Question

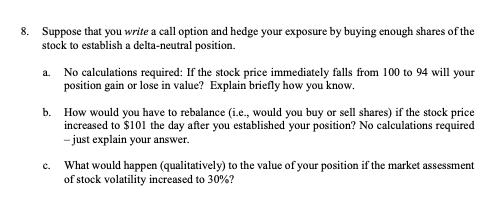

8. Suppose that you write a call option and hedge your exposure by buying enough shares of the stock to establish a delta-neutral position.

8. Suppose that you write a call option and hedge your exposure by buying enough shares of the stock to establish a delta-neutral position. a. No calculations required: If the stock price immediately falls from 100 to 94 will your position gain or lose in value? Explain briefly how you know. b. How would you have to rebalance (i.e., would you buy or sell shares) if the stock price increased to $101 the day after you established your position? No calculations required - just explain your answer. C. What would happen (qualitatively) to the value of your position if the market assessment of stock volatility increased to 30%?

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a When stock price falls from 100 to 94 call option is not exercised and it gets laps ed so total am...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App