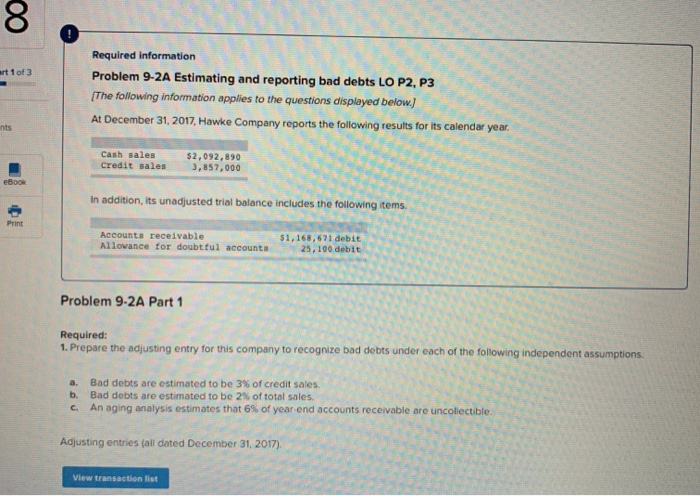

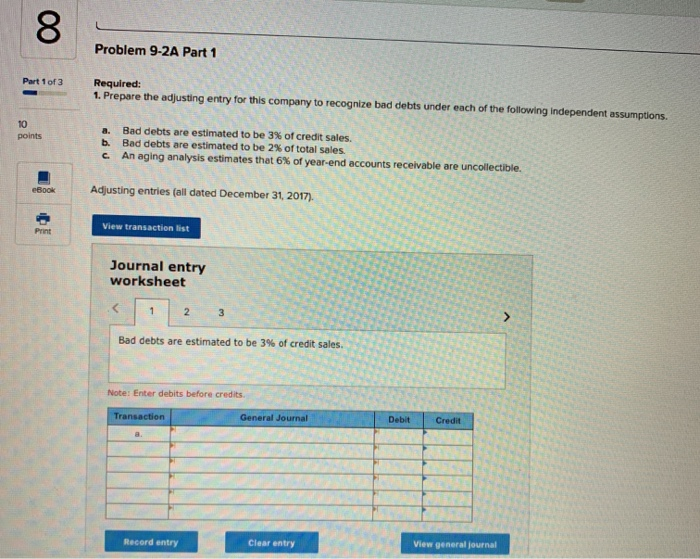

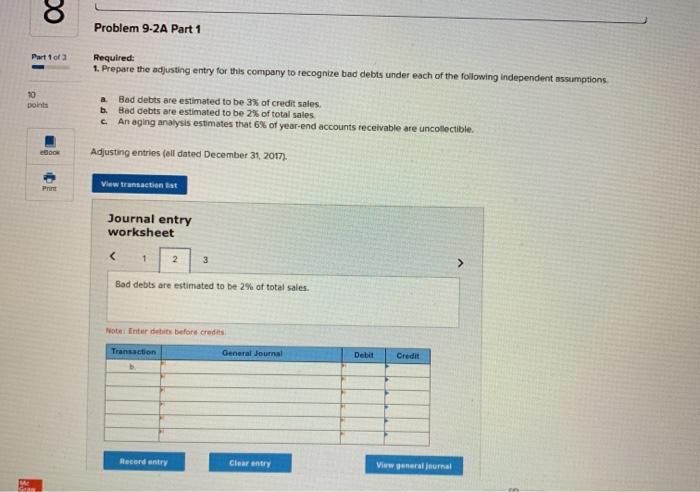

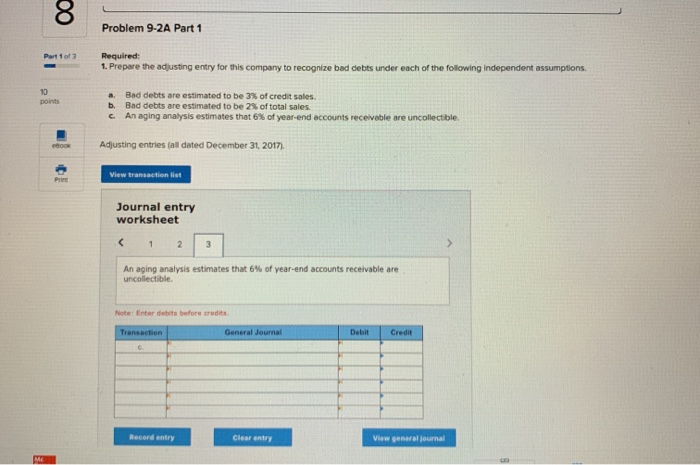

8 Required information Problem 9-2A Estimating and reporting bad debts LO P2, P3 The following information applies to the questions displayed below) At December 31, 2017, Hawke Company reports the following results for its calendar year. rt 1 of 3 nts Cash sales credit sales $2,092,890 3,857,000 eBook In addition, its unadjusted trial balance includes the foilowing items Print Accounts receivable Allovance for doubtful accounts 1,168,671 debit 25, 100 debit Problem 9-2A Part Required: 1. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions Bad debts are estimated to be 3% of credit sales. Bad debts are estimated to be 2% of total sales. An aging analysis estimates that 6% of year end accounts receivable are uncollectible. a. b. c. Adjusting entries (all dated December 31, 2017). View transaction list Problem 9-2A Part 1 Part 1 of 3 Required: 1. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions. 10 points Bad debts are estimated to be 3% of credit sales. Bad debts are estimated to be 2% of total sales An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. a. b. c. eBook Adjusting entries (all dated December 31, 2017). View transaction list Print Journal entry worksheet Bad debts are estimated to be 3% of credit sales. Note: Enter debits before credits General Journal Debit Credit Transaction View general journal Record entry Clear entry Problem 9-2A Part 1 Part 1 of 3 Required 1. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent Bad debts are estimated to be 3% of credit sales. Bad debts are estimated to be 2% of total sales An aging analysis estimates that 6% of year-end accoun points ts receivable are uncollectible. c. eook Adjusting entries (ell dated December 31, 2017) Print Journal entry worksheet Bad debts are estimated to be 2% of total sales. Note: Enter debits before credns Debit Credit View general journal Record entry Clear entry Problem 9-2A Part 1 Part 1 of 3 Required: 1. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions Bad debts are estimated to be 3% ofcredit sales. Bad debts are estimated to be 2% of total sales. An aging analysis estimates that 6% of year-end accounts receivable are uncollectie. a. b. e points Bo0kAdjusting entries (all dated December 31, 2017) View t Print Journal entry worksheet An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. Note Enter debits before credits Debit Credit Record entry Clear entry view general journal