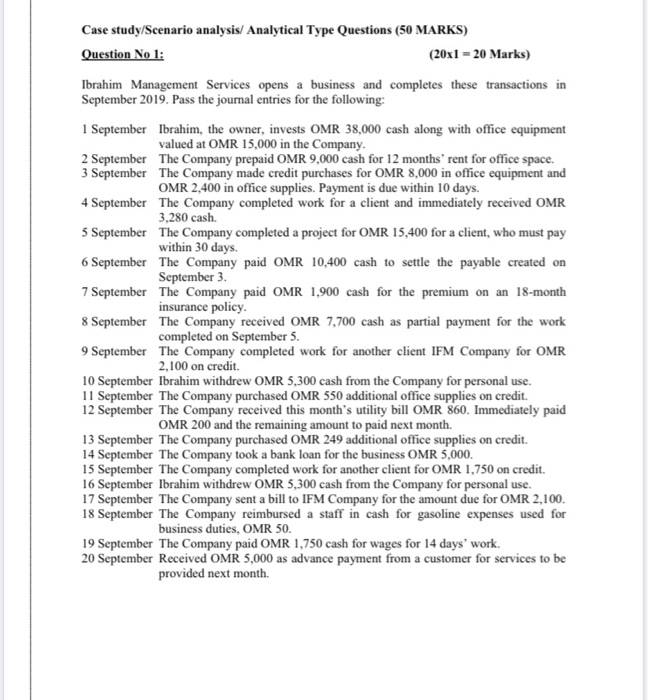

Case study/Scenario analysis/ Analytical Type Questions (50 MARKS) Question No 1: (20x1 = 20 Marks) Ibrahim Management Services opens a business and completes these transactions in September 2019. Pass the journal entries for the following: 1 September Ibrahim, the owner, invests OMR 38,000 cash along with office equipment valued at OMR 15,000 in the Company. 2 September The Company prepaid OMR 9,000 cash for 12 months' rent for office space. 3 September The Company made credit purchases for OMR 8,000 in office equipment and OMR 2,400 in office supplies. Payment is due within 10 days. 4 September The Company completed work for a client and immediately received OMR 3,280 cash. 5 September The Company completed a project for OMR 15,400 for a client, who must pay within 30 days. 6 September The Company paid OMR 10,400 cash to settle the payable created on September 3. 7 September The Company paid OMR 1,900 cash for the premium on an 18-month insurance policy 8 September The Company received OMR 7,700 cash as partial payment for the work completed on September 5. 9 September The Company completed work for another client IFM Company for OMR 2,100 on credit 10 September Ibrahim withdrew OMR 5,300 cash from the Company for personal use. 11 September The Company purchased OMR 550 additional office supplies on credit. 12 September The Company received this month's utility bill OMR 860. Immediately paid OMR 200 and the remaining amount to paid next month. 13 September The Company purchased OMR 249 additional office supplies on credit. 14 September The Company took a bank loan for the business OMR 5,000. 15 September The Company completed work for another client for OMR 1,750 on credit. 16 September Ibrahim withdrew OMR 5,300 cash from the Company for personal use. 17 September The Company sent a bill to IFM Company for the amount due for OMR 2,100. 18 September The Company reimbursed a staff in cash for gasoline expenses used for business duties, OMR 50. 19 September The Company paid OMR 1,750 cash for wages for 14 days' work. 20 September Received OMR 5,000 as advance payment from a customer for services to be provided next month. Case study/Scenario analysis/ Analytical Type Questions (50 MARKS) Question No 1: (20x1 = 20 Marks) Ibrahim Management Services opens a business and completes these transactions in September 2019. Pass the journal entries for the following: 1 September Ibrahim, the owner, invests OMR 38,000 cash along with office equipment valued at OMR 15,000 in the Company. 2 September The Company prepaid OMR 9,000 cash for 12 months' rent for office space. 3 September The Company made credit purchases for OMR 8,000 in office equipment and OMR 2,400 in office supplies. Payment is due within 10 days. 4 September The Company completed work for a client and immediately received OMR 3,280 cash. 5 September The Company completed a project for OMR 15,400 for a client, who must pay within 30 days. 6 September The Company paid OMR 10,400 cash to settle the payable created on September 3. 7 September The Company paid OMR 1,900 cash for the premium on an 18-month insurance policy. 8 September The Company received OMR 7,700 cash as partial payment for the work completed on September 5. 9 September The Company completed work for another client IFM Company for OMR 2,100 on credit. 10 September Ibrahim withdrew OMR 5,300 cash from the Company for personal use. 11 September The Company purchased OMR 550 additional office supplies on credit. 12 September The Company received this month's utility bill OMR 860. Immediately paid OMR 200 and the remaining amount to paid next month. 13 September The Company purchased OMR 249 additional office supplies on credit. 14 September The Company took a bank loan for the business OMR 5,000. 15 September The Company completed work for another client for OMR 1,750 on credit. 16 September Ibrahim withdrew OMR 5,300 cash from the Company for personal use. 17 September The Company sent a bill to IFM Company for the amount due for OMR 2,100. 18 September The Company reimbursed a staff in cash for gasoline expenses used for business duties, OMR 50. 19 September The Company paid OMR 1,750 cash for wages for 14 days' work. 20 September Received OMR 5,000 as advance payment from a customer for services to be provided next month