80%, equity, financing leases with unguaranteed residual value, fixed asset profit. Steven Truck Company has been an 80%-owned subsidiary of Paulz Heavy Equipment since January 1, 2013, when Paulz acquired 128,000 shares of Steven common stock for $832,000, an amount equal to the book value of Stevens net assets at that date. Stevens net income and dividends paid since acquisition are as follows: PROVIDE AS MUCH AS POSSIBLE BUT REALLY NEED ELIMINATIONS/ADJUSTMENTS SHEET PLEASE!

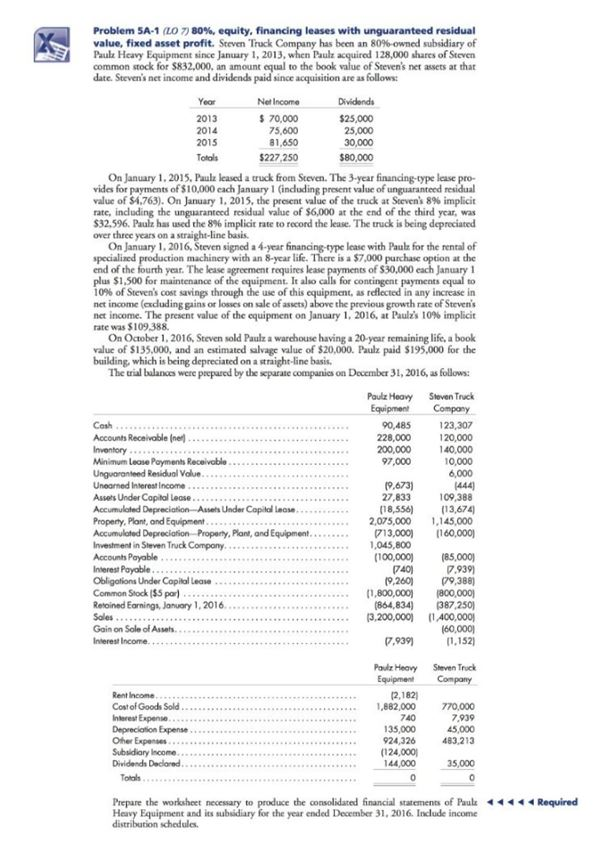

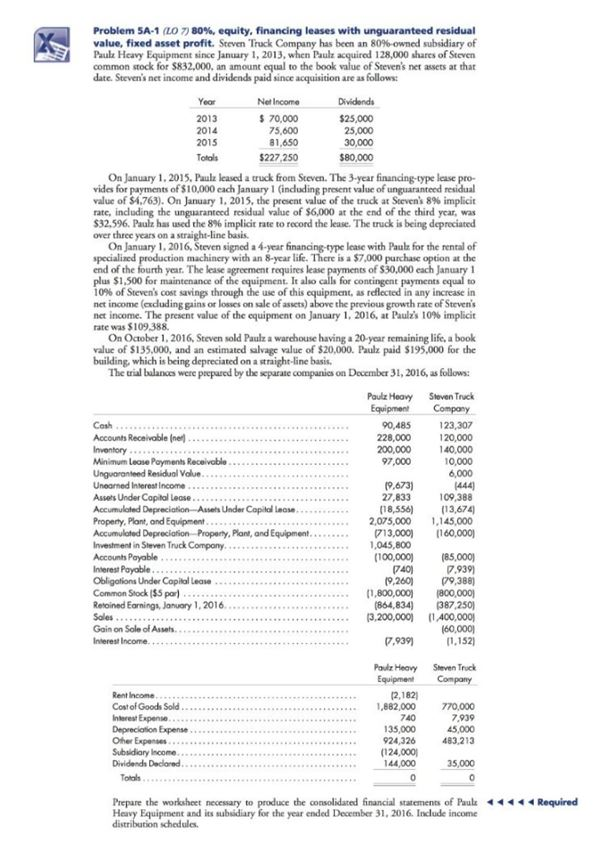

Problem 5A-1 (LO 80%, equity, financing leases with unguaranteed residual value, fixed asset profit. Steven Truck Paulz Heavy Equipment since January 1, 2013, when Paulz acquired 128,000 shares of Steven common stock for $832,000, an amount equal to the book value of Steven's ner assets at that date. Steven's net income and dividends paid since acquisition are as follows has been an 80%-owned subsidiary of Net Income Dividends 2014 2015 Totals s 70,000 75,600 81 ,650 $227.250 25,000 25,000 30,000 80,000 On January 1.2015, Paulk leased a truck from Steven. The 3-year financing-type lease pro- vides for payments of $10,000 each January 1 (including present value of unguaranteed residual value of $4,763). On January 1, 2015, the present value of the truck at Steven's 8% implicit rate, including the ungaranteed residual value of $6,000 at the end of the third year, was 32.596. Paulz has used the 8% implicit tate to record the lease. "The truck is being depreciated over three years on a straight-line basis On January 1,2016, Steven signed a 4-year end of the 10% of Steven's cost savings through the use lease with Paule for the rental of machinery with an 8-year life. There is a $7,000 purchase option at the of $30,000 each January 1 plus $1,500 for maintenance of the equipment. It also calls for contingent payments equal to as reflected in any increase in net income (excduding gains or losses on sale of assets) above the previous growth rate of Stevens net income. The present value of the equipment on January 1, 2016, at Paula's 10% implicit year. The lease agreement requires lease rate was $109.388. On October 1, 2016, Steven sold Paulz a warehouse having a 20-year remaining life, a book alue of $135.000, and an estimated salvage value of $20,000. Paulz pad195.000or the building, which is being depreciated on a straight-line basis. The wial bulances were prepared by the separate companics on December 31, 2016, as follows: Paukz Heavy Steven Truck Equipment Company Cosh 90,485 23,307 228,000 20,000 200.000 40.000 Minimum Lease Payments Receivable Unguaranteed Residual Value Unearned Interest Income.... 97,000 10,000 6,000 9,673) 27,833 109.388 (18,556) (13,674 ..2,075,000 145,000 13,000) [160,000] Accumulated Depreciation-Assets Under Copial lecse Property, Plant, and Equipment Plant, andEquipment. Investment in Steven Truck Compony... Accounts Payable.... Interest Payable ...045,800 (100,00 (9,26 (864,834) (85,000) 9,388 poo,0001 (387,250! 400,000 (60,000 Common Stock($5 par) Retoined Earnings, January 1,2016 (1,800,0 .... 3,200,000 7,939 152) Pauiz Heavy Steven Truck Equipment Compny Rent Income 770,000 7.939 45,000 924,326483,213 Other Expenses (124,000 144,000 scome 35,000 Prepare the worksheet necessary to produce de consolidated financial statements of Paulz Equipment and its subsidiary for the year ended December 31, 2016. Include income Required schedules