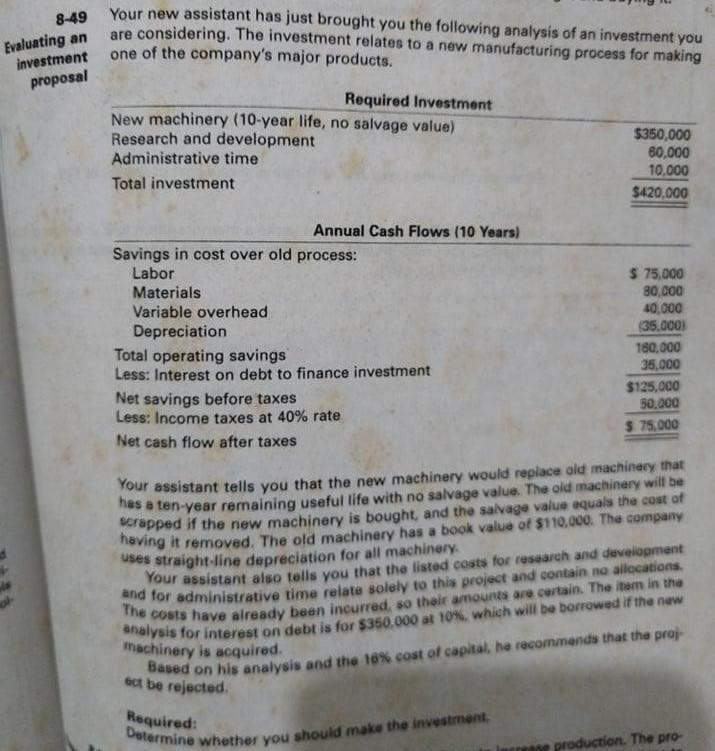

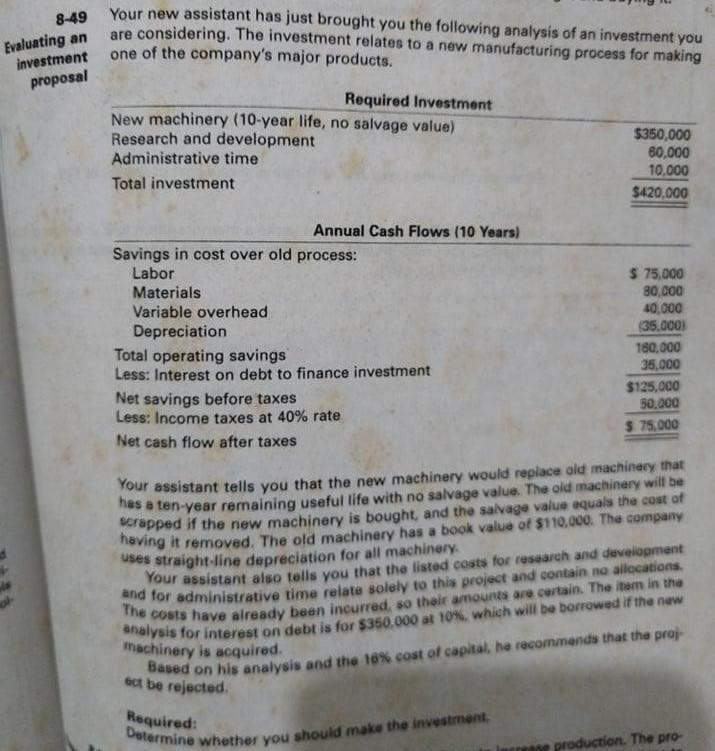

8-49 Your new assistant has just brought you the following analysis of an investment you are considering. The investment relates to a new manufacturing process for making one of the company's major products. Evaluating an investment proposal Required Investment New machinery (10-year life, no salvage value) Research and development Administrative time Total investment $350,000 80,000 10.000 $420,000 Annual Cash Flows (10 Years) Savings in cost over old process: Labor Materials Variable overhead Depreciation Total operating savings Less: Interest on debt to finance investment Net savings before taxes Less: Income taxes at 40% rate Net cash flow after taxes $ 75,000 80,000 40.000 (35.000 160.000 35,000 $125,000 50.000 $ 75,000 Your assistant tells you that the new machinery would replace old machinery that has a ten-year remaining useful life with no salvage value. The old machinery will be scrapped if the new machinery is bought, and the salvage value equals the cost of having it removed. The old machinery has a book value of $110,000. The company uses straight line depreciation for all machinery Your assistant also tells you that the listed costs for research and development and for administrative time relate solely to this project and contain ne allocations The costs have already been incurred, so the amounts are certain. The item in the analysis for interest on debt is for $350.000 al 10%, which will be borrowed if the new Machinery is acquired. bet be rejected Based on his analysis and the 18% cost of capital, ha recommands that the proj Required: Determine whether you should make the investment production. The pro- 8-49 Your new assistant has just brought you the following analysis of an investment you are considering. The investment relates to a new manufacturing process for making one of the company's major products. Evaluating an investment proposal Required Investment New machinery (10-year life, no salvage value) Research and development Administrative time Total investment $350,000 80,000 10.000 $420,000 Annual Cash Flows (10 Years) Savings in cost over old process: Labor Materials Variable overhead Depreciation Total operating savings Less: Interest on debt to finance investment Net savings before taxes Less: Income taxes at 40% rate Net cash flow after taxes $ 75,000 80,000 40.000 (35.000 160.000 35,000 $125,000 50.000 $ 75,000 Your assistant tells you that the new machinery would replace old machinery that has a ten-year remaining useful life with no salvage value. The old machinery will be scrapped if the new machinery is bought, and the salvage value equals the cost of having it removed. The old machinery has a book value of $110,000. The company uses straight line depreciation for all machinery Your assistant also tells you that the listed costs for research and development and for administrative time relate solely to this project and contain ne allocations The costs have already been incurred, so the amounts are certain. The item in the analysis for interest on debt is for $350.000 al 10%, which will be borrowed if the new Machinery is acquired. bet be rejected Based on his analysis and the 18% cost of capital, ha recommands that the proj Required: Determine whether you should make the investment production. The pro