I need help for the D.

I need help for the D.

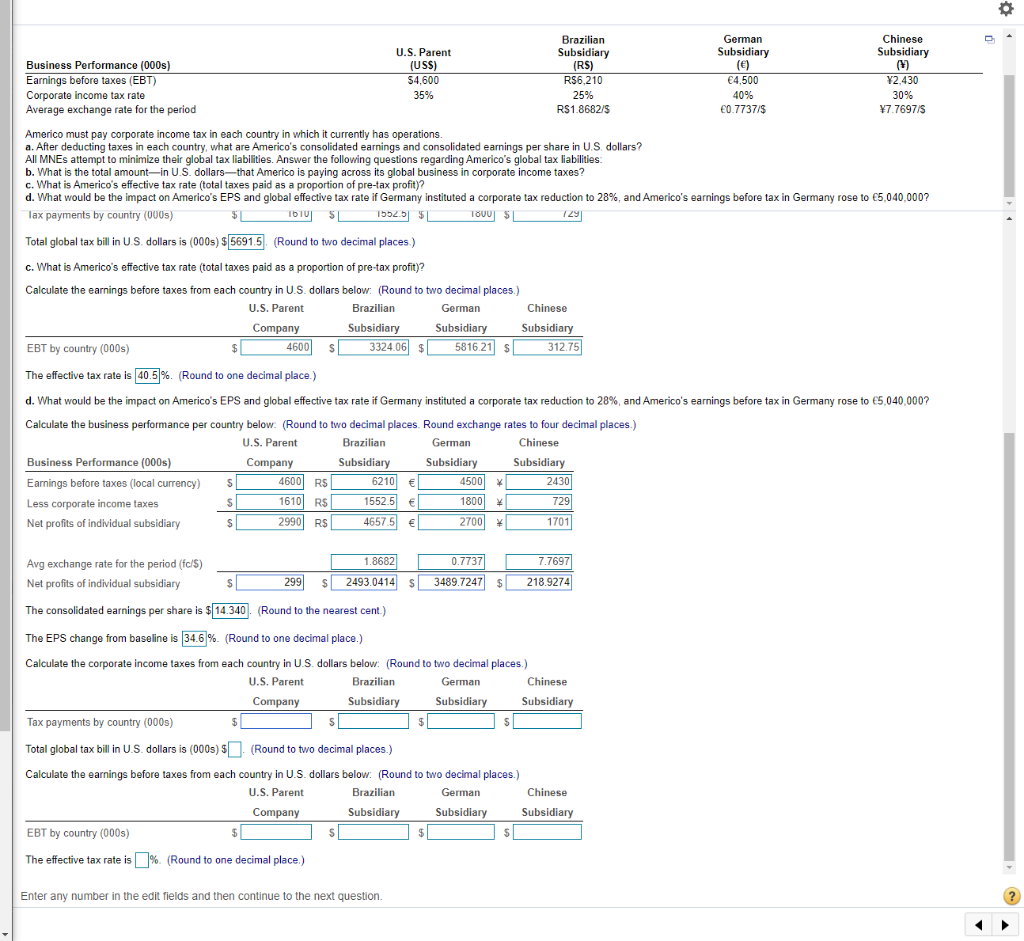

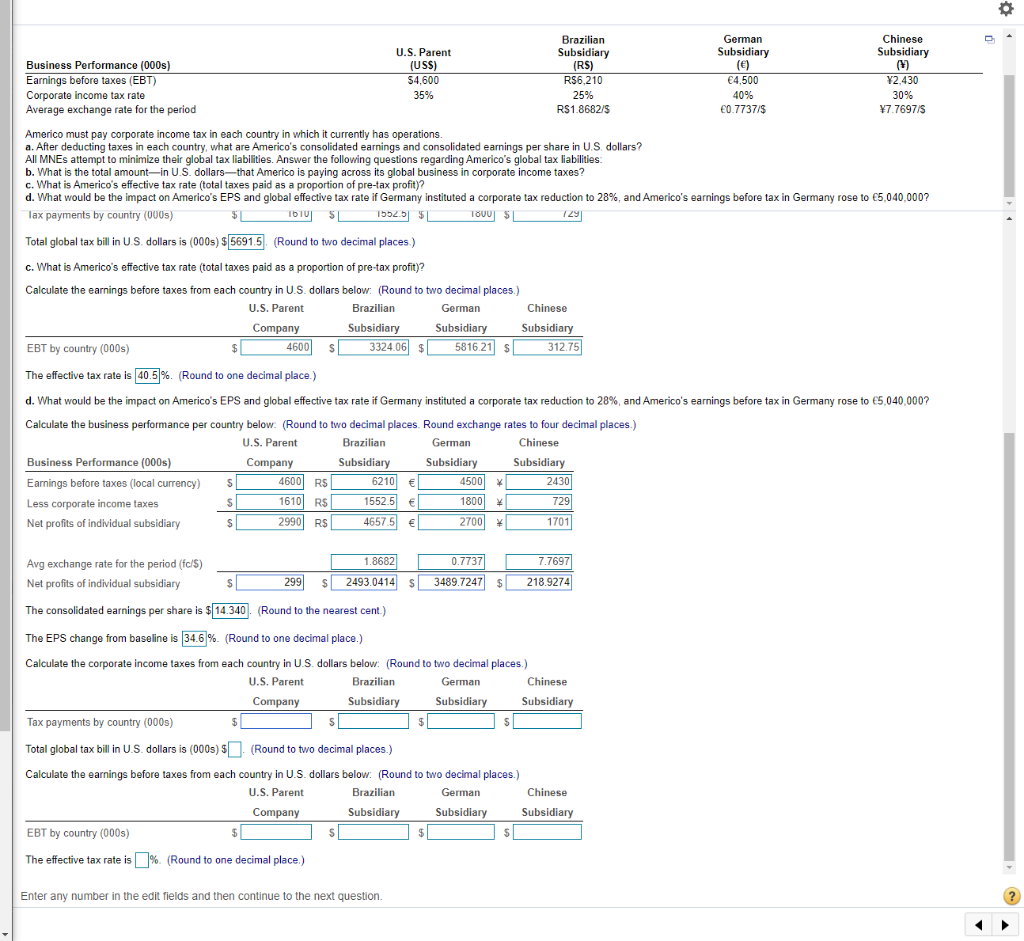

o D Brazilian German Chinese U.S. Parent Subsidiary Subsidiary Subsidiary Business Performance (000s) (USS) (RS) () Earnings before taxes (EBT) $4,600 R$6,210 4,500 2.430 Corporate income tax rate 35% 25% 40% 30% Average exchange rate for the period R$ 1.8682/5 0.7737/$ 7.7697/8 Americo must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? All MNEs attempt to minimize their global tax liabilities. Answer the following questions regarding America's global tax liabilities b. What is the total amount-in US dollarsthat Americo is paying across its global business in corporate income taxes? c. What is Americo's effective tax rate (total taxes paid as a proportion of pre-tax profit)? d. What would be the impact on America's EPS and global effective tax rate if Germany instituted a corporate tax reduction to 28%, and Americo's earnings before tax in Germany rose to 5,040,000? Tax payments by country (0005) $ Ibu SL 15525 $ 1800 S $ 129 Total global tax bill in US dollars is (000s) $ 5691.5 (Round to two decimal places.) c. What is America's effective tax rate (total taxes paid as a proportion of pre-tax profit)? Calculate the earnings before taxes from each country in U.S. dollars below: (Round to two decimal places.) U.S. Parent Brazilian German Chinese Company Subsidiary Subsidiary Subsidiary EBT by country (000s) $ 4600 $ 3324.06 $1 5816.21 $ 312.75 The effective tax rate is 40.5%. (Round to one decimal place.) d. What would be the impact on America's EPS and global effective tax rate if Germany instituted a corporate tax reduction to 28%, and Americo's earnings before tax in Germany rose to 5.040,000? Calculate the business performance per country below. (Round to two decimal places. Round exchange rates to four decimal places.) U.S. Parent Brazilian German Chinese Business Performance (000s) Company Subsidiary Subsidiary Subsidiary Earnings before taxes (local currency) S 6210 4500 * 2430 Less corporate income taxes $ 1552.5 1800 729 Net profits of individual subsidiary 2990 RS 4657.5 2700 * 1701 4600 RS 1610 RS $ 1.8682 Avg exchange rate for the period (fc/5) Net profits of individual subsidiary 0.7737 3489.7247 $ 7.7697 218.9274 $ 299 $ 2493.0414 $ The consolidated earnings per share is $14.340 (Round to the nearest cent.) The EPS change from baseline is 34.6% (Round to one decimal place.) Calculate the corporate income taxes from each country in U.S. dollars below: (Round to two decimal places.) U.S. Parent Brazilian German Chinese Company Subsidiary Subsidiary Subsidiary Tax payments by country (000s) ) $ s Total global tax bill in US dollars is (0005) $ (Round to two decimal places.) Calculate the earnings before taxes from each country in U.S. dollars below: (Round to two decimal places.) U.S. Parent Brazilian German Chinese Company Subsidiary Subsidiary Subsidiary EBT by country (000s) $ S $ The effective tax rate is % (Round to one decimal place.) Enter any number in the edit fields and then continue to the next

I need help for the D.

I need help for the D.