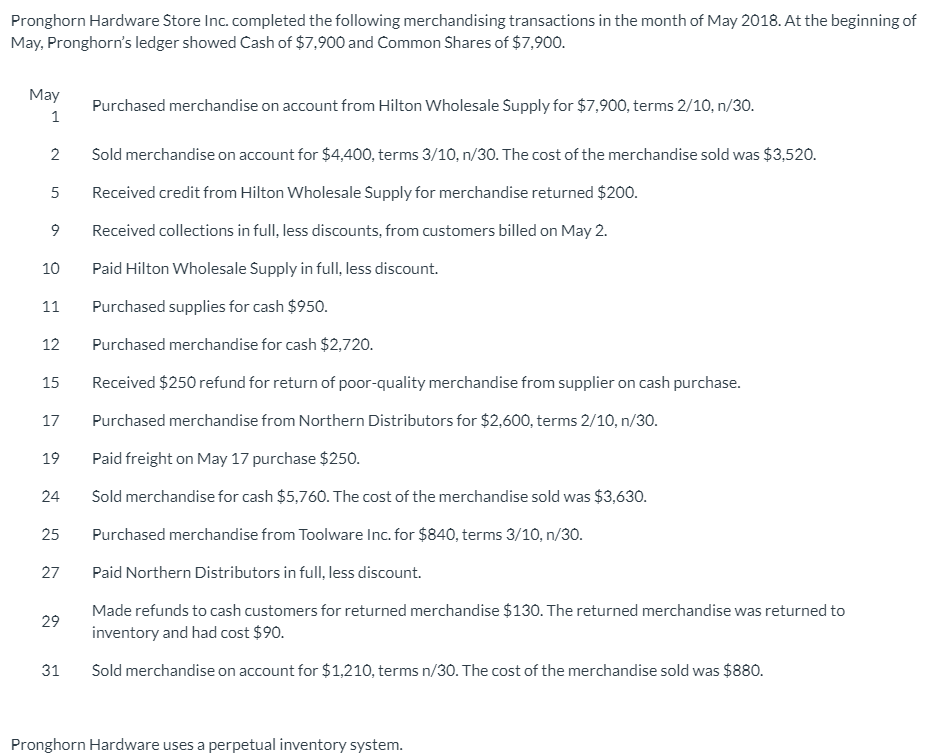

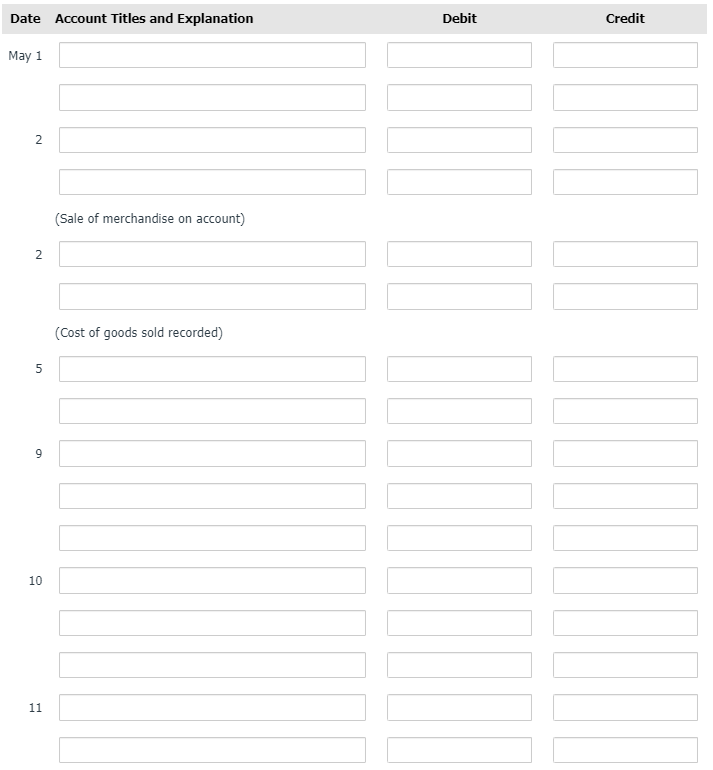

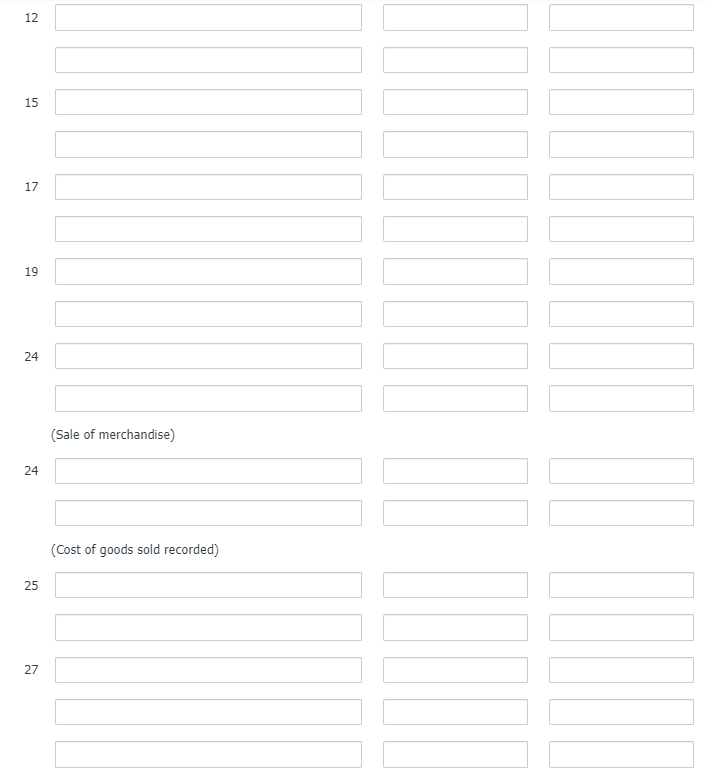

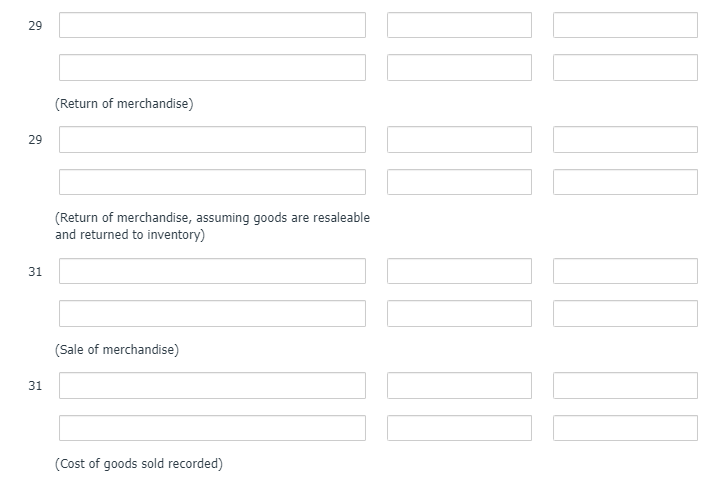

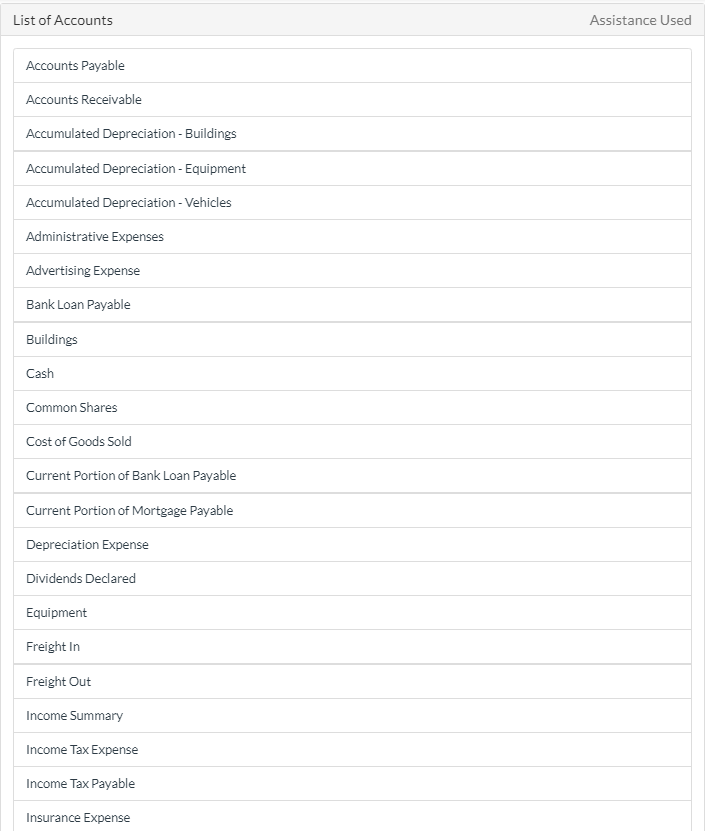

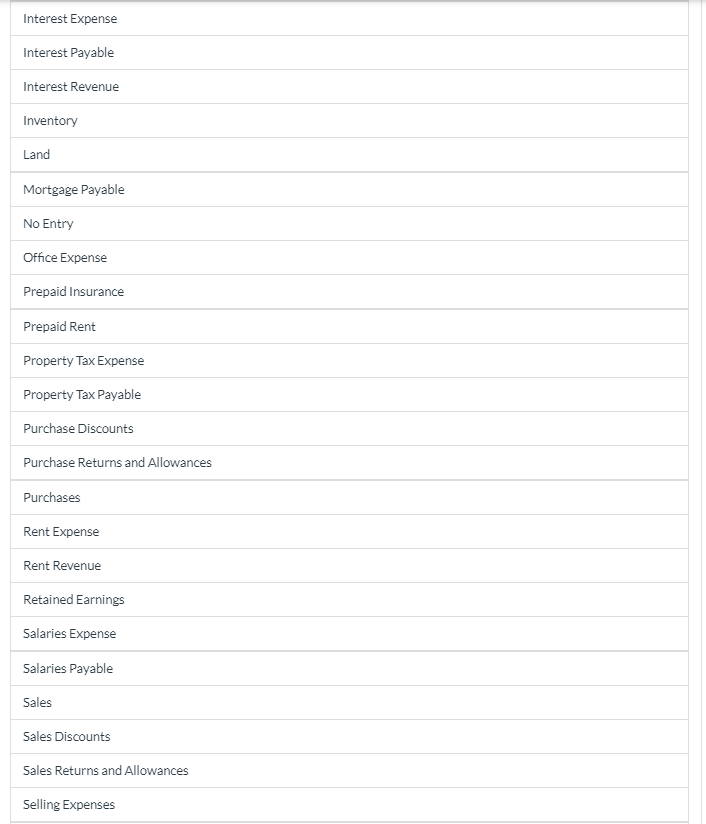

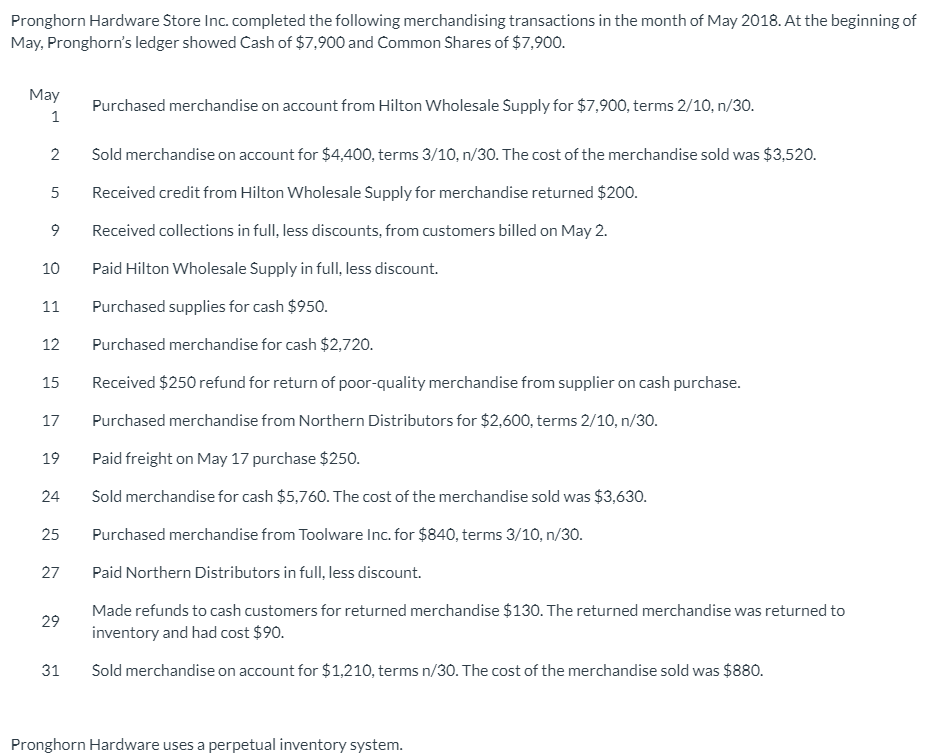

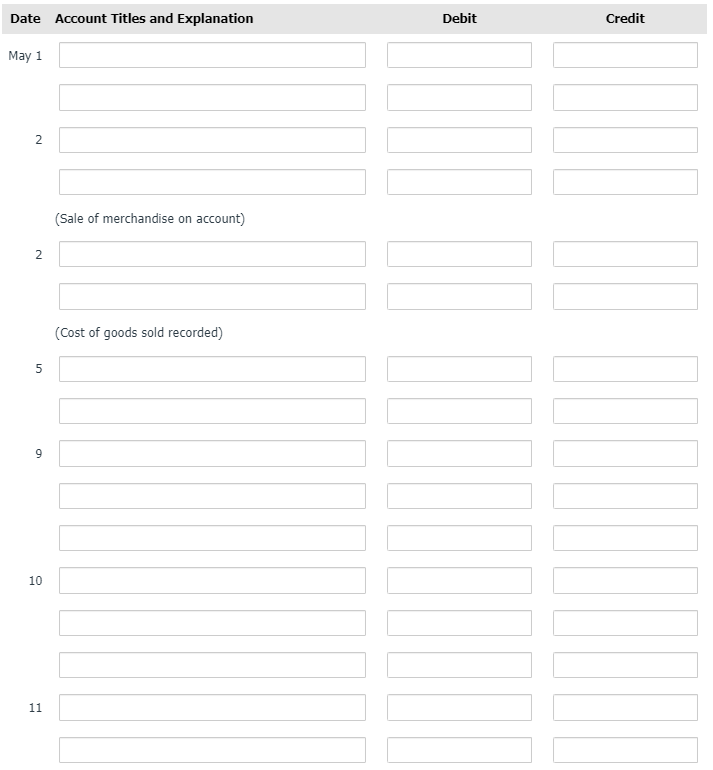

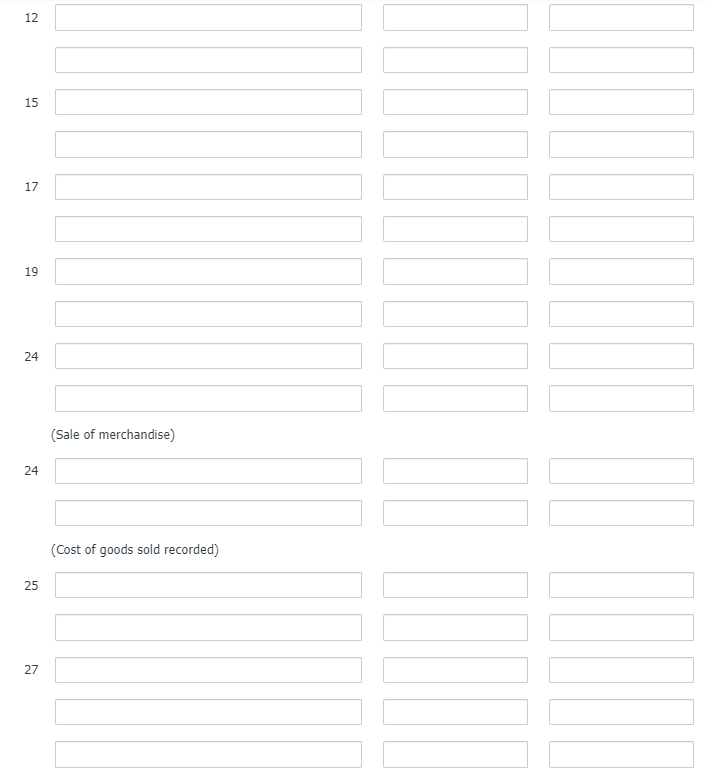

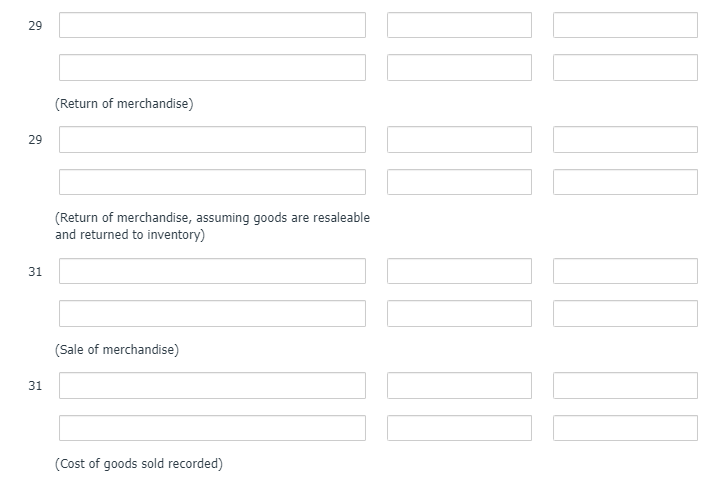

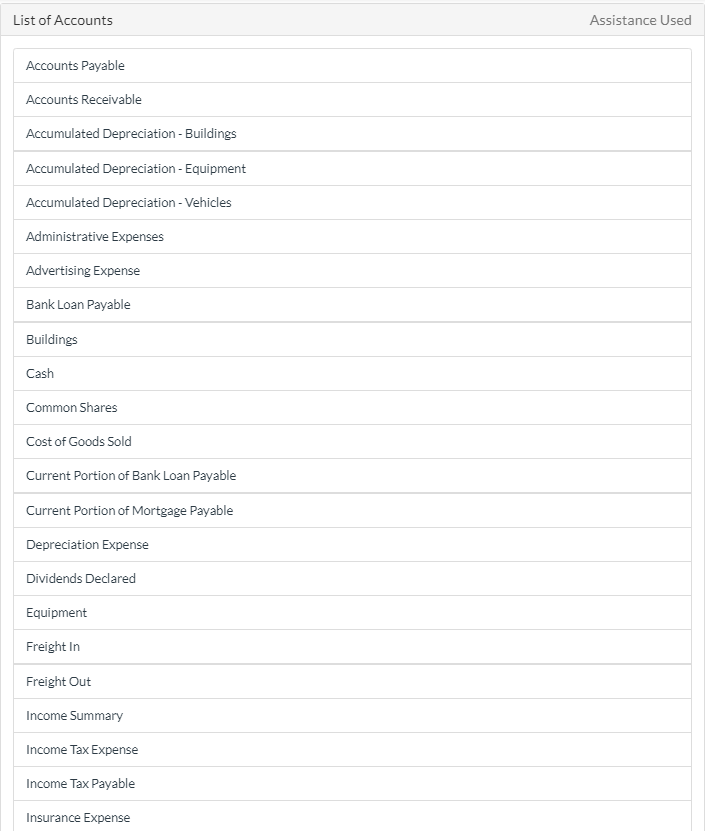

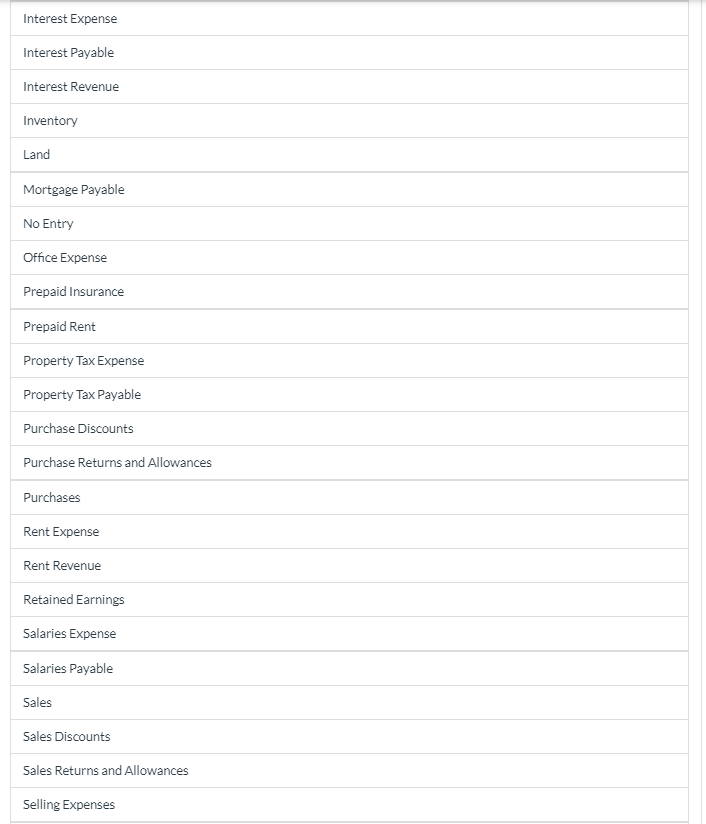

Pronghorn Hardware Store Inc. completed the following merchandising transactions in the month of May 2018. At the beginning of May, Pronghorn's ledger showed Cash of $7,900 and Common Shares of $7,900. May Purchased merchandise on account from Hilton Wholesale Supply for $7,900, terms 2/10, n/30. 1 2 Sold merchandise on account for $4,400, terms 3/10,n/30. The cost of the merchandise sold was $3.520. 5 Received credit from Hilton Wholesale Supply for merchandise returned $200. 9 Received collections in full, less discounts, from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $950. 12 Purchased merchandise for cash $2,720. 15 Received $250 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,600, terms 2/10,n/30. 19 Paid freight on May 17 purchase $250. 24 Sold merchandise for cash $5,760. The cost of the merchandise sold was $3,630. 25 Purchased merchandise from Toolware Inc. for $840, terms 3/10, n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $130. The returned merchandise was returned to inventory and had cost $90. 31 Sold merchandise on account for $1,210, terms n/30. The cost of the merchandise sold was $880. Pronghorn Hardware uses a perpetual inventory system. Date Account Titles and Explanation Debit Credit May 1 N (Sale of merchandise on account) 2 (Cost of goods sold recorded) 5 9 10 11 12 15 17 19 24 (Sale of merchandise) 24 (Cost of goods sold recorded) 25 27 29 (Return of merchandise) 29 (Return of merchandise, assuming goods are resaleable and returned to inventory) 31 (Sale of merchandise) 31 (Cost of goods sold recorded) List of Accounts Assistance Used Accounts Payable Accounts Receivable Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Vehicles Administrative Expenses Advertising Expense Bank Loan Payable Buildings Cash Common Shares Cost of Goods Sold Current Portion of Bank Loan Payable Current Portion of Mortgage Payable Depreciation Expense Dividends Declared Equipment Freight in Freight Out Income Summary Income Tax Expense Income Tax Payable Insurance Expense Interest Expense Interest Payable Interest Revenue Inventory Land Mortgage Payable No Entry Office Expense Prepaid Insurance Prepaid Rent Property Tax Expense Property Tax Payable Purchase Discounts Purchase Returns and Allowances Purchases Rent Expense Rent Revenue Retained Earnings Salaries Expense Salaries Payable Sales Sales Discounts Sales Returns and Allowances Selling Expenses