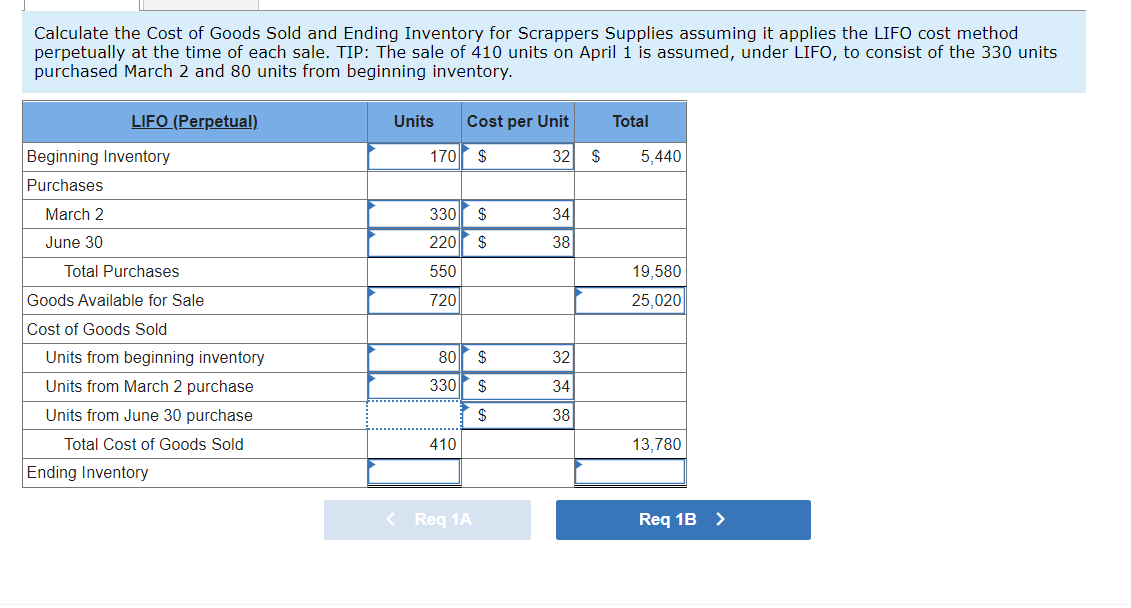

8 Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. 1 points Units 170 Unit Cost $ 32 Transactions Beginning inventory, January 1 Transactions during the year: a. Purchase on account, March 2 b. Cash sale, April 1 ($48 each) c. Purchase on account, June 30 d. Cash sale, August 1 ($48 each) eBook 34 330 (410) 220 (80) 38 Print References Required: 1-a. Calculate the cost of Goods Sold and Ending Inventory for Scrappers Supplies assuming it applies the LIFO cost method perpetually at the time of each sale. TIP: The sale of 410 units on April 1 is assumed, under LIFO, to consist of the 330 units purchased March 2 and 80 units from beginning inventory. 1-b. Does the use of a perpetual inventory system result in a higher or lower Cost of Goods Sold than the periodic inventory system when costs are rising? Complete this question by entering your answers in the tabs below. Req 1A Req 1B Calculate the cost of Goods Sold and Ending Inventory for Scrappers Supplies assuming it applies the LIFO cost method perpetually at the time of each sale. TIP: The sale of 410 units on April 1 is assumed, under LIFO, to consist of the 330 units purchased March 2 and 80 units from beginning inventory. Calculate the cost of Goods Sold and Ending Inventory for Scrappers Supplies assuming it applies the LIFO cost method perpetually at the time of each sale. TIP: The sale of 410 units on April 1 is assumed, under LIFO, to consist of the 330 units purchased March 2 and 80 units from beginning inventory. LIFO (Perpetual), Units Cost per Unit Total 170 $ 32 $ 5,440 Beginning Inventory Purchases March 2 34 June 30 330 $ 220 $ 550 38 Total Purchases 19,580 25.020 720 80 $ 32 Goods Available for Sale Cost of Goods Sold Units from beginning inventory Units from March 2 purchase Units from June 30 purchase Total Cost of Goods Sold Ending Inventory 330 $ 34 $ 38 410 13.780