Answered step by step

Verified Expert Solution

Question

1 Approved Answer

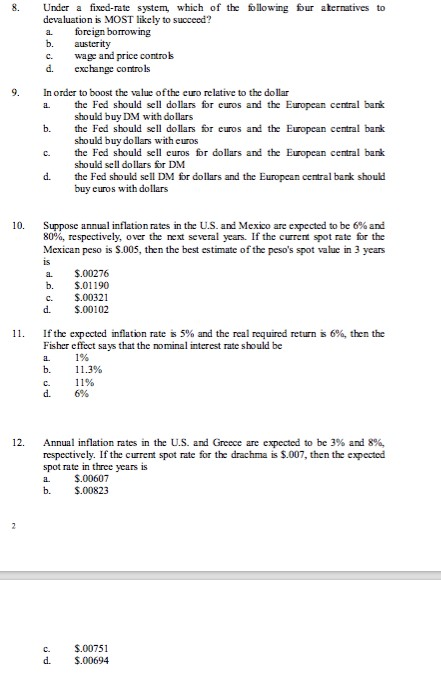

8. Under a fixed-rate system, which of the following fbur aternatives to devaluation is MOST likely to succeed? foreign borrowing austerity wage and price controk

8. Under a fixed-rate system, which of the following fbur aternatives to devaluation is MOST likely to succeed? foreign borrowing austerity wage and price controk exchange controls a. b. c. d. In order to boost the value ofthe euro relative to the dollar the Fed should sell dollars for euros and the European central bank should buy DM with dollars the Fed should sell dollars for euros and the European central bank 9. a. b. should buy do llars with euros the Fed should sell euros for dollars and the European central bank should sell dollars for DM C. d. the Fed should sell DM for dollars and the European central bank should buy euros with dollars Suppose annual inflation rates in the U.S. and Mexico are expected to be 6% and 80%, respectively, over the next several years. If the current spot rate for the Mexican peso is S.005, then the best estimate of the peso's spot value in 3 years 10. is $.00276 $.01190 $.00321 $.00102 a. b. c. d. If the expected inflation rate is 5% and the real required return is 6%, then the Fisher effect says that the nominal interest rate should be 11. 1% 11.3% a. b. 11% C. d. Annual inflation rates in the U.S. and Greece are expected to be 3% and 8%, respectively. If the current spot rate for the drachma is $.007, then the expected spot rate in three years is 12. $.00607 $.00823 a. b. $.00751 $.00694 C. d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started