Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. The projected costs for a new plant are given below (all numbers are in $106 ). Land cost =$7.5 Fixed capital investment =$120 (

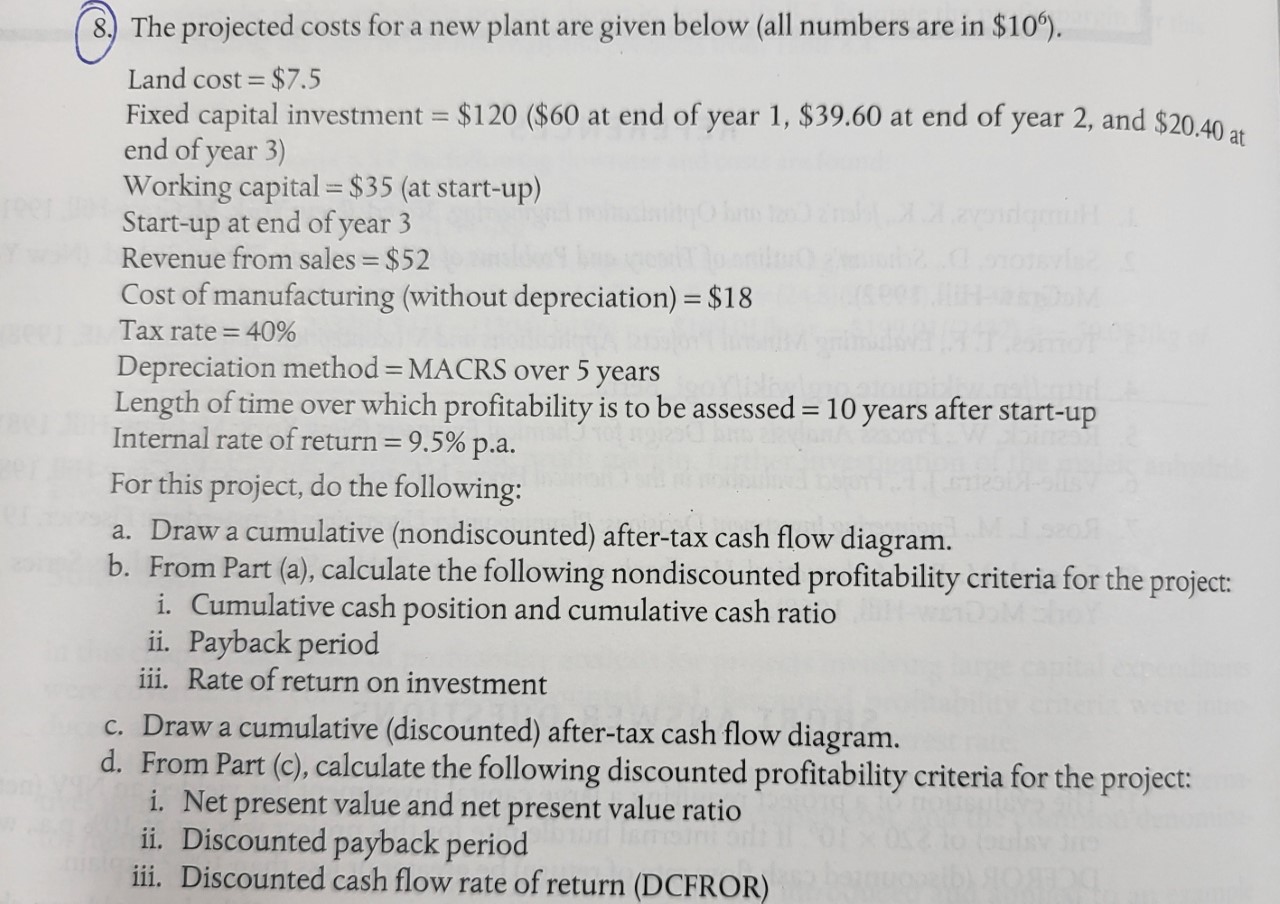

8. The projected costs for a new plant are given below (all numbers are in $106 ). Land cost =$7.5 Fixed capital investment =$120 ( $60 at end of year 1,$39.60 at end of year 2 , and $20.40 at end of year 3) Working capital =$35 (at start-up) Start-up at end of year 3 Revenue from sales =$52 Cost of manufacturing (without depreciation) =$18 Tax rate =40% Depreciation method = MACRS over 5 years Length of time over which profitability is to be assessed =10 years after start-up Internal rate of return =9.5% p.a. For this project, do the following: a. Draw a cumulative (nondiscounted) after-tax cash flow diagram. b. From Part (a), calculate the following nondiscounted profitability criteria for the project: i. Cumulative cash position and cumulative cash ratio ii. Payback period iii. Rate of return on investment c. Draw a cumulative (discounted) after-tax cash flow diagram. d. From Part (c), calculate the following discounted profitability criteria for the project: i. Net present value and net present value ratio ii. Discounted payback period iii. Discounted cash flow rate of return (DCFROR)

8. The projected costs for a new plant are given below (all numbers are in $106 ). Land cost =$7.5 Fixed capital investment =$120 ( $60 at end of year 1,$39.60 at end of year 2 , and $20.40 at end of year 3) Working capital =$35 (at start-up) Start-up at end of year 3 Revenue from sales =$52 Cost of manufacturing (without depreciation) =$18 Tax rate =40% Depreciation method = MACRS over 5 years Length of time over which profitability is to be assessed =10 years after start-up Internal rate of return =9.5% p.a. For this project, do the following: a. Draw a cumulative (nondiscounted) after-tax cash flow diagram. b. From Part (a), calculate the following nondiscounted profitability criteria for the project: i. Cumulative cash position and cumulative cash ratio ii. Payback period iii. Rate of return on investment c. Draw a cumulative (discounted) after-tax cash flow diagram. d. From Part (c), calculate the following discounted profitability criteria for the project: i. Net present value and net present value ratio ii. Discounted payback period iii. Discounted cash flow rate of return (DCFROR) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started