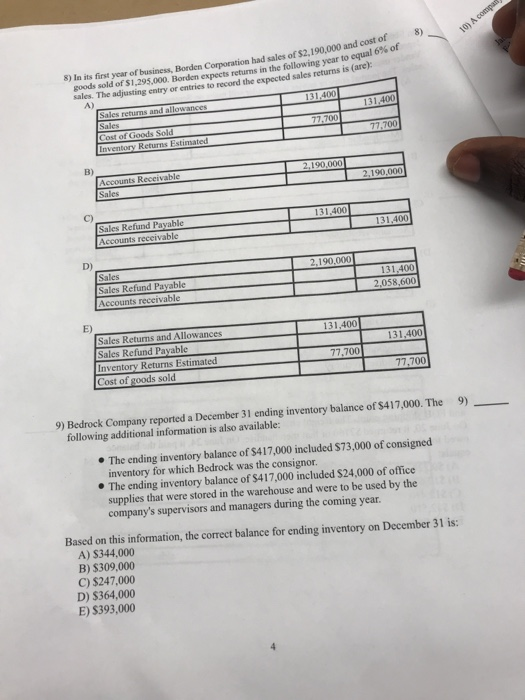

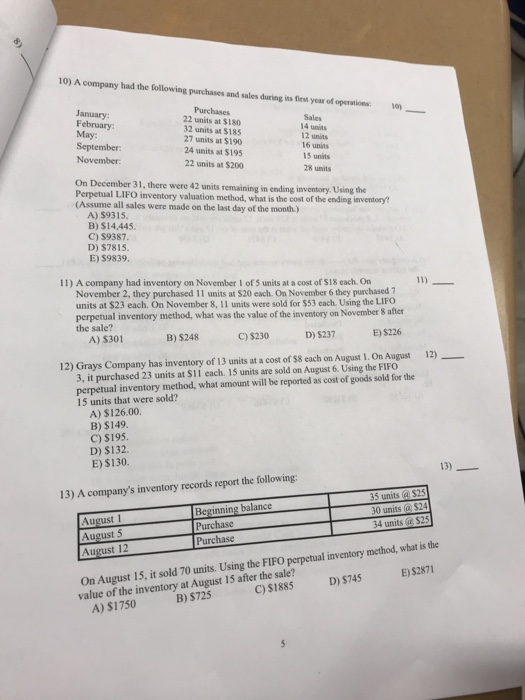

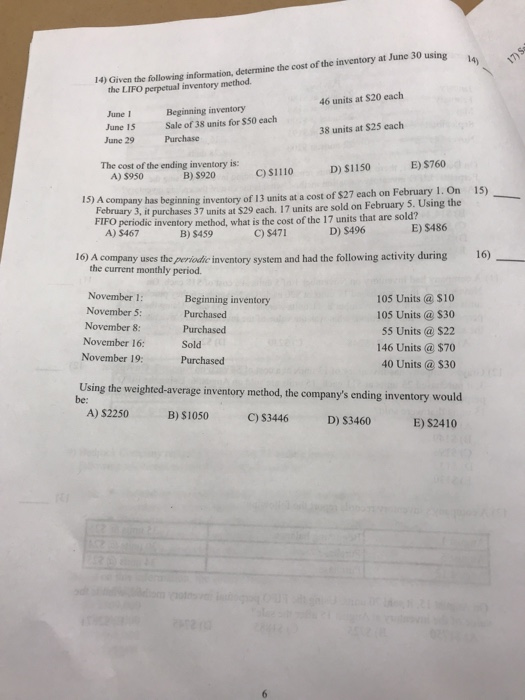

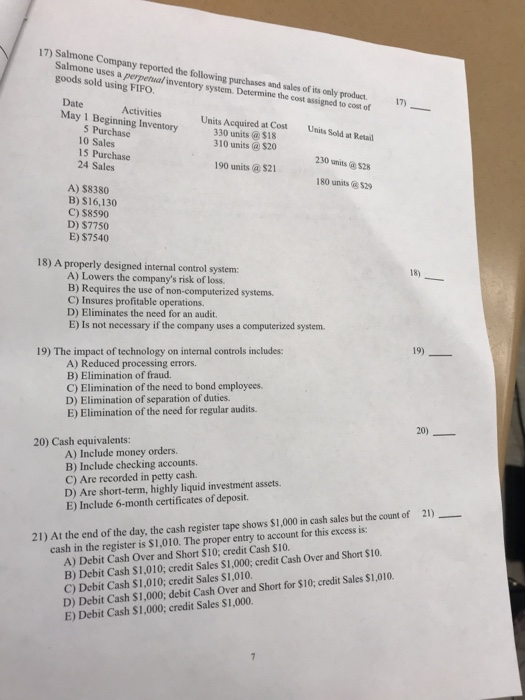

81 10) A compat 8) In its first year of business, Borden Corporation had sales of $2.190,000 and cost of goods sold of $1,295,000. Borden expects returns in the following year to equal 6% of sales. The adjusting entry or entries to record the expected sales returns is (arek A) Sales returns and allowances Sales Cost of Goods Sold Inventory Returns Estimated 131,400 131.400 77,700 77,700 B) Accounts Receivable Sales 2,190.000 2,190,000 C) Sales Refund Payable Accounts receivable 131.400 131,400 D) Sales 2.190.000 Sales Refund Payable Accounts receivable 131,400 2,058,600 E) Sales Returns and Allowances Sales Refund Payable 131.400 131,400 Inventory Returns Estimated Cost of goods sold 77,700 77,700 9) Bedrock Company reported a December 31 ending inventory balance of $417,000. The following additional information is also available 9) The ending inventory balance of $417,000 included $73,000 of consigned inventory for which Bedrock was the consignor. The ending inventory balance of $417,000 included $24,000 of office supplies that were stored in the warehouse and were to be used by the company's supervisors and managers during the coming year. Based on this information, the correct balance for ending inventory A) $344,000 B) $309,000 C) $247,000 D) $364,000 E) $393,000 on December 31 is: 10) A company had the following purchases and sales during its first year of operations 10 January February May Purchases 22 units at $180 32 units at $185 27 units at $190 Sales 14 units 12 units 16 units September November 24 units at $195 15 units 22 units at $2004 28 units On December 31, there were 42 units remaining in ending inventory. Using the Perpetual LIFO inventory valuation method, what is the cost of the ending inventory? (Assume all sales were made on the last day of the month.) A) $9315, B) $14,445 C) $9387. D) $7815. E) $9839. 11) A company had inventory on November 1 of 5 units at a cost of $18 each. On November 2, they purchased 11 units at $20 each. On November 6 they purchased 7 units at $23 each. On November 8, 11 units were sold for $53 each. Using the LIFO perpetual inventory method, what was the value of the inventory on November 8 after the sale? 11) E) $226 C) $230 B) $248 D) $237 A) $301 12) Grays Company has inventory of 13 units at a cost of $8 each on August 1. On August 3, it purchased 23 units at $11 each. 15 units are sold on August 6, Using the FIFO perpetual inventory method, what amount will be reported as cost of goods sold for the 15 units that were sold? 12) A) $126.00 B) $149 C) S195. D) $132 E) $130. 13) - 13) A company's inventory records report the following: 35 units @$25 Beginning balance Purchase Purchase 30 units @$24 August 1 August 5 34 units $25 On August 15, it sold 70 units. Using the FIFO perpetual inventory method, what is the C) $1885 August 12 value of the inventory at August 15 after the sale? A) S1750 E) $2871 D) $745 B) $725 14) Given the following information, determine the cost of the inventory at June 30 using the LIFO perpetual inventory method. 14) 17) S 46 units at $20 each Beginning inventory Sale of 38 units for $50 each June 1 June 15 38 units at $25 each June 29 Purchase The cost of the ending inventory is: A) $950 E) $760 D) $1150 C) $1110 B) $920 15) A company has beginning inventory of 13 units at a cost of $27 each on February 1. On February 3, it purchases 37 units at $29 each, 17 units are sold on February 5. Using the FIFO periodic inventory method, what is the cost of the 17 units that are sold? A) $467 15) E) $486 B) $459 D) $496 C) $471 16) A company uses the periodic inventory system and had the following activity during the current monthly period. 16) November 1: Beginning inventory 105 Units @ $10 November 5: Purchased 105 Units @ $30 November 8: Purchased 55 Units@ $22 November 16: Sold 146 Units @ $70 November 19 Purchased 40 Units @ $30 Using the weighted-average inventory method, the company's ending inventory would be A) $2250 B) $1050 C) $3446 D) $3460 E) $2410 17) Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpefual inventory system. Determine the cost assigned to cost of goods sold using FIFO. 17) Date Activities May 1 Beginning Inventory 5 Purchase 10 Sales 15 Purchase 24 Sales Units Acquired at Cost 330 units @S18 310 units @ S20 Units Sold at Retail 230 units @S28. 190 units $21 180 units$29 A) $8380 B) $16,130 C) $8590 D) $7750 E) $7540 18) 18) A properly designed internal control system: A) Lowers the company's risk of loss. B) Requires the use of non-computerized systems C) Insures profitable operations. D) Eliminates the need for an audit. E) Is not necessary if the company uses a computerized system. 19) on internal controls includes: 19) The impact of technology A) Reduced processing errors. B) Elimination of fraud. C) Elimination of the need to bond employees. D) Elimination of separation of duties. E) Elimination of the need for regular audits 20) 20) Cash equivalents: A) Include money orders. B) Include checking accounts. C) Are recorded in petty cash. D) Are short-term, highly liquid investment assets. E) Include 6-month certificates of deposit. 21) 21) At the end of the day, the cash register tape shows $1,000 in cash sales but the count of cash in the register is $1,010. The proper entry to account for this excess is A) Debit Cash Over and Short $10; credit Cash $10. B) Debit Cash $1,010; credit Sales $1.000; credit Cash Over and Short $10. C) Debit Cash $1,010; credit Sales S1,010. D) Debit Cash $1,000; debit Cash Over and Short for $10; credit Sales $1,010. E) Debit Cash S1,000; credit Sales $1,000. 1