Answered step by step

Verified Expert Solution

Question

1 Approved Answer

86% 20:01 Read Only - You can't save changes to t... Question 5 If you answer question 5, please answer all 10 parts. Each part

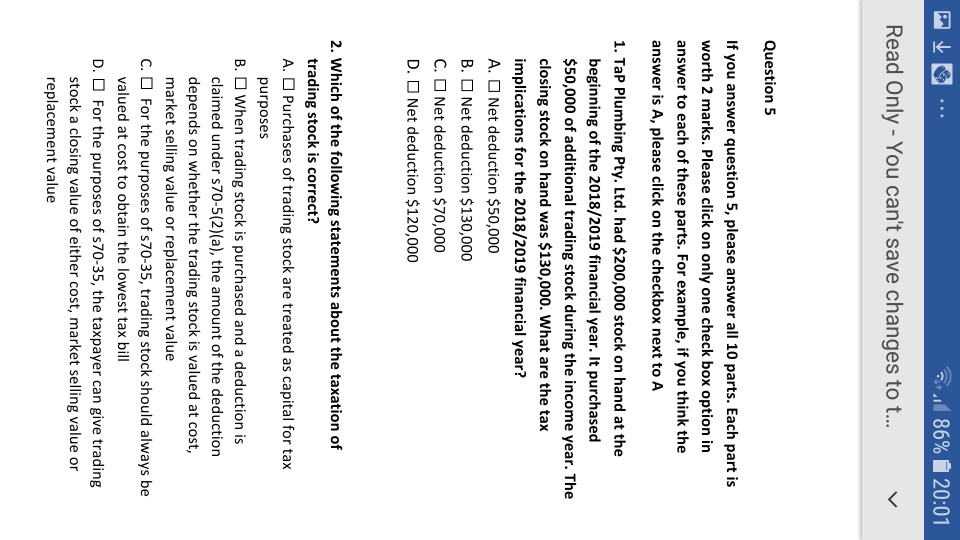

86% 20:01 Read Only - You can't save changes to t... Question 5 If you answer question 5, please answer all 10 parts. Each part is worth 2 marks. Please click on only one check box option in answer to each of these parts. For example, if you think the answer is A, please click on the checkbox next to A 1. TaP Plumbing Pty. Ltd. had $200,000 stock on hand at the beginning of the 2018/2019 financial year. It purchased $50,000 of additional trading stock during the income year. The closing stock on hand was $130,000. What are the tax implications for the 2018/2019 financial year? A. Net deduction $50,000 B. Net deduction $130,000 C. Net deduction $70,000 D. Net deduction $120,000 2. Which of the following statements about the taxation of trading stock is correct? A. O Purchases of trading stock are treated as capital for tax purposes B. O When trading stock is purchased and a deduction is claimed under s70-5(2)(a), the amount of the deduction depends on whether the trading stock is valued at cost, market selling value or replacement value C. O For the purposes of s70-35, trading stock should always be valued at cost to obtain the lowest tax bill D. O For the purposes of s70-35, the taxpayer can give trading stock a closing value of either cost, market selling value or replacement value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started