Question

8. If the equipments salvage value was $700,000 instead of $500,000, what would be the projects simple rate of return? 9. Assume a postaudit showed

8. If the equipments salvage value was $700,000 instead of $500,000, what would be the projects simple rate of return?

9. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the projects actual net present value?

10.Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the projects actual payback period?

11. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the projects actual simple rate of return?

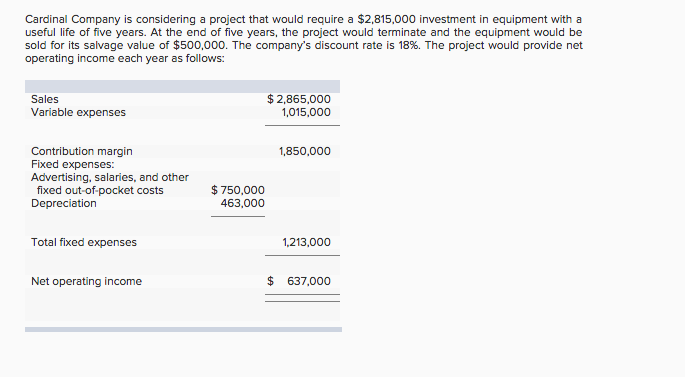

Cardinal Company is considering a project that would require a $2,815,000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $500,000. The company's discount rate is 18%. The project would provide net operating income each year as follows: Sales Variable expenses $2,865,000 1,015,000 1,850,000 Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $750,000 463,000 Total fixed expenses 1,213,000 Net operating income $ 637,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started