Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8 more employees left the company during the year, and Sun-Brights estimates that 8 more employees would leave the company in 20x5, i.e. 29

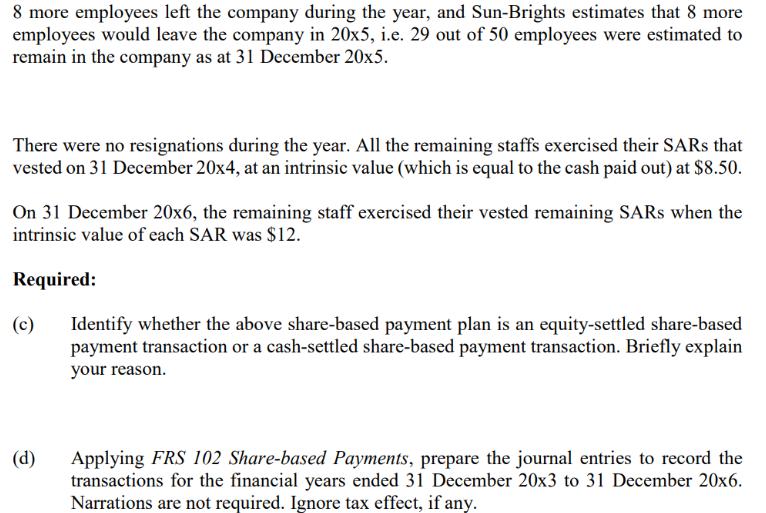

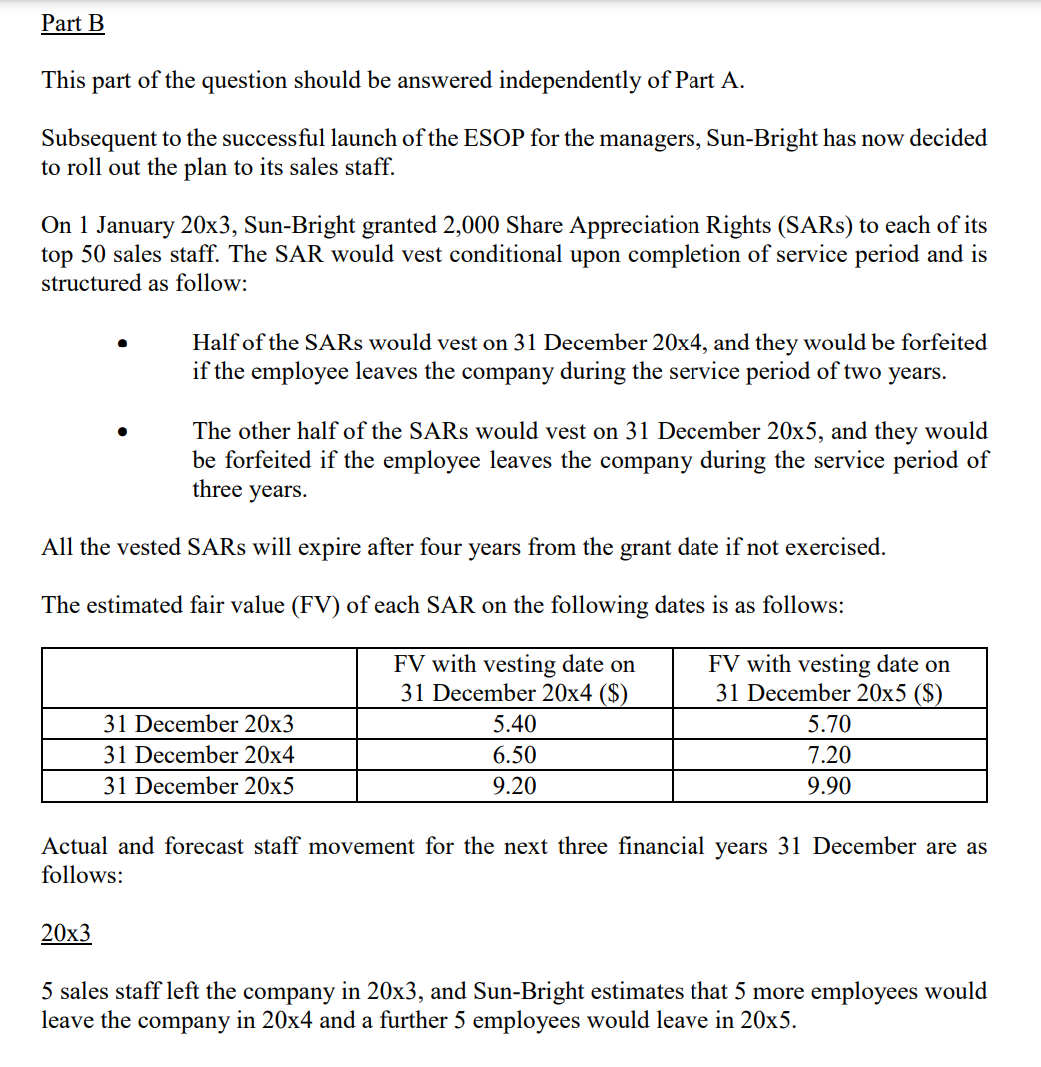

8 more employees left the company during the year, and Sun-Brights estimates that 8 more employees would leave the company in 20x5, i.e. 29 out of 50 employees were estimated to remain in the company as at 31 December 20x5. There were no resignations during the year. All the remaining staffs exercised their SARs that vested on 31 December 20x4, at an intrinsic value (which is equal to the cash paid out) at $8.50. On 31 December 20x6, the remaining staff exercised their vested remaining SARs when the intrinsic value of each SAR was $12. Required: (c) Identify whether the above share-based payment plan is an equity-settled share-based payment transaction or a cash-settled share-based payment transaction. Briefly explain your reason. (d) Applying FRS 102 Share-based Payments, prepare the journal entries to record the transactions for the financial years ended 31 December 20x3 to 31 December 20x6. Narrations are not required. Ignore tax effect, if any. Part B This part of the question should be answered independently of Part A. Subsequent to the successful launch of the ESOP for the managers, Sun-Bright has now decided to roll out the plan to its sales staff. On 1 January 20x3, Sun-Bright granted 2,000 Share Appreciation Rights (SARS) to each of its top 50 sales staff. The SAR would vest conditional upon completion of service period and is structured as follow: Half of the SARs would vest on 31 December 20x4, and they would be forfeited if the employee leaves the company during the service period of two years. The other half of the SARs would vest on 31 December 20x5, and they would be forfeited if the employee leaves the company during the service period of three years. All the vested SARs will expire after four years from the grant date if not exercised. The estimated fair value (FV) of each SAR on the following dates is as follows: 31 December 20x3 FV with vesting date on 31 December 20x4 ($) FV with vesting date on 31 December 20x5 ($) 5.70 7.20 9.90 31 December 20x4 31 December 20x5 5.40 6.50 9.20 Actual and forecast staff movement for the next three financial years 31 December are as follows: 20x3 5 sales staff left the company in 20x3, and Sun-Bright estimates that 5 more employees would leave the company in 20x4 and a further 5 employees would leave in 20x5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started