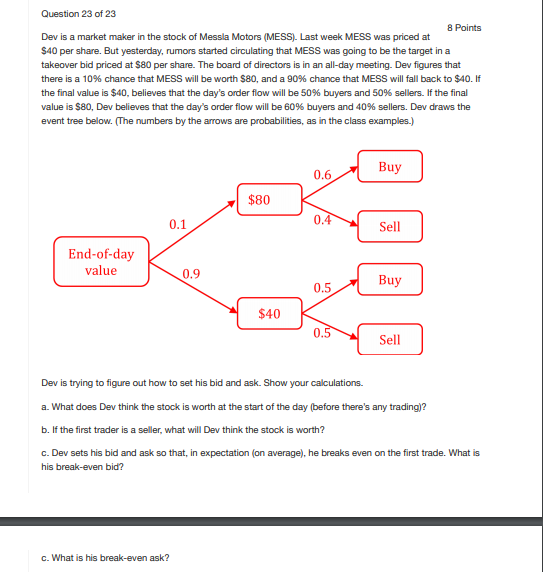

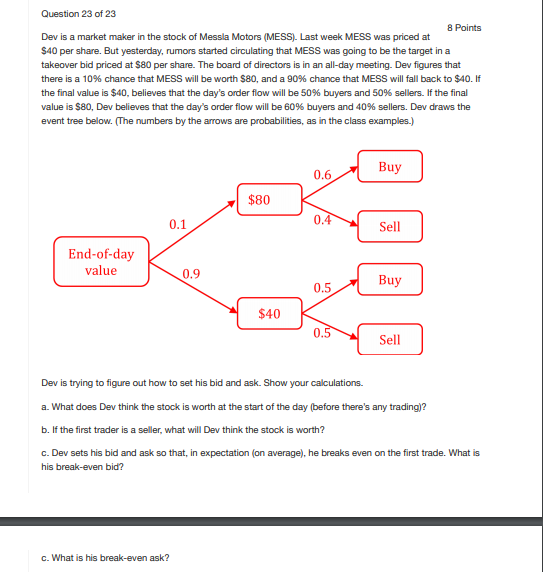

8 Points Question 23 of 23 Dev is a market maker in the stock of Messla Motors (MESS). Last week MESS was priced at $40 per share. But yesterday, rumors started circulating that MESS was going to be the target in a takeover bid priced at $80 per share. The board of directors is in an all-day meeting. Dev figures that there is a 10% chance that MESS will be worth $80, and a 90% chance that MESS will fall back to $40. If the final value is $40, believes that the day's order flow will be 50% buyers and 50% sellers. If the final value is $80, Dev believes that the day's order flow will be 60% buyers and 40% sellers. Dev draws the event tree below. (The numbers by the arrows are probabilities, as in the class examples.) 0.6 Buy $80 0.1 0.4 Sell End-of-day value 0.9 0.5 Buy $40 0.5 Sell Dev is trying to figure out how to set his bid and ask. Show your calculations. a. What does Dev think the stock is worth at the start of the day (before there's any trading)? b. If the first trader is a seller, what will Dev think the stock is worth? C. Dev sets his bid and ask so that, in expectation (on average), he breaks even on the first trade. What is his break-even bid? c. What is his break-even ask? 8 Points Question 23 of 23 Dev is a market maker in the stock of Messla Motors (MESS). Last week MESS was priced at $40 per share. But yesterday, rumors started circulating that MESS was going to be the target in a takeover bid priced at $80 per share. The board of directors is in an all-day meeting. Dev figures that there is a 10% chance that MESS will be worth $80, and a 90% chance that MESS will fall back to $40. If the final value is $40, believes that the day's order flow will be 50% buyers and 50% sellers. If the final value is $80, Dev believes that the day's order flow will be 60% buyers and 40% sellers. Dev draws the event tree below. (The numbers by the arrows are probabilities, as in the class examples.) 0.6 Buy $80 0.1 0.4 Sell End-of-day value 0.9 0.5 Buy $40 0.5 Sell Dev is trying to figure out how to set his bid and ask. Show your calculations. a. What does Dev think the stock is worth at the start of the day (before there's any trading)? b. If the first trader is a seller, what will Dev think the stock is worth? C. Dev sets his bid and ask so that, in expectation (on average), he breaks even on the first trade. What is his break-even bid? c. What is his break-even ask