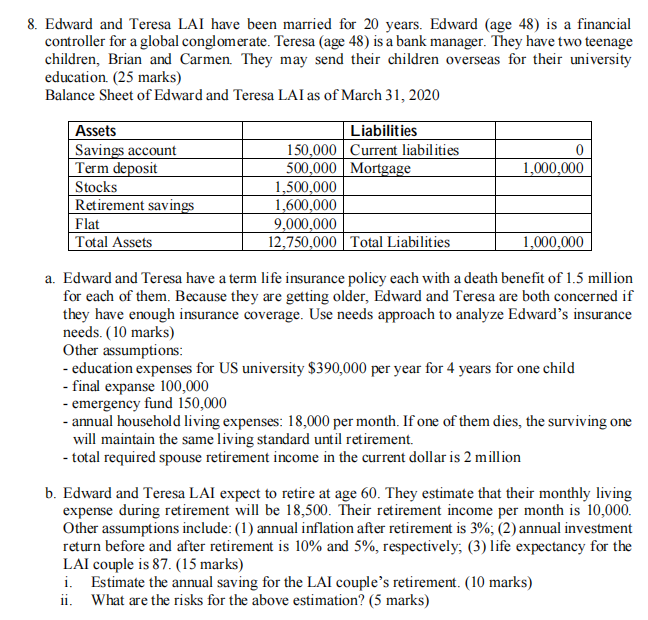

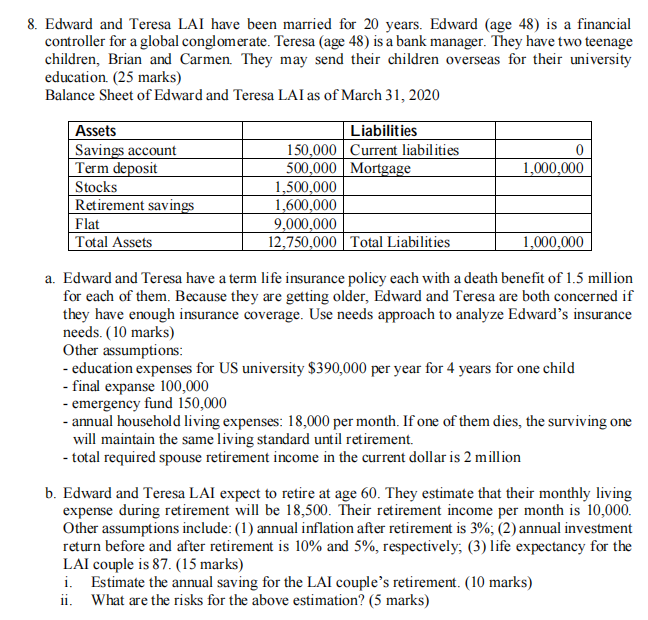

8. Edward and Teresa LAI have been married for 20 years. Edward (age 48) is a financial controller for a global conglomerate. Teresa (age 48) is a bank manager. They have two teenage children, Brian and Carmen. They may send their children overseas for their university education (25 marks) Balance Sheet of Edward and Teresa LAI as of March 31, 2020 1,000,000 Assets Savings account Term deposit Stocks Retirement savings Flat Total Assets Liabilities 150,000 Current liabilities 500,000 Mortgage 1,500,000 1,600,000 9,000,000 12,750,000 Total Liabilities 1,000,000 a. Edward and Teresa have a term life insurance policy each with a death benefit of 1.5 million for each of them. Because they are getting older, Edward and Teresa are both concerned if they have enough insurance coverage. Use needs approach to analyze Edward's insurance needs. (10 marks) Other assumptions: - education expenses for US university $390,000 per year for 4 years for one child - final expanse 100,000 - emergency fund 150,000 - annual household living expenses: 18,000 per month. If one of them dies, the surviving one will maintain the same living standard until retirement. - total required spouse retirement income in the current dollar is 2 million b. Edward and Teresa LAI expect to retire at age 60. They estimate that their monthly living expense during retirement will be 18,500. Their retirement income per month is 10,000. Other assumptions include: (1) annual inflation after retirement is 3%; (2) annual investment return before and after retirement is 10% and 5%, respectively, (3) life expectancy for the LAI couple is 87. (15 marks) i. Estimate the annual saving for the LAI couple's retirement. (10 marks) ii. What are the risks for the above estimation? (5 marks) 8. Edward and Teresa LAI have been married for 20 years. Edward (age 48) is a financial controller for a global conglomerate. Teresa (age 48) is a bank manager. They have two teenage children, Brian and Carmen. They may send their children overseas for their university education (25 marks) Balance Sheet of Edward and Teresa LAI as of March 31, 2020 1,000,000 Assets Savings account Term deposit Stocks Retirement savings Flat Total Assets Liabilities 150,000 Current liabilities 500,000 Mortgage 1,500,000 1,600,000 9,000,000 12,750,000 Total Liabilities 1,000,000 a. Edward and Teresa have a term life insurance policy each with a death benefit of 1.5 million for each of them. Because they are getting older, Edward and Teresa are both concerned if they have enough insurance coverage. Use needs approach to analyze Edward's insurance needs. (10 marks) Other assumptions: - education expenses for US university $390,000 per year for 4 years for one child - final expanse 100,000 - emergency fund 150,000 - annual household living expenses: 18,000 per month. If one of them dies, the surviving one will maintain the same living standard until retirement. - total required spouse retirement income in the current dollar is 2 million b. Edward and Teresa LAI expect to retire at age 60. They estimate that their monthly living expense during retirement will be 18,500. Their retirement income per month is 10,000. Other assumptions include: (1) annual inflation after retirement is 3%; (2) annual investment return before and after retirement is 10% and 5%, respectively, (3) life expectancy for the LAI couple is 87. (15 marks) i. Estimate the annual saving for the LAI couple's retirement. (10 marks) ii. What are the risks for the above estimation