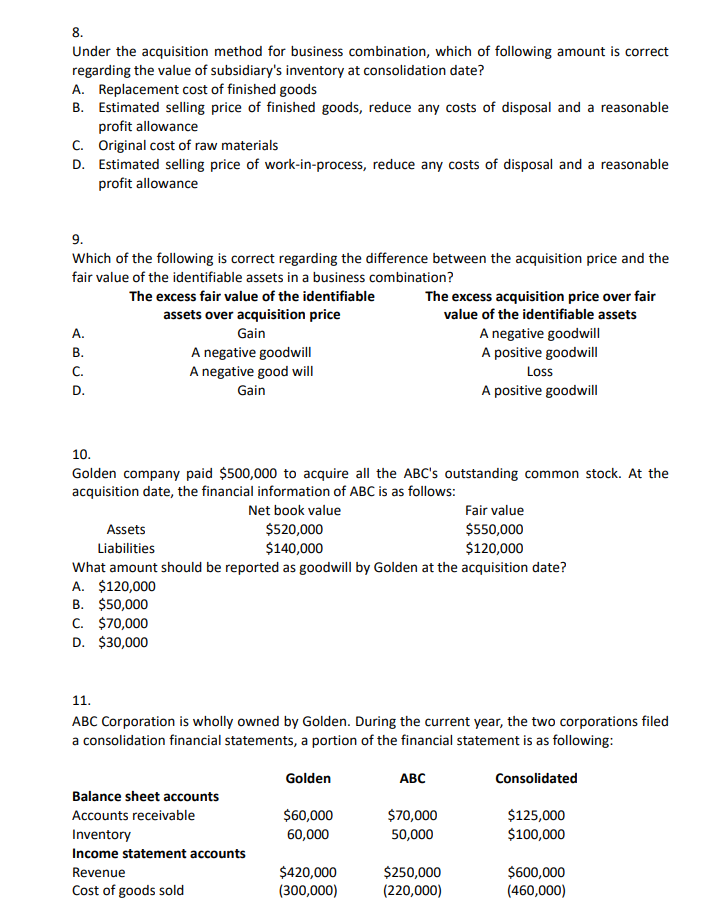

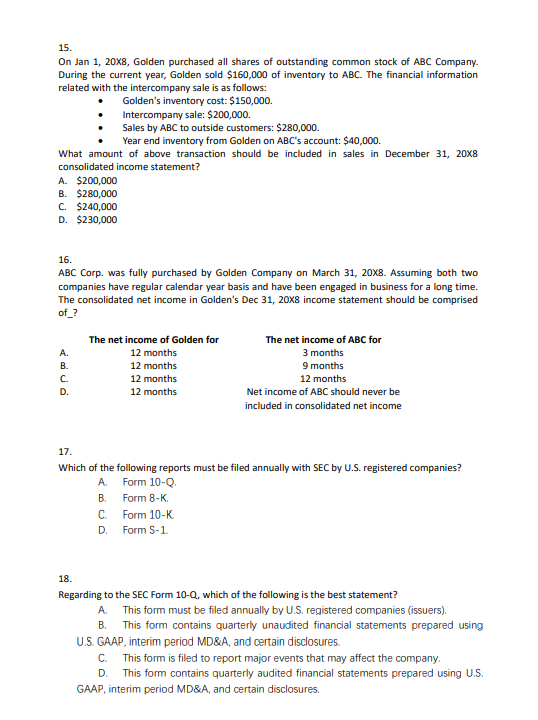

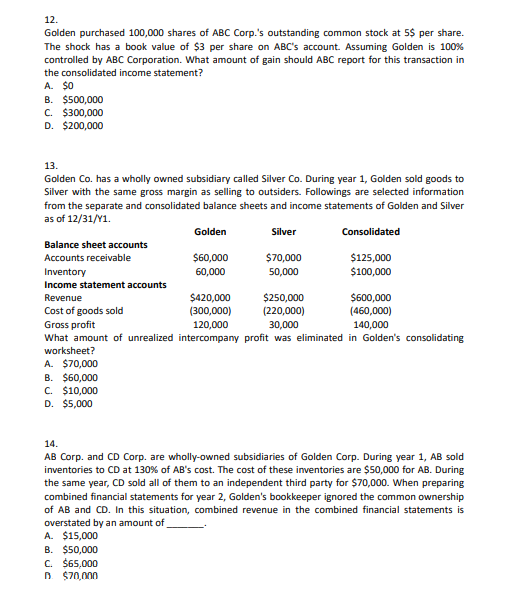

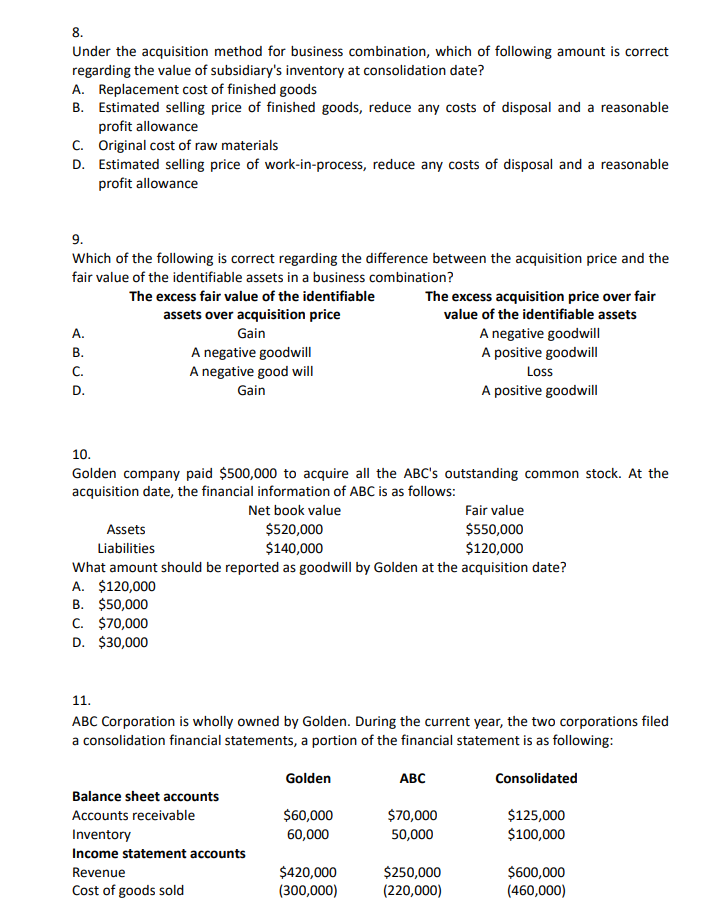

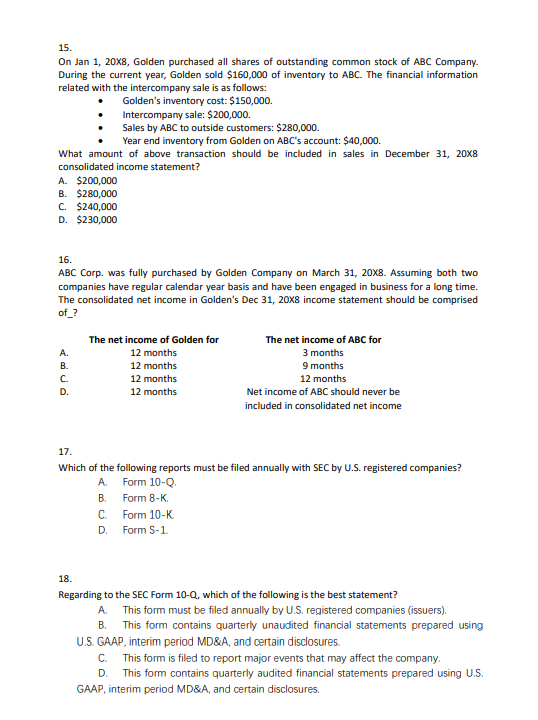

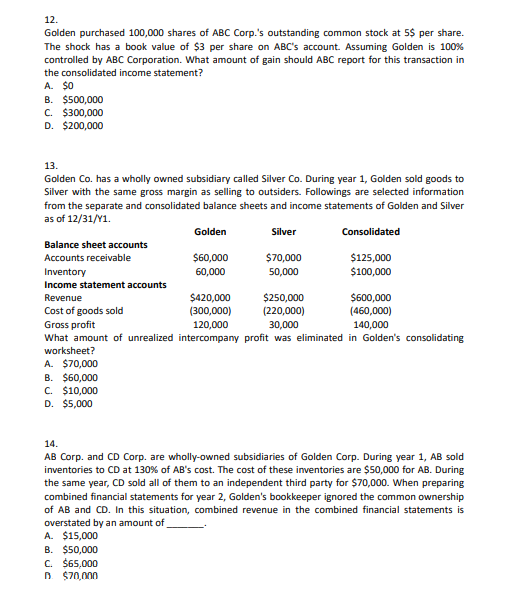

8. Under the acquisition method for business combination, which of following amount is correct regarding the value of subsidiary's inventory at consolidation date? A. Replacement cost of finished goods B. Estimated selling price of finished goods, reduce any costs of disposal and a reasonable profit allowance C. Original cost of raw materials D. Estimated selling price of work-in-process, reduce any costs of disposal and a reasonable profit allowance 9. Which of the following is correct regarding the difference between the acquisition price and the fair value of the identifiable assets in a business combination? The excess fair value of the identifiable The excess acquisition price over fair assets over acquisition price value of the identifiable assets A. Gain A negative goodwill B. A negative goodwill A positive goodwill C. A negative good will Loss D. Gain A positive goodwill 10. Golden company paid $500,000 to acquire all the ABC's outstanding common stock. At the acquisition date, the financial information of ABC is as follows: Net book value Fair value Assets $520,000 $550,000 Liabilities $140,000 $120,000 What amount should be reported as goodwill by Golden at the acquisition date? A. $120,000 B. $50,000 C. $70,000 D. $30,000 11. ABC Corporation is wholly owned by Golden. During the current year, the two corporations filed a consolidation financial statements, a portion of the financial statement is as following: Golden ABC Consolidated $60,000 60,000 $70,000 50,000 Balance sheet accounts Accounts receivable Inventory Income statement accounts Revenue Cost of goods sold $125,000 $100,000 $420,000 (300,000) $250,000 (220,000) $600,000 (460,000) 15. On Jan 1, 20x8, Golden purchased all shares of outstanding common stock of ABC Company. During the current year, Golden sold $160,000 of inventory to ABC. The financial information related with the intercompany sale is as follows: Golden's inventory cost: $150,000. Intercompany sale: $200,000. Sales by ABC to outside customers: $280,000. Year end inventory from Golden on ABC's account: $40,000. What amount of above transaction should be included in sales in December 31, 20x8 consolidated income statement? A $200,000 B. $280,000 C. $240,000 D. $230,000 16. ABC Corp. was fully purchased by Golden Company on March 31, 20x8. Assuming both two companies have regular calendar year basis and have been engaged in business for a long time. The consolidated net income in Golden's Dec 31, 20x8 income statement should be comprised of_? The net income of Golden for The net income of ABC for A. 12 months 3 months B. 12 months 9 months . 12 months 12 months 12 months Net income of ABC should never be included in consolidated net income D. 17 Which of the following reports must be filed annually with SEC by U.S. registered companies? A Form 10-02 B. Form 8-K C Form 10-K D. Form 5-1 18. Regarding to the SEC Form 10-Q, which of the following is the best statement? A. This form must be filed annually by U.S. registered companies (issuers). B. This form contains quarterly unaudited financial statements prepared using U.S. GAAP, interim period MD&A, and certain disclosures. C. This form is filed to report major events that may affect the company. This form contains quarterly audited financial statements prepared using U.S. GAAP, interim period MD&A, and certain disclosures D 12. . Golden purchased 100,000 shares of ABC Corp.'s outstanding common stock at 5$ per share. The shock has a book value of $3 per share on ABC's account. Assuming Golden is 100% controlled by ABC Corporation. What amount of gain should ABC report for this transaction in the consolidated income statement? A. $0 B. $500,000 C. $300,000 D. $200,000 13. Golden Co. has a wholly owned subsidiary called Silver Co. During year 1, Golden sold goods to Silver with the same gross margin as selling to outsiders. Followings are selected information from the separate and consolidated balance sheets and income statements of Golden and Silver as of 12/31/41. Golden Silver Consolidated Balance sheet accounts Accounts receivable $60,000 $70,000 $125,000 Inventory 60,000 50,000 $100,000 Income statement accounts Revenue $420,000 $250,000 $600,000 Cost of goods sold (300,000) (220,000) (460,000) Gross profit 120,000 30,000 140,000 What amount of unrealized intercompany profit was eliminated in Golden's consolidating worksheet? A. $70,000 B. $60,000 C. $10,000 D. $5,000 14. AB Corp. and CD Corp. are wholly-owned subsidiaries of Golden Corp. During year 1, AB sold inventories to CD at 130% of AB's cost. The cost of these inventories are $50,000 for AB. During the same year, CD sold all of them to an independent third party for $70,000. When preparing combined financial statements for year 2, Golden's bookkeeper ignored the common ownership of AB and CD. In this situation, combined revenue in the combined financial statements is overstated by an amount of A $15,000 B. $50,000 C. $65,000 $70,000