Answered step by step

Verified Expert Solution

Question

1 Approved Answer

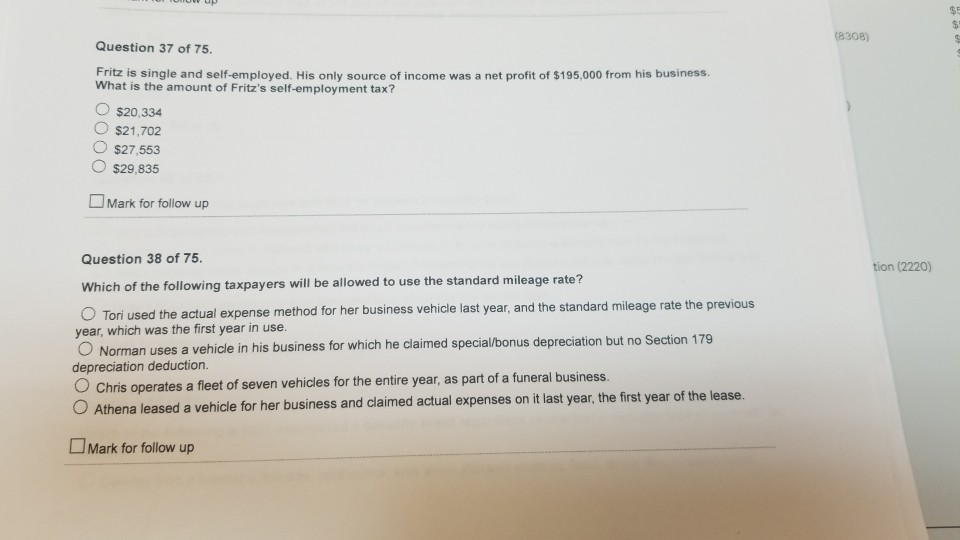

(8308) OF Question 37 of 75. Fritz is single and self-employed. His only source of income was a net profit of $195,000 from his business.

(8308) OF Question 37 of 75. Fritz is single and self-employed. His only source of income was a net profit of $195,000 from his business. What is the amount of Fritz's self-employment tax? O $20,334 $21,702 O $27,553 O $29,835 Mark for follow up Question 38 of 75. tion (2220) Which of the following taxpayers will be allowed to use the standard mileage rate? Tori used the actual expense method for her business vehicle last year, and the standard mileage rate the previous year, which was the first year in use. O Norman uses a vehicle in his business for which he claimed special/bonus depreciation but no Section 179 depreciation deduction. Chris operates a fleet of seven vehicles for the entire year, as part of a funeral business. O Athena leased a vehicle for her business and claimed actual expenses on it last year, the first year of the lease. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started