Answered step by step

Verified Expert Solution

Question

1 Approved Answer

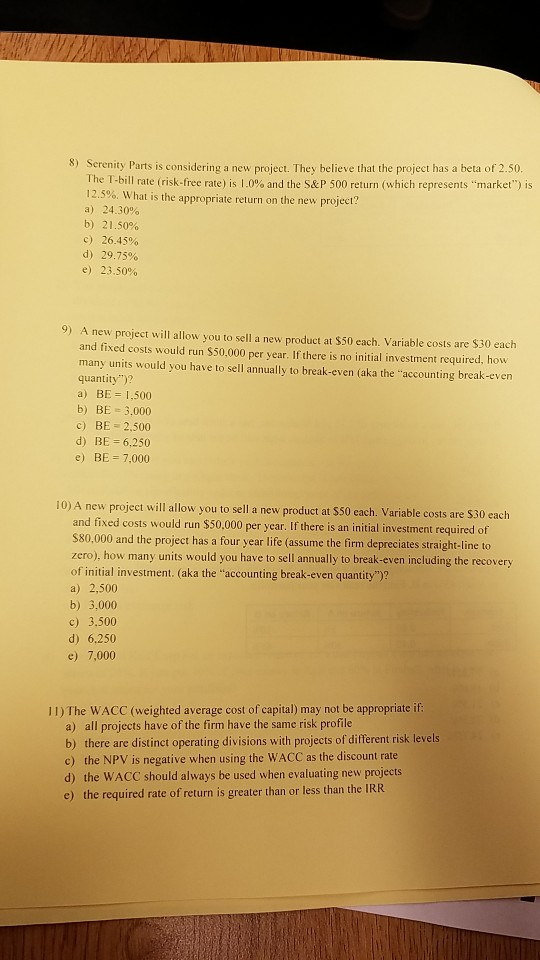

8) Serenity Parts is considering a new project. They believe that the project has a beta of 2.50. e T-bill rate (risk-free rate is 1.0%

8) Serenity Parts is considering a new project. They believe that the project has a beta of 2.50. e T-bill rate (risk-free rate is 1.0% and the S&P 500 return (which represents "market") is 12.5%. What is the appropriate return on the new project? a) 24.30% b) 21.50% c) 26.45% d) 29.75% e) 23.50% 9) A new project will allow you to sell a new product at $50 each. Variable costs are $30 each and fixed costs would run $50,000 per year. If there is no initial investment required, how many units would you have to sell annually to break-even (aka the "accounting break-even quantity")? a) BE 1.500 b) BE 3,000 c) BE 2,500 d) BE 6,250 e) BE 7,000 10) A new project will allow you to sell a new product at $50 each. Variable costs are $30 each and fixed costs would run $50,000 per year. If there is an initial investment required of and the project has a four year l life (assume the firm depreciates straight-line to zero), how many units would you have to sell annually to break-even including the recovery of initial investment. (aka the "accounting break-even quantity")? a) 2,500 b) 3,000 c) 3,500 d) 6,250 e) 7,000 I1) The WACC (weighted average cost of capital) may not be appropriate if: a) all projects have of the firm have the same risk profile b) there are distinct operating divisions with projects of different risk levels c) the NPV is negative when using the WACC as the discount rate d) the WACC should always be used when evaluating new projects e) the required rate of return is greater than or less than the IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started