Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Valuing Preferred Stock [LO1] Resnor, Inc., has an issue of preferred stock outstanding that pays a $5.50 dividend every year in perpetuity. If

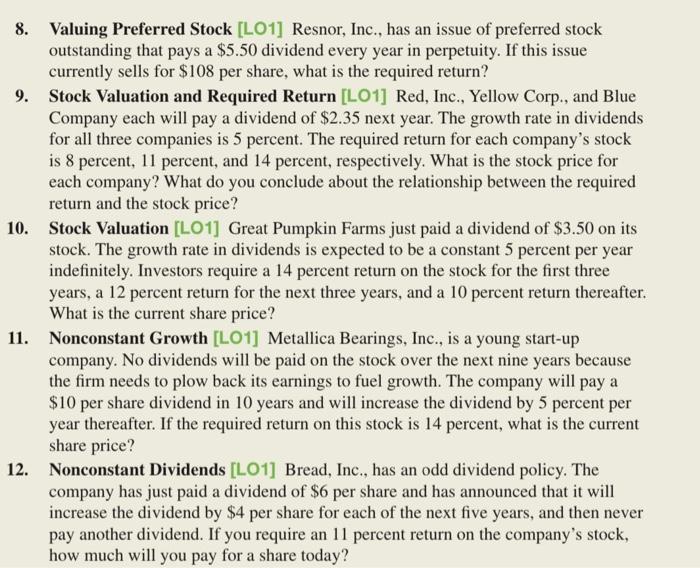

8. Valuing Preferred Stock [LO1] Resnor, Inc., has an issue of preferred stock outstanding that pays a $5.50 dividend every year in perpetuity. If this issue currently sells for $108 per share, what is the required return? 9. Stock Valuation and Required Return [LO1] Red, Inc., Yellow Corp., and Blue Company each will pay a dividend of $2.35 next year. The growth rate in dividends for all three companies is 5 percent. The required return for each company's stock is 8 percent, 11 percent, and 14 percent, respectively. What is the stock price for each company? What do you conclude about the relationship between the required return and the stock price? 10. Stock Valuation [LO1] Great Pumpkin Farms just paid a dividend of $3.50 on its stock. The growth rate in dividends is expected to be a constant 5 percent per year indefinitely. Investors require a 14 percent return on the stock for the first three years, a 12 percent return for the next three years, and a 10 percent return thereafter. What is the current share price? 11. Nonconstant Growth [LO1] Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a $10 per share dividend in 10 years and will increase the dividend by 5 percent per year thereafter. If the required return on this stock is 14 percent, what is the current share price? 12. Nonconstant Dividends [LO1] Bread, Inc., has an odd dividend policy. The company has just paid a dividend of $6 per share and has announced that it will increase the dividend by $4 per share for each of the next five years, and then never pay another dividend. If you require an 11 percent return on the company's stock, how much will you pay for a share today?

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Valuing Preferred Stock LO1 Resnor Inc has an issue of preferred stock outstanding that pays a 550 d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started