Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find the above attached question and give the answer properly. 4. G Solutions Ltd. is an established IT company running for last 40 years. For

Find the above attached question and give the answer properly.

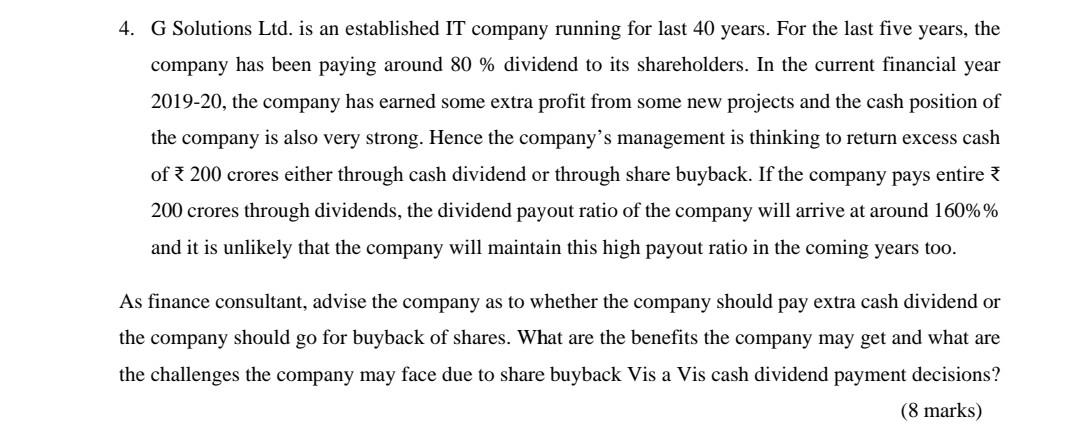

4. G Solutions Ltd. is an established IT company running for last 40 years. For the last five years, the company has been paying around 80 % dividend to its shareholders. In the current financial year 2019-20, the company has earned some extra profit from some new projects and the cash position of the company is also very strong. Hence the company's management is thinking to return excess cash of : 200 crores either through cash dividend or through share buyback. If the company pays entire 200 crores through dividends, the dividend payout ratio of the company will arrive at around 160%% and it is unlikely that the company will maintain this high payout ratio in the coming years too. As finance consultant, advise the company as to whether the company should pay extra cash dividend or the company should go for buyback of shares. What are the benefits the company may get and what are the challenges the company may face due to share buyback Vis a Vis cash dividend payment decisions? (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started